Winners And Losers Of Q1: KLA Corporation (NASDAQ:KLAC) Vs The Rest Of The Semiconductor Manufacturing Stocks

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the semiconductor manufacturing industry, including KLA Corporation (NASDAQ:KLAC) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.3%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, but semiconductor manufacturing stocks have shown resilience, with share prices up 8.8% on average since the previous earnings results.

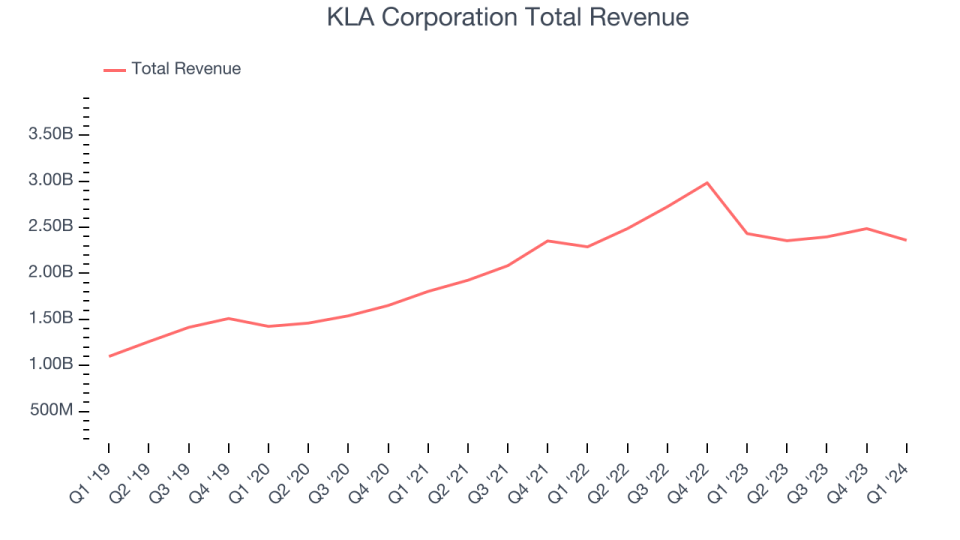

KLA Corporation (NASDAQ:KLAC)

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ:KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

KLA Corporation reported revenues of $2.36 billion, down 3% year on year, topping analysts' expectations by 1.7%. It was a decent quarter for the company, with a solid beat of analysts' EPS estimates and optimistic revenue guidance for the next quarter.

"KLA's March quarter results were above our adjusted guidance as customer demand and company execution tracked consistent with our expectations," said Rick Wallace, president and CEO, KLA Corporation.

The stock is up 17.6% since the results and currently trades at $793.21.

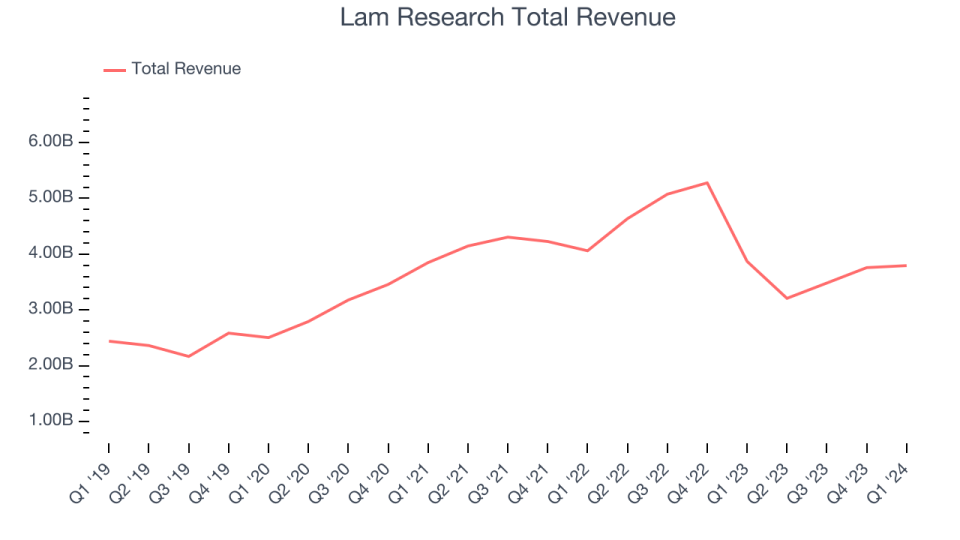

Best Q1: Lam Research (NASDAQ:LRCX)

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $3.79 billion, down 2% year on year, outperforming analysts' expectations by 1.7%. It was a strong quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

The stock is up 13% since the results and currently trades at $1,000.61.

Is now the time to buy Lam Research? Access our full analysis of the earnings results here, it's free.

Kulicke and Soffa (NASDAQ:KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $172.1 million, down 0.5% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

The stock is up 2.5% since the results and currently trades at $45.37.

Read our full analysis of Kulicke and Soffa's results here.

Entegris (NASDAQ:ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ:ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $771 million, down 16.4% year on year, falling short of analysts' expectations by 0.1%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and an increase in its inventory levels.

The stock is down 0.4% since the results and currently trades at $132.42.

Read our full, actionable report on Entegris here, it's free.

IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $252 million, down 27.4% year on year, falling short of analysts' expectations by 0.7%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

IPG Photonics had the slowest revenue growth among its peers. The stock is down 2.6% since the results and currently trades at $86.28.

Read our full, actionable report on IPG Photonics here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance