Yen Drops, Aussie Dollar Gains in Risk-On Start to Trading Week

DailyFX.com -

Talking Points:

Japanese Yen falls, commodity FX gains in risk-on start to the trading week

Geopolitical jitters may return EU’s Tusk, US VP Pence give joint presser

Thin liquidity, muted trade likely as US markets close for President’s Day

The Japanese Yen declined as most Asian stocks traded higher to start the trading week, pressuring the standby anti-risk currency. Meanwhile, the sentiment-linked Australian, Canadian and New Zealand Dollars led the way higher.

Looking ahead, a quiet economic calendar in European trading hours may give way to geopolitical jitters as the European Council President Donald Tusk gives a joint press conference with US Vice President Mike Pence. Last week, similar circumstances translated into US Dollar weakness.

Sentiment continues to look relatively upbeat however, with futures tracking top European and US equity index benchmarks pointing firmly higher. That suggests risk-on dynamics witnessed overnight have scope to carry forward.

In any case, follow-through may be limited with US markets closed for the President’s Day holiday. That is likely to translate into thin liquidity and generally muted price action. Traders would be wise to remember that low participation levels can amplify volatility if unexpected headline risk emerges however.

Are the major currencies behaving as DailyFX analysts expected so far in 2017? Find out here!

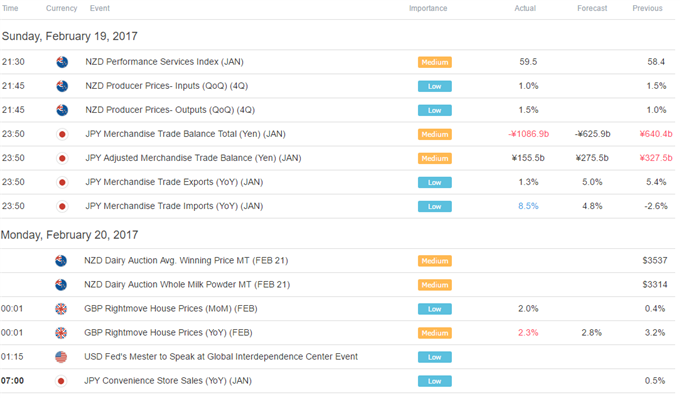

Asia Session

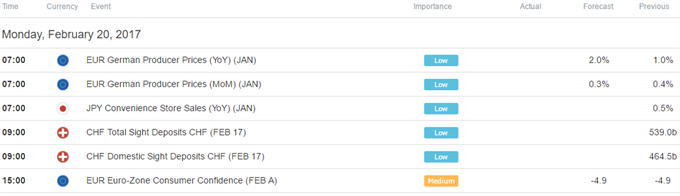

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance