WTI Crude Oil Price Forecast: Support Holds As Supply Fears Fade

DailyFX.com -

To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

Crude Oil Technical Strategy: Support at $43 Remains Pivotal For Remaining Bullish

Without a Strong Dollar, Oil Bears May Have Little Hope For Now

Sentimental Trading System Shows Upside Signal Strengthening

The US Dollar and Crude Oil are both higher on the day along with SPX500. Much of what happened on Tuesday appears to be fueled by a risk-on rally as even the European Stoxx 600 rose by the most in six weeks at 2.2% on ~110% of its average monthly volume.

The risk-on sentiment appears to be bringing to favor the view that the supply imbalance that impaled Bulls in 2015 and the beginning of 2016 is dissipating.

Compete to Win Cash Prizes With Your FXCM Mini Account, Click Here For More Info

On Wednesday, the EIA inventory data and Cushing Stock will be looked to confirm recent sentiment that there are large draws on current supplies that are aligning with disruptions of supply in Nigeria to further support price toward $50/bbl. Tomorrow’s EIA numbers are expected to come in at 2.25m bbl decline in crude stockpiles. Thankfully, the disruptions in Crude from the Canadian Wildfires don’t appear to be long-lasting as Canadian oil-sands facilities that workers evacuated last week due to wildfires are being allowed to prepare for the restart.

Long-Term Oil Trendline (Chart from Jamie Saettele, CMT, Sr. Technical Strategist)

To See How FXCM’s Live Clients Are Positioned In FX & Equities Click Here Now.

The larger technical picture aligns nicely with the sentiment of the larger fundamental pressure. In short, there is an overwhelming question about whether the market will instantly become over-supplied as high prices force producers to bring new supply to the market. Similarly, there is a question about the charts, and whether or not price can clear $50/bbl for WTI Crude Oil.

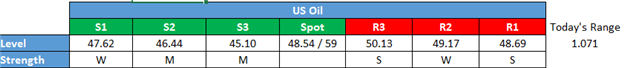

Key Support & Resistance Levels from Here (Visual Map Below)

Looking at the chart, since bouncing off the $43 level to almost piercing $50/bbl, the market appears determined to buy dips toward multi-day lows. The recent low worth focusing on appears to be the May 19 low of $47.26 followed by the May 12 low of $46.34 per barrel. The weekly pivot is close to $48 and appears to be a good support to favor staying long above or to not pay attention to getting short until it breaks.

Current Resistance is the 2016 high of $49.26 followed by the Weekly R1 Pivot resistance at $49.77. While $50/bbl is a good psychological level, there is a potential that with the risk-on rally in 2016 benefiting commodities the most that Oil could easily get bid-up through $50 on money moving from not only risk-off assets to Oil but also from lower performing risk-on assets like stocks. Either way, the layers of support should be watching to hold Oil up on its way to and possibly through $50/bbl.

Contrarian System Warns of Further Upside As of 5/24/16

In addition to the technical focus around multiple support-zones, we should keep an eye on retail sentiment, which favors more upside price action. Further upside is currently aligned with our Speculative Sentiment Index or SSI for now.

According to client positions at FXCM, the ratio of long to short positions in the US Oil stands at -1.83 as 35% of traders are long. Short positions are 23.1% higher than levels seen last week. Open interest is 36.2% higher than yesterday and 3.0% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives a signal that the US Oil may continue higher.

Key Levels Over the Next 48-hrs As of Monday, May 24, 2016

T.Y.

Think Oil has more room to run? Trade Oil With Low Margin Requirements (non-US Residents only)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance