Xiaomi Raises Target for Marquee EV in Signal of Confidence

(Bloomberg) -- Xiaomi Corp. aims to deliver 120,000 of its SU7 electric-vehicles this year, hiking its target for a car it hopes can someday compete with Tesla Inc. and fuel its broader ambitions.

Most Read from Bloomberg

World’s Largest Nuclear Plant Sits Idle While Energy Needs Soar

Treasuries Hit as US Sales Struggle to Lure Buyers: Markets Wrap

New BYD Hybrid Can Drive Non-Stop for More Than 2,000 Kilometers

President Lu Weibing disclosed that latest goal after Xiaomi reported its fastest pace of quarterly revenue growth in more than two years, reflecting an improving smartphone market. Revenue rose a faster-than-expected 27% to 75.51 billion yuan ($10.4 billion) in the March quarter, about 2.7% above the average estimate.

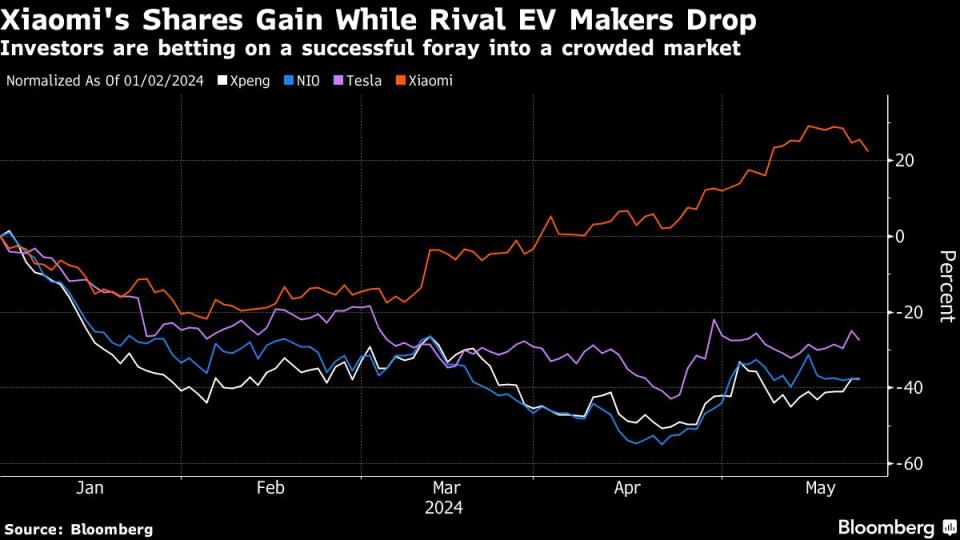

Xiaomi’s raised target suggests billionaire co-founder Lei Jun is confident of making headway in his $10 billion foray into the crowded electric car market. His company unveiled the SU7 in late March, and later said he expected to deliver more than 100,000 of the vehicles.

As of the end of April, orders for the SU7 series neared 90,000. On Thursday, Lu told reporters on a call his company was on track to ship 10,000 SU7s in June — about as much as Xiaomi moved during the first 43 days of sales — meaning it could shoot for a loftier annual goal of 120,000 units.

Xiaomi, which gets more than 60% of its revenue from smartphones, has been trying to diversify in part because of sluggish demand in its home market. On Thursday, it reported a 1% slide in net income to 4.2 billion yuan for the March quarter.

Still, signs point toward a gradual mobile recovery in China and beyond. Smartphone unit shipments at Xiaomi grew by nearly 34% last quarter amid a broader market bounceback, narrowing the gap with leaders Samsung Electronics Co. and Apple Inc., according to market tracker IDC. Apple’s global iPhone shipments slid more than expected as sales flagged in China.

The company is also developing a sport utility vehicle similar to Tesla’s Model Y, aiming to launch sales as early as 2025, according to people familiar with the matter. The EV business may make up a mid-to-high single digit percentage of the company’s revenue in 2024, said Bloomberg Intelligence analysts Steven Tseng and Sean Chen.

By the end of 2024, Xiaomi envisions a network of 219 sales stores covering 46 cities.

Read More: Apple Faces Worst iPhone Slump Since Covid as Rivals Rise

--With assistance from Ville Heiskanen.

(Updates with executive’s comments from the second paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance