Will Williams-Sonoma's (WSM) E-commerce Drive Aid FY'2023?

Williams-Sonoma, Inc. WSM has been declining lately, unlike its respective industry. The company has been witnessing supply-chain woes, material and labor shortages, and macro uncertainties.

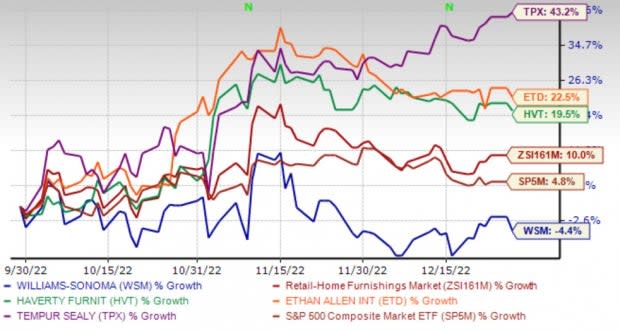

In the past three months, its shares have declined 4.4% against the Zacks Retail - Home Furnishings industry’s 10% growth and the S&P 500 index’s 4.8% increase. In fact, Tempur Sealy International, Inc. TPX, Ethan Allen Interiors, Inc. ETD and Haverty Furniture Companies, Inc. HVT gained 43.2%, 22.5% and 19.5%, respectively.

Nonetheless, the company has been banking on a digital-first but not digital-only channel strategy. Also, backlog order fulfillment, strong product margins and disciplined cost control are added benefits.

Image Source: Zacks Investment Research

Let’s check out the factors substantiating this Zacks Rank #3 (Hold) company. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Growth Factors

E-commerce Platform Driving Growth: Williams-Sonoma is one of the largest e-commerce retailers in the United States. The company is observing higher-than-expected e-commerce traffic and very strong demand from the e-commerce business in Canada. Its innovative efforts have helped the company drive e-commerce growth. The company’s investment in the merchandising of its brands, efficient catalog circulations and digital marketing boosts revenues from the e-commerce channel.

The company remains on track to invest nearly $350 million in the business in fiscal 2022, prioritizing technology and supply chain initiatives that primarily support e-commerce growth. Notably, in the fiscal third quarter, WSM delivered 4.4% comps growth in e-commerce. The company is expected to generate more revenues from the e-commerce channel as it focuses on re-platforming mobile sites to progressive web app technology, streamlining the checkout process and implementing the next generation of machine learning, on-site search and personalization experiences.

Product Innovation, Marketing & Digitalization: Williams-Sonoma is a highly customer-centric company that focuses on enhancing the customer experience through technological innovation as well as operational improvement. Also, continuous technological and new product innovation helps it enhance customer engagement. The company’s initiatives in e-commerce and real estate optimization strategies have been driving its channel mix shift.

It has also been reworking the marketing strategy, placing more emphasis on digitally targeted marketing and investing in store remodeling. In digital advertising, the company is transitioning from catalog mailing to higher-impact digital channels to drive a short-term return on investment, long-term gains and customer growth. Higher digital marketing is driving incremental customer counts. Its newest division, Williams-Sonoma Inc. Business-to-Business, made significant progress. Its B2B business had a solid quarter, driving a 17% increase in demand in the fiscal third quarter. It also remains on track to become a $1 billion business in fiscal 2022. WSM continues to grow in this space by focusing on diversifying its product pipeline across a range of industry verticals.

Headwinds

Supply-Chain, Inflation & Macro-Economic Woes: Williams-Sonoma witnessed short-term and long-term delays in the last few quarters. The company has been experiencing incremental distribution center costs, ocean freight costs that are higher along with dray and demurrage costs. The gross margin declined in the fiscal third quarter due to an increased furniture mix, higher backorder fulfillment and incremental freight costs.

WSM expects cost pressures to persist for the balance of fiscal 2022 and into the first half of fiscal 2023, primarily across the supply chain. These headwinds include incremental distribution centers, higher product and freight costs and efforts to best serve its customers by delivering products as timely as possible.

For fiscal 2023, the Zacks Consensus Estimate has declined to $14.35 per share from $16.23 per share in the past two months. This reflects a 13.2% year-over-year decline on 2.4% lower revenues.

Competitive Pressure: The specialty e-commerce and retail businesses are highly competitive. Williams-Sonoma competes with other retailers that market the same kind of merchandise. The company also competes with national, regional and local businesses that follow a similar retail store strategy as well as traditional furniture stores, department and specialty stores. It remains under uncontrollable competitive pressure from companies with similar concepts or products. To proactively respond to this competition, the company needs to regularly keep track on a market-by-market basis. The substantial sales growth in the e-commerce industry in the last decade has encouraged the entry of new competitors and business models as well. Increased competition can reduce Williams-Sonoma’s sales and harm its operating results and business.

A Brief Overview of the Above-Mentioned Stocks

Tempur Sealy: This home improvement company focuses on bedding products that are sold in the U.S. and Canada, as well as other markets. The company remains focused on long-term growth by expansion of the total global addressable market, international expansion, industry-leading innovation capabilities and balanced capital allocation.

TPX’s shares have declined 27% over the past year, outperforming the industry. Earnings estimates for 2023 have remained stable at $2.63 per share over the past 30 days.

Ethan Allen: This Danbury, CT-based company engages in interior design, manufacture and retail of home furnishings. Its wide array of offerings, a strong network of retail design centers and focus on interior design services as well as technological enhancements have been benefiting the company. It remains well-positioned for fiscal 2023 with its product offerings, advantage of vertical integration, including its North American manufacturing, interior design-focused retail network, a strong logistics network and a healthy balance sheet to maximize opportunities during the year.

ETD’s shares have declined 1.1% over the past year, outperforming the industry. Earnings estimates for fiscal 2023 have remained stable at $3.54 per share over the past 60 days.

Haverty: Based in Atlanta, GA, Haverty operates as a specialty retailer of residential furniture and accessories in the United States. The company’s focus on enhancing its online presence is expected to drive profit. For this, the company has been making investments in information technology. Although challenges like lower traffic and lower written orders owing to high inflation and slowing housing sales persist, the company’s commitment to serving customers better with fashion, value, design and customization bodes well.

The HVT stock has declined 1.7% over the past year, outperforming the industry. The company’s earnings estimates for 2023 have increased to $4.35 per share from $3.85 in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tempur Sealy International, Inc. (TPX) : Free Stock Analysis Report

WilliamsSonoma, Inc. (WSM) : Free Stock Analysis Report

Haverty Furniture Companies, Inc. (HVT) : Free Stock Analysis Report

Ethan Allen Interiors Inc. (ETD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance