Yacktman Fund Adjusts Portfolio, Major Reduction in Pioneer Natural Resources Co

Insights from Yacktman Fund (Trades, Portfolio)'s First Quarter 2024 N-PORT Filing

Yacktman Fund (Trades, Portfolio), known for its objective and patient investment approach, has revealed its first quarter 2024 portfolio updates through the latest N-PORT filing. The fund, which is part of Yacktman Asset Management (Trades, Portfolio), focuses on achieving long-term capital appreciation by investing in a mix of dividend-paying and non-dividend-paying U.S. stocks. The team at Yacktman Fund (Trades, Portfolio) adheres to a disciplined strategy, targeting growth companies at attractive prices, and seeks businesses with strong management and competitive purchase prices.

New Additions to the Yacktman Portfolio

Yacktman Fund (Trades, Portfolio) expanded its portfolio with 2 new stocks in the first quarter of 2024:

The most significant addition was Kellanova Co (NYSE:K), acquiring 1,200,000 shares, which now comprise 0.86% of the portfolio, valued at $68.75 million.

The second largest new holding is Darling Ingredients Inc (NYSE:DAR), with a purchase of 1,005,000 shares, representing 0.59% of the portfolio, totaling $46.74 million.

Positions Yacktman Fund (Trades, Portfolio) Exited

The fund closed its position in 2 companies during the first quarter of 2024:

Weatherford International PLC (NASDAQ:WFRD) was completely sold off, with 1,000,000 shares liquidated, impacting the portfolio by -1.26%.

All 7,000,000 shares of GrafTech International Ltd (NYSE:EAF) were divested, resulting in a -0.2% portfolio impact.

Significant Reductions in Existing Holdings

Yacktman Fund (Trades, Portfolio) reduced its stake in 21 stocks, with notable adjustments including:

A substantial cut in Pioneer Natural Resources Co (NYSE:PXD) by 515,000 shares, marking a -71.03% decrease and a -1.49% impact on the portfolio. PXD's average trading price was $234.47 during the quarter, with a 22.39% return over the past 3 months and a 21.74% year-to-date gain.

The fund also trimmed its position in Associated British Foods PLC (LSE:ABF) by 1,200,000 shares, a -17.65% reduction, affecting the portfolio by -0.47%. ABF traded at an average price of 23.14 and has seen a 6.23% return over the past 3 months and a 1.65% increase year-to-date.

Yacktman Fund (Trades, Portfolio)'s Portfolio Overview

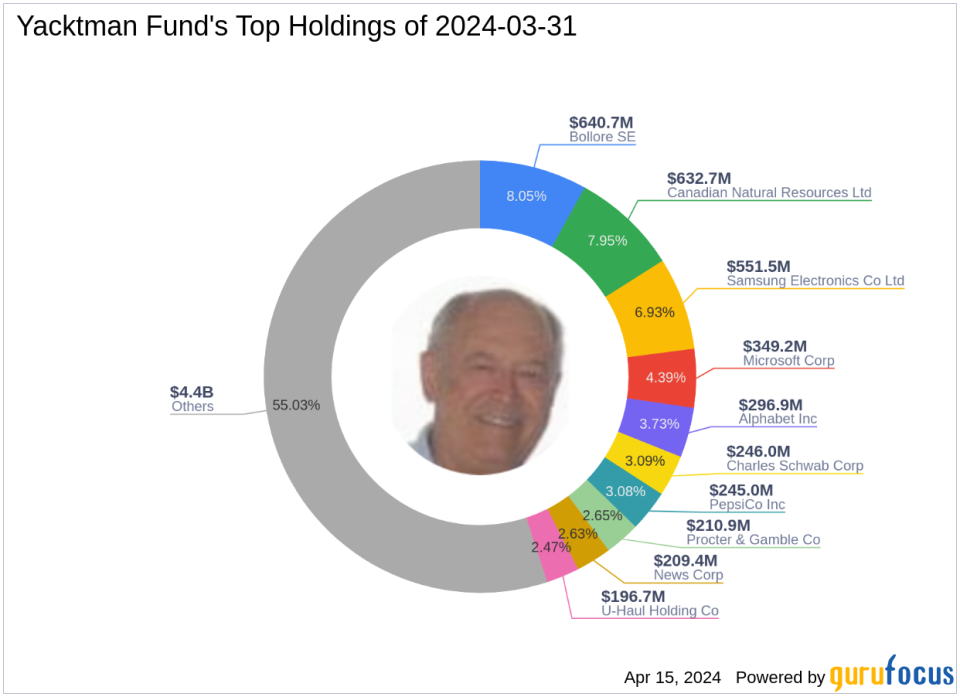

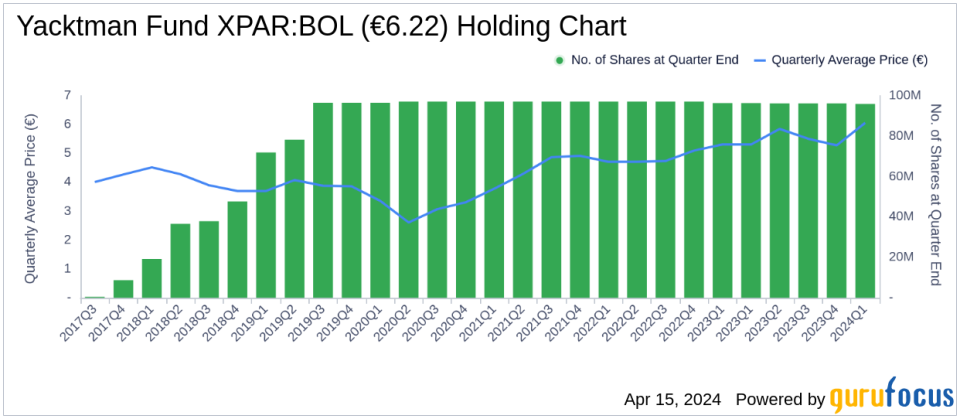

As of the first quarter of 2024, the Yacktman Fund (Trades, Portfolio)'s portfolio is composed of 58 stocks. Leading the pack are top holdings such as 8.05% in Bollore SE (XPAR:BOL), 7.95% in Canadian Natural Resources Ltd (NYSE:CNQ), and 6.93% in Samsung Electronics Co Ltd (XKRX:005935). Other significant positions include 4.39% in Microsoft Corp (NASDAQ:MSFT) and 3.73% in Alphabet Inc (NASDAQ:GOOG).

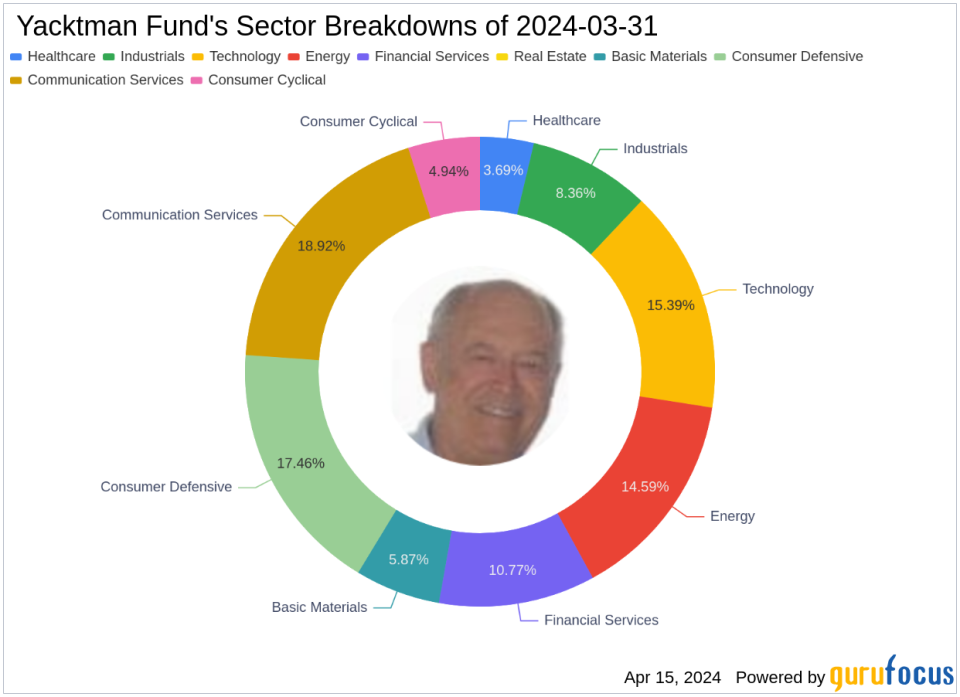

The fund's investments are primarily concentrated across 9 industries, spanning Communication Services, Consumer Defensive, Technology, Energy, Financial Services, Industrials, Basic Materials, Consumer Cyclical, and Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance