Yelp's (YELP) Q2 Earnings and Revenues Surpass Estimates

Yelp Inc. YELP reported second-quarter 2020 loss per share of 33 cents, narrower than the Zacks Consensus Estimate of a loss of 54 cents. In the year-ago quarter, Yelp had reported earnings of 16 cents per share.

Yelp provides information through online communities on restaurants, shopping, nightlife, financial, health and other services. However, the coronavirus-led lockdowns and restrictions on public life are hurting these businesses, in turn, affecting Yelp.

Revenues declined 31.6% year over year to $169 million. The figure however surpassed the Zacks Consensus Estimate by 10.5%.

Top-line Details

Advertising revenues (95.8% of total revenues) decreased 32% year over year to $162 million. This decrease was due to coronavirus-led reduction in advertising budgets by customers, particularly those in the restaurants and nightlife categories. Paying advertising locations declined 31% year over year to 377K sites in the second quarter.

Other service revenues declined 53% to $3 million, primarily as a result of approximately $5 million in relief provided to customers in the second quarter of 2020, mainly in the form of waived fees.

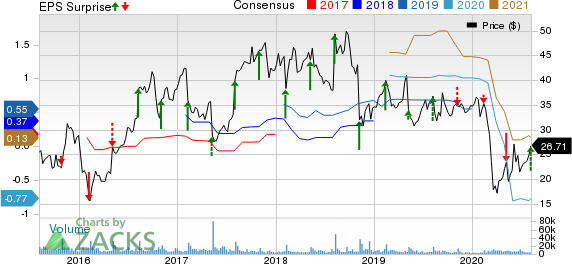

Yelp Inc. Price, Consensus and EPS Surprise

Yelp Inc. price-consensus-eps-surprise-chart | Yelp Inc. Quote

Transaction revenues were $4 million in the second quarter of 2020, up 26% from the year-ago quarter due to increases in food take-out and delivery orders as a result of the coronavirus pandemic, which forced many restaurants to close for dine-in services and provide take-out and delivery services only.

Cumulative reviews climbed 12% year over year to 214 million. However, app unique devices declined 23% year over year to 28 million on a monthly-average basis.

Profits and Margins

Gross profit decreased 32.2% year over year to $157.2 million. Gross margin contracted 90 basis points (bps) to 93%, mainly on inflated cost of sales. Costs flared up on higher advertising fulfillment costs and website infrastructure expense.

Total costs and expenses declined 13% year over year to $204 million. Yelp’s second-quarter adjusted EBITDA plunged 80% year over year to $11 million. Moreover, adjusted EBITDA margin shrunk to 7% from the year-ago quarter’s 22%.

Balance Sheet & Cash Flow

As of Jun 30, 2020, Yelp’s cash, cash equivalents & marketable securities were $526 million, up from $491 million as of Mar 31, 2020.

Net cash flow from operating activities was $57.2 million compared with the previous quarter’s $41 million.

Outlook

Yelp had already withdrawn the full-year 2020 outlook citing uncertainties related to the coronavirus pandemic, which is impacting global business and consumer activities.

Zacks Rank & Other Stocks to Consider

Yelp currently carries a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the broader technology sector are ANGI Homeservices ANGI, Agilent A and Analog Devices ADI. All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ANGI Homeservices, Agilent and Analog Devices are set to report their quarterly results on Aug 10, 18 and 19, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.3% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

ANGI Homeservices Inc. (ANGI) : Free Stock Analysis Report

Yelp Inc. (YELP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance