Woodward (WWD) Misses on Q4 Earnings Despite Top-Line Growth

Woodward, Inc. WWD reported decent fourth-quarter fiscal 2021 results with adjusted earnings and sales increasing on a year-over-year basis. The rise was driven by improving market conditions, strength across the aerospace segment resulting from recovering passenger traffic, and effective working capital management along with solid defense original equipment manufacturer (OEM), commercial OEM and aftermarket sales.

However, both the bottom line and top line lagged their respective Zacks Consensus Estimate. Despite the global economic upswing, macroeconomic uncertainties, weak industrial segment sales, regional market volatility, and supply chain disruptions stemming from the pandemic continue to hamper Woodward’s business.

Net Income

On a GAAP basis, net earnings in the quarter were $49.9 million or 76 cents per share compared with $57.2 million or 89 cents per share in the year-ago quarter. The year-over-year decline despite top-line improvement was due to higher operating expenses.

Adjusted net earnings came in at $53.6 million or 82 cents per share compared with $48.1 million or 75 cents per share in the year-earlier quarter. The bottom line missed the Zacks Consensus Estimate by 3 cents.

In fiscal 2021, GAAP earnings decreased to $208.6 million or $3.18 per share from $240.4 million or $3.74 per share in the prior fiscal. Adjusted net earnings in fiscal 2021 came in at $212.4 million or $3.24 per share compared with $254 million or $3.96 per share in fiscal 2020.

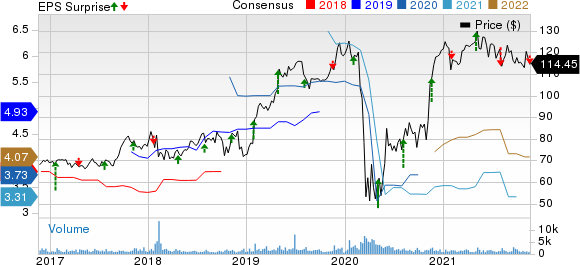

Woodward, Inc. Price, Consensus and EPS Surprise

Woodward, Inc. price-consensus-eps-surprise-chart | Woodward, Inc. Quote

Revenues

Net sales in the fiscal fourth quarter improved 7.3% year over year to $570.2 million due to higher sales in the Aerospace segment. However, it was negatively impacted by delayed orders and global supply chain disruptions, mainly hampering the aerospace business. Apart from COVID-19 hardships, regional market volatility acted as a major headwind. In fiscal 2021, net sales were $2,245.8 million compared with $2,495.7 million in the prior year.

Commercial OEM and aftermarket sales improved on a year-over-year basis, thanks to the increasing aircraft build rates and recovering domestic passenger traffic. Defense OEM sales were down 6% year over year. The company expects guided weapons volume to considerably fall in fiscal 2022. With businesses picking up pace despite the lingering COVID-19 impact, factors such as increasing crude prices and energy demand have boosted the global oil and gas markets, thereby accelerating investments. The top line lagged the consensus estimate of $600 million.

Segment Results

Aerospace: Net sales were up to $376.8 million from $336.3 million led by higher commercial OEM (up 67% year over year) and aftermarket sales (up 23%) resulting from improving passenger traffic. Favorable defense spending along with aircraft utilization and upgrade programs aided the segment’s quarterly results amid the global turmoil.

Positive indicators such as Boeing 737 MAX’s service recovery across key markets and gradual increase in aircraft production rates are expected to boost the segment’s revenues in the upcoming quarters. The segment’s earnings were $65.7 million, up from $58.5 million in the year-ago quarter driven by higher sales volume in commercial OEM.

Industrial: Net sales totaled $193.4 million, down 0.8% year over year due to the impact of global supply chain constraints stemming from the pandemic accompanied by weakness in China natural gas engines and lower industrial gas turbines sales. The China V diesel truck pre-buy dampened natural gas engine sales. Excluding the divestiture of renewable power systems and related businesses, favorable forex enhanced the segment’s profitability.

Investments are expected to increase with the gradual improvement in global oil demand and increasing prices. The segment’s earnings were $20.7 million, up from $18.7 million in the year-ago quarter.

Other Details

Total costs and expenses increased to $509.2 million from $463.1 million a year ago. Adjusted EBITDA came in at $106.1 million compared with $98.3 million in the year-ago quarter.

Cash Flow & Liquidity

In fiscal 2021, Woodward generated $464.7 million of net cash from operating activities compared with $349.5 million a year ago. Free cash flow in the same period came in at $427 million compared with $302.4 million in the prior-year period, driven by lower capital expenditures and effective working capital management. As of Sep 30, 2021, the company had $484.5 million in cash and cash equivalents with $734.1 million of long-term debt (less current portion) compared with respective tallies of $153.3 million and $736.8 million in the prior-year period.

Guidance

In fiscal 2022, net sales are expected to be between $2.45 and $2.65 billion with improvement in both the segment sales. While Aerospace segment earnings are likely to increase by approximately 200 to 300 basis points on the back of increased sales volume in both commercial OEM and aftermarket businesses, Industrial segment earnings are expected to be approximately flat to up 150 basis points driven by higher sales volume. Woodward remains focused on leveraging its operational structure and optimizing working capital to tap on growth opportunities and return to pre-COVID-19 capital allocation strategy to enhance long-term shareholder value. Earnings are likely to be in the range of $3.55 to $3.95 per share.

Zacks Rank & Stocks to Consider

Woodward currently has a Zacks Rank #4 (Sell).

A better-ranked stock in the industry is Watts Water Technologies, Inc. WTS, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Watts Water has a long-term earnings growth expectation of 8% and delivered an earnings surprise of 14.6%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 4.6% in the past 90 days. Watts Water aims to continuously launch smart and connected products, which are likely to provide it with a competitive edge in the marketplace.

Transcat, Inc. TRNS, carrying a Zacks Rank #2, is another solid pick for investors. It has a long-term earnings growth expectation of 8% and delivered an earnings surprise of 37.2%, on average, in the trailing four quarters.

Earnings estimates for the next year for the stock have moved up 7.1% in the past 90 days. Shares of Transcat have moved up a stellar 215.9% over the past year.

Arista Networks, Inc. ANET carries a Zacks Rank #2. It has a long-term earnings growth expectation of 16.7% and delivered an earnings surprise of 6%, on average, in the trailing four quarters.

Arista is likely to benefit from strong momentum and diversification across its top verticals and product lines. It has expanded its cognitive campus edge portfolio with a new Wi-Fi 6E access point and has introduced an enterprise-grade Software-as-a-Service offering for its flagship CloudVision platform.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Transcat, Inc. (TRNS) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance