Should You Worry About Elders Limited's (ASX:ELD) CEO Pay Cheque?

Mark Allison has been the CEO of Elders Limited (ASX:ELD) since 2014. First, this article will compare CEO compensation with compensation at similar sized companies. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for Elders

How Does Mark Allison's Compensation Compare With Similar Sized Companies?

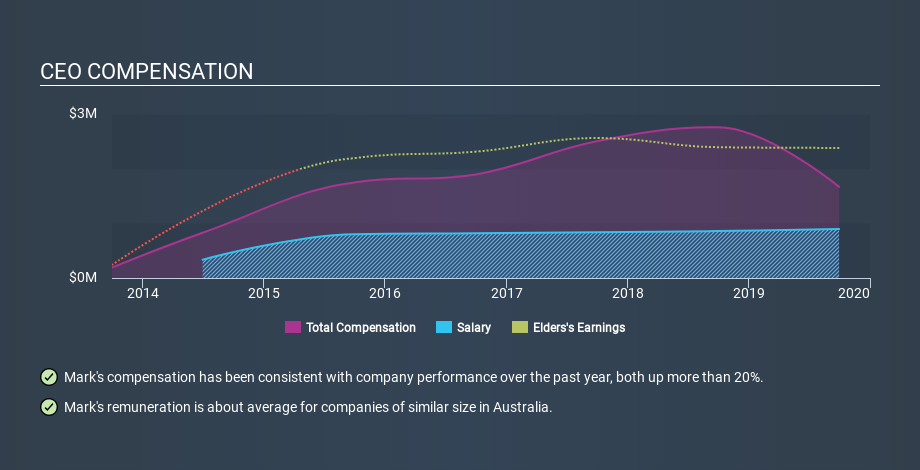

Our data indicates that Elders Limited is worth AU$884m, and total annual CEO compensation was reported as AU$1.7m for the year to September 2019. That's below the compensation, last year. While we always look at total compensation first, we note that the salary component is less, at AU$896k. We looked at a group of companies with market capitalizations from AU$585m to AU$2.3b, and the median CEO total compensation was AU$1.4m.

So Mark Allison is paid around the average of the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

You can see, below, how CEO compensation at Elders has changed over time.

Is Elders Limited Growing?

Elders Limited has reduced its earnings per share by an average of 8.2% a year, over the last three years (measured with a line of best fit). It achieved revenue growth of 4.2% over the last year.

Sadly for shareholders, earnings per share are actually down, over three years. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. It could be important to check this free visual depiction of what analysts expect for the future.

Has Elders Limited Been A Good Investment?

Most shareholders would probably be pleased with Elders Limited for providing a total return of 78% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Mark Allison is paid around what is normal the leaders of comparable size companies.

The company isn't growing earnings per share, but shareholder returns have been strong over the last three years. So we can't see a reason to suggest the pay is inappropriate. So you may want to check if insiders are buying Elders shares with their own money (free access).

If you want to buy a stock that is better than Elders, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance