Year in review: 2018 Australian property market

Over the last year or two a number of factors played out to create a perfect storm causing house prices (particularly in Sydney and Melbourne) to drop and house price growth in other states to slow.

These include:

• Poor affordability after house prices in our two biggest capital cities had grown at unsustainable rates for a number of years. In particular first home buyers are having difficulty saving a big enough deposit to get a foothold in the market.

• Tight credit conditions – initially because of APRA’s macro prudential controls (decreasing lending to investors and reducing the number of interest only loans); but then the Haynes Royal Commission into Banking exposing some, let’s call them “interesting”, lending practices which caused the big banks to become allergic to risk.

• A surge in the supply of new and off the plan apartments in most of our capital cities.

• A collapse in foreign demand as we pulled the welcome mat out from under the thousands of overseas investors who were driving up the price of new apartments;

• An out of cycle interest rate rise by the banks in August and September.

• Increased interest rates for some property investors while other borrowers had to meet the extra cash flow commitments of switching from interest only to principle and interest loans.

• Fears by investors of what the proposed changes to negative gearing and capital gains tax could mean if there was a change of government next year.

• A general crisis of investor confidence caused by the media’s continual conveyor belt of scary headlines

Yet despite all this we are experiencing what I’m calling a “soft landing.”

You see…there are no forced sales with desperate vendors having to give their homes away at any price.

In fact, the current downturn is quite different from previous ones which have typically been triggered by a change in monetary policy (interest rates) or because of economic shocks such as the Global Financial Crisis.

This time we’re in the middle of an orchestrated slowdown due to significantly tighter credit conditions brought on by our regulators who wanted to avoid the type of market crash we could have experienced had the Sydney and Melbourne property markets kept growing at the unsustainable rate they were.

What nobody really predicted was the extent of tightening credit conditions in the wake of the Haynes Royal Commission which, on top of the previous regulatory tightening, resulted in many borrowers simply not being in a position to borrow as much as they could a year or two ago.

Now let’s look at the latest statistics and charts provided by Corelogic to see what’s happening to the property markets around Australia.

Source: Corelogic

The national housing markets continued to lose steam last month, with price falls largely confined to Sydney and Melbourne which together comprise approximately 55% of the value of Australia’s housing asset class.

Since peaking in July last year, Sydney’s housing market is down 9.5% which is on track to eclipse the previous record peak-to-trough decline set during the last recession when values fell 9.6% between 1989 and 1991.

Melbourne dwelling values peaked four months later than Sydney, in November 2017, and have since fallen by 5.8% through to the end of November 2018.

Let’s put some context to this:

Australia’s total residential property markets are estimated by Corelogic to be worth $7.6 trillion dollars, yet the total value of all residential debt is $1.8 trillion.

Put simply, with a total loan to value ratio of less than 30% all the fuss made about the high level of mortgage debt is really unfounded.

There’s no sugar coating it

Nationally, dwelling values are down 4.2% since peaking in October last year, with dwelling values retracing back to levels last seen in December 2016.

And it’s realistic to expect prices to keep falling through to the middle of 2019, but most likely at a slower pace.

Higher value housing markets continue to lead the market downturn.

As always happens at the stage of the cycle the highest value quarter of the market has led the national downturn.

This is reflective of the weaker conditions across the capital cities, particularly Sydney and Melbourne and the fact that there is less discretionary spending at the top end of our property markets.

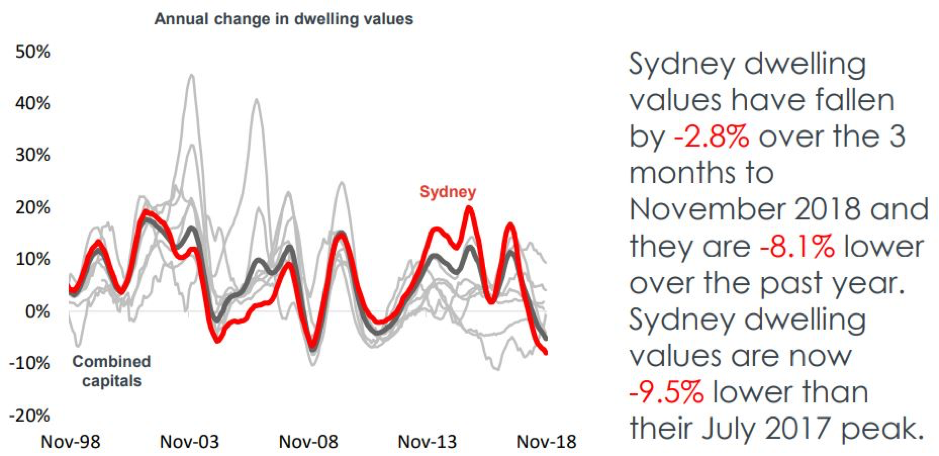

Sydney Housing Market

The Sydney property market peaked in mid 2017 and Sydney real estate values have been fallen 9.5% since then.

But remember this is in the context of median dwelling prices having increased by up to 70% in Sydney in the previous 5 years.

Some segments have performed better than others, particularly the eastern suburbs and overall apartments have performed better than houses.

Obviously some segments of the Sydney property market are likely to fall considerably more than that average – we’re looking at you “off the plan properties” where there is a considerable pipeline of new construction yet to be absorbed.

Currently most “off the plan” purchases are valuing in at considerably less than the contract price on completion and with banks being more reluctant to lend against these properties some purchasers will find themselves in financial strife.

2018 will also be remembered as the year when Sydney auction clearance rates plummeted from close to 80% in the heady days to around 40%.

However, first home buyers are active in Sydney creating stronger markets over the lower quarter of the market.

Vacancy rates are creeping up in Sydney and at Metropole Property Management we’re finding that landlords are often having to reduce their rentals to secure tenants when a vacancy arises.

Rents have fallen 3% in Sydney over the last 12 months, with some locations (eg Rouse Hill) having over double this rate.

On the other hand, strong economic growth and jobs creation is leading to population growth and ongoing demand for property in Sydney. At the same time international interest from tourists and migrants continues.

Trent Wiltshire – economist at Domain and author of their Property Price Forecast report suggests that 2019 looks likely to be a year of greater stability.

He forecasts Sydney property values to remain stable in 2019 and then increase by 4% in 2020.

Melbourne Housing Market

The Melbourne property market peaked in November 2017 and is experiencing a soft landing after 5 years of strong price growth.

Property values are now 5.8 % below their peak with apartments performing better than houses.

However, over the previous five years, median property prices in Melbourne had increased by 41.5% and over the past decade they are 77.3% higher.

But now Melbourne auction clearance rates have fallen below the magic 50% mark, it is taking a little longer to sell a home (38 days compared to 31 days a year ago) and vendors are discounting their asking prices a little more than 12 months ago (-5.6% compared to -4.6% a year ago.)

While Melbourne’s property prices are likely to fall by a little further, there is no crash in sight.

Trent Wiltshire – economist at Domain and author of their Property Price Forecast report suggests that 2019 looks likely to be a year of greater stability.

Melbourne property values are forecast to fall around 1% in 2019 and then increase by 4% in 2020 according to Domain.

It is likely that property values will be underpinned by a robust economy, jobs growth Australia’s strongest population growth and the influx of 35% of all overseas migrants.

Remember…Melbourne remains the nation’s population growth powerhouse and the rate of growth is likely to slow a little Melbourne still rates as one of the 10 fastest growing large cities in the developed world, with its population likely to increase by around 10% in the next 4 years.

As dwelling values trend lower, rental rates in Melbourne are recording a moderate rise.

Brisbane Housing Market

Overall Brisbane property had an unexciting year with minimal price growth.

In fact that’s been the story of Brisbane for the last few years with slow property price growth, however all indicators suggest the Brisbane property market has the potential for significant growth over the next 3 years, with Queensland leading the nation in net interstate migration over the past year.

While overall dwelling values unchanged over the last few months, the markets were fragmented and some segments of the Brisbane property market are outperforming – particularly homes within 5-7 km of the CBD.

There is still an oversupply of Brisbane apartments and values remain 11.2% below their previous record high recorded back in 2010, however with high supply levels moving back towards balance and rising demand we may start to see this sector showing a consistent improvement.

According to SQM Research Brisbane vacancy rates have been falling from a peak of 4.1% recorded in December 2016 to 2.8% now.

Vacancy rates should keep falling in 2019 due to the surge of interstate migrants, especially out of Sydney and Melbourne at a time when apartment completions are falling below the accelerating demand.

Another positive sign emerging is Queensland’s strong job creation, in part due to all the infrastructure development that is occurring.

Interstate migration numbers are continuing to improve

Trent Wiltshire – economist at Domain and author of their Property Price Forecast report suggests that Brisbane property values could grow 4% in 2019 and 5% in 2020.

Our Metropole Brisbane team has noticed a significant increase in local consumer confidence with many more homebuyers and investors showing interest in property. At the same time we are getting more enquiries from interstate investors there we have for many, many years.

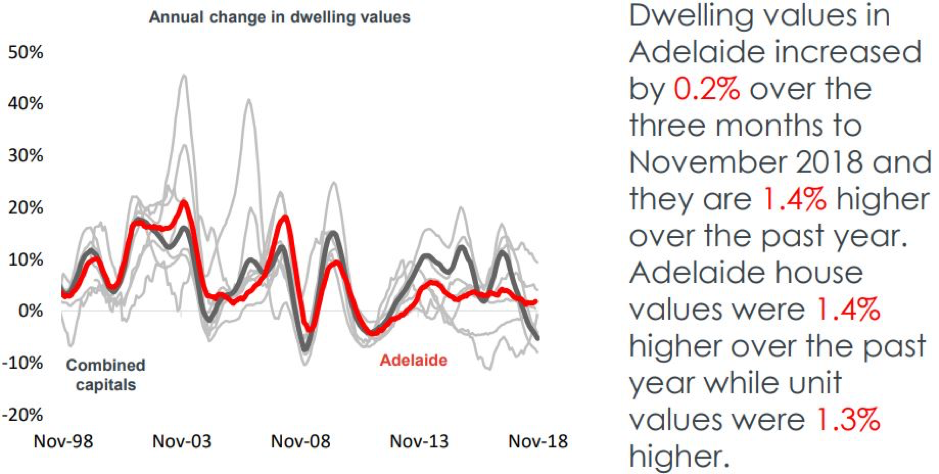

Adelaide Housing Market

The Adelaide property market has been flat over the last decade with a rise in property values of 10% over the last 10 years (in other words house prices haven’t kept up with inflation.)

Over the last 12 months house values were 1.4% higher and apartments grew in value by 1.3%.

On the rental side vacancy rates have been steadily falling and house rentals have risen by 2.6% over the last year.

I know some interstate investors are looking at Adelaide as a future “hotspot”, but I would caution that there are a few long-term growth drivers in Adelaide.

Currently Adelaide has been experiencing difficult economic conditions with rising unemployment.

While Adelaide might be a lovely city to live in and is still very affordable, our research suggests investors should look elsewhere.

For example, there are better long-term growth drivers in the Brisbane property market.

Perth Housing Market

The Perth property market has been on a downward trajectory since peaking in June 2014.

Although values are still falling, many of the other metrics are now suggesting that the Perth property market is bottoming out, though it has not found a floor yet.

But like all other capital cities, the market is fragmented with performance varying across various subregions.

Currently rents are slowly rising as vacancy rates are consistently falling

Although the outlook for the state economy has become more positive with the Perth economy in recovery and population growth starting to pick up, the dwelling surplus in Perth looks set to remain in place for some time,

While the Perth market may level out in the next year, it’s much too early for a countercyclical investment in the west – I can’t see prices rising significantly for a number of years due to the reluctant demand from investors and the significant oversupply of new apartments there is little to no prospect of capital growth or rental growth in the Perth apartment market for many years.

Like the other states, Western Australia’s population trend has a significant impact on the overall performance of its property market.

To get people back into the State more jobs will need to be created.

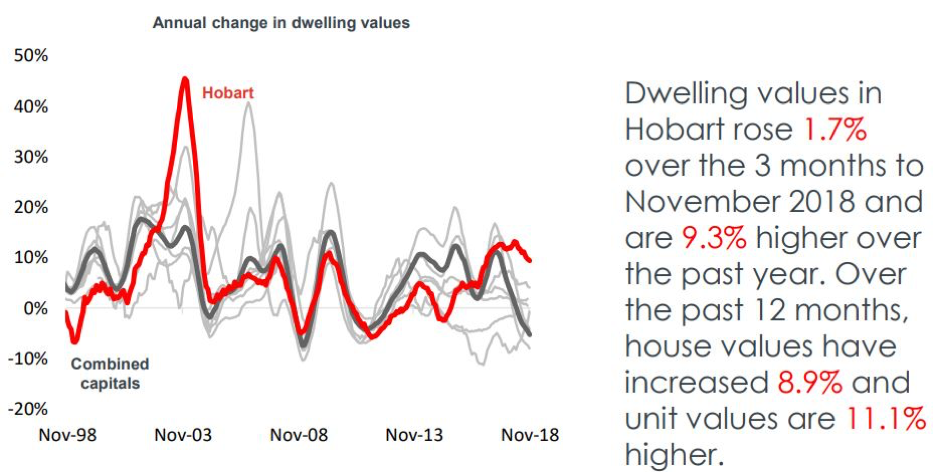

Hobart Housing Market

Hobart has been the strongest performing capital city over the last 3 years, with dwelling values being 9.3% higher than a year ago, but indicators are suggesting that this market has now topped out.

Given the relatively strong rental market, alongside the recovery in the Tasmanian economy (driven particularly by tourism) and continued population growth due to net interstate migration.

House prices are expected to continue growing in the short term but then, as many ew apartment projects under construction are completed, price growth is likely to slow down.

Rents have been rising strongly in Hobart as rental vacancy rates remain at historic lows

One cost of Hobart’s property boom is that over the last five years median dwelling prices have increased at about double the rate of household income growth creating a deterioration in housing affordability in the Apple Isle.

This together with investors moving their aim to the next “hot spot” are further reasons that Hobart’s property prices growth phase is near its peak.

Trent Wiltshire – economist at Domain and author of their Property Price Forecast report suggests that Hobart property values are likely to grow by only 2% over the next two years.

Darwin Housing Market

The Darwin property market peaked in August 2010 is still suffering from the effects of the end of our mining boom today 8 years later.

But with prices falling less than 1% over the last year Darwin house prices may finally be bottoming out.

Rentals have fallen by up to 10% over the last 12 months – in fact rentals have fallen 38% from their peaks according to SQM Research

As opposed to the east coast capital cities where many jobs are being created, Darwin had a net loss of jobs last year, and the Northern Territory Treasury Department forecasts another year of State economic recession with negative state final demand.

Darwin does not have significant growth drivers on the horizon and would be best avoided by investors.

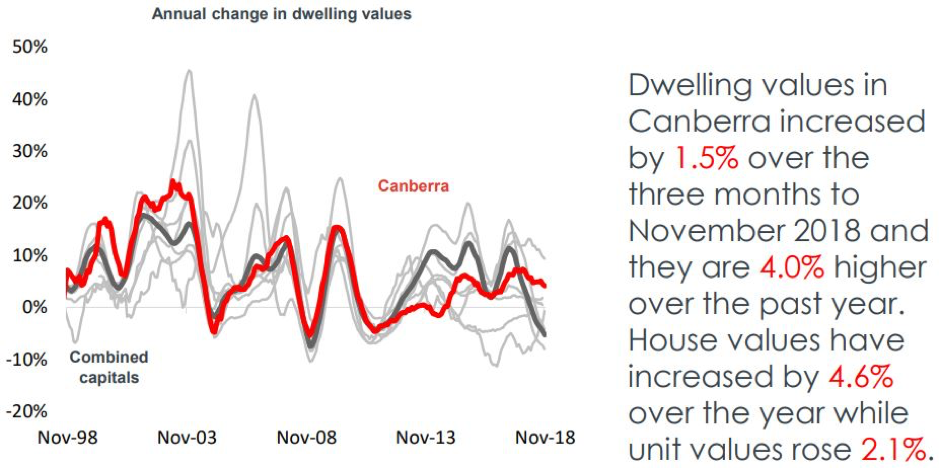

Canberra Housing Market

Canberra’s property market is a “quiet achiever” with dwelling values having grown 4.0% over the last year with house price growth (+4.6%) much stronger than the apartment market (+2.1%)

There is strong rental demand in Canberra from overseas students and government department professionals pushing Canberra house rentals up 7.7% over the last year. Apartment rents rose 4.8%.

In fact over the past 3 years Canberra rental grew 32% for houses and 18% for apartments.

Trent Wiltshire – economist at Domain and author of their Property Price Forecast report suggests that

Canberra house prices are likely to grow by 4 % in each of the next two years, while apartment growth will be more subdued (+2% in each of the next 2 years.)

Economic growth in the A.C.T is projected to begin to slow in the 2019 financial year yet remain above the national average.

Population growth is expected to remain strong, which will support underlying demand for dwellings.

With public sector employment accounting for more than 40% of jobs in the Australian Capital Territory, if history repeats itself the uncertain political climate leading up to the federal election next year will reduce local consumer confidence and dampen housing demand a little but, as always, this will correct itself after the election and Canberra’s property market is likely to continue to perform well in the medium term.

The Rental Market

Rental markets around Australia continue to slow, with national rents unchanged over the month and only 0.7% higher over the past year.

This is unusual as rents usually rise at a time of softening property markets when fewer Australians buy property and more remain as tenants. However the oversupply of properties is satisfying rental demand.

Rental yields have continued to lift from their record lows as rental growth outpaces value growth, however yields generally remain well below the long term average in most cities.

Signs of our softening markets

Our quieter markets have translated into fewer property sales with transaction volumes 12% lower than they were a year ago.

Vendor metrics have generally softened, with the number of days it takes to sell a property and the amount vendors need to discount their initial asking price trending higher.

And of course auction clearance rates are at the lowest level they have been for a long time.

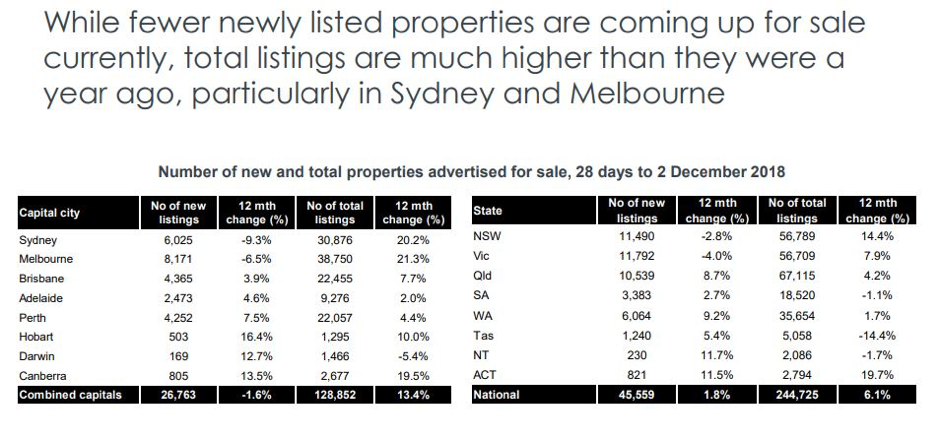

These factors have weakened vendor confidence, leading to fewer new properties for sale being added to the market, but the total advertised stock levels are tracking higher due to a slower rate of selling those properties that are on the market.

Compared to sales over the previous 12 months, the number of settled transactions was -12.0% lower.

These figures are estimates for settled sales; off-the-plan sales will typically settle upon completion of the project, at that time these sales will be counted at their contract date. Given this, it is expected that recent years of sales activity will be revised higher once these settlements occur.

The days on market figure measures the average time from the first listing date to the contract date for properties sold by private treaty.

Combined capital city homes are currently taking an average of 51 days to sell compared to 42 days at the same time a year ago.

Brisbane, Adelaide and Canberra were the only capital cities in which discounting levels are currently lower than they were a year ago.

Lower auction clearance rates are an indication of the weaker demand for property. There are fewer genuine bidders turning up to those properties selling at auction and the result is fewer properties are selling at auction.

Supply and demand

While Australia’s population continues to grow quite rapidly, the rate of growth has slowed as both the rate of net overseas migration and the rate of natural increase fell.

Population growth in both Sydney and Melbourne is tapering slightly with a slight drop in net overseas migration, as well as an increase in interstate migration from Melbourne and Sydney to South East Queensland.

Having said this, Melbourne is still experiencing interstate migration from South Australia and West Australia.

Of course slower population growth has a negative implication for housing demand.

Dwelling approvals rose in September, however the trend is toward fewer approvals particularly in the apartment sector.

It remains to be seen how many of these approved new properties will be built given our slowing housing market conditions and generally tighter financing arrangements for both investors and developers.

Clearly developers are losing their appetite to take on new projects as they are having difficulty obtaining pre-sales and therefore construction funding.

Finance

Official interest rates remain at 1.5%, however variable mortgage rates have edged higher in both September and October, reflecting out of cycle rises from some lenders.

Lending to investors is well below its peak and continues to trend lower as APRA gets its way and slows down our markets.At the same time, while owner occupier lending has slowed it remains relatively healthy, rising 7.0% over the 12 months to October 2018, but the average owner occupier loan size has fallen slightly over recent months.

Owner occupier first home buyer finance commitments have climbed higher since the middle of 2017.

With our slowing economy and poor wages growth it is unlikely that official interest rates will rise over the next year.

If anything there is an argument for the RBA to lower rates to boost our economy and underpin flagging property prices.

The Bottom Line…

Property values (particularly in Sydney and Melbourne) grew at a rapid and unsustainable rate for a number of years.

This was spurred by:

• Comparatively stronger economic conditions compared to the rest of Australia, leading to

• Strong population growth including higher migration

• Local and overseas investors chasing much the same type of property at a time of low mortgage interest rates.

• Owner occupiers keen to upgrade as the saw property values surging.

We’re now clearly in the next stage of the property cycle, one of moderate growth in some regions and virtually no growth in others and falling prices in yet others.

Australia’s property markets are very fragmented, driven by local factors including jobs growth, population growth, consumer confidence and supply and demand.

This makes it an opportune time for both home buyers and investors to buy property at a time when they’ll face less competition.

However correct asset selection will be more important now than ever, so only buy in areas where there are multiple long term growth drivers such as employment growth, population growth or major infrastructure changes.

Similarly suburbs undergoing gentrification are likely to outperform.

Source of graphs and data: CoreLogic

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Now read: The £30m mega-mansion created from two houses in the heart of London

Now read: ‘Sophisticated’ scam targets wannabe traders

Now read: Jetstar taken to court for misleading customers about refunds

Yahoo Finance

Yahoo Finance