Why Ulta Beauty Inc. Stock Fell 11% in October

What happened

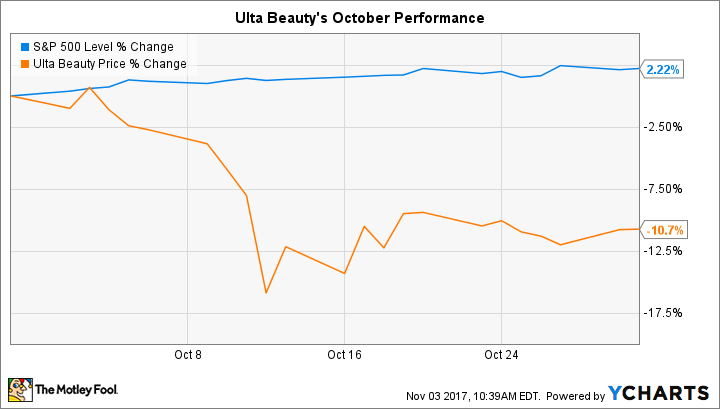

Spa and beauty retailer Ulta Beauty (NASDAQ: ULTA) lost 11% last month, according to data provided by S&P Global Market Intelligence, even as the broader market rose by over 2%.

The dip added to significant short-term losses for the former Wall Street darling, which is now down about 20% since the start of the year.

So what

Shares were pressured last month by a few investment-bank downgrades, including one from an analyst at Piper Jaffray, who cut his price target on the stock from $260 to $210 per share. The cosmetics industry is likely to see slowing growth and increased competition, the analyst predicted.

Now what

There's no evidence of these trends hurting Ulta's results yet. In fact, the retailer's latest numbers included soaring e-commerce sales, rising customer traffic, and increased spending per customer. Following that report, CEO Mary Dillon and her team raised their full-year outlook for the second time this year.

Image source: Getty Images.

Ulta is set to post its third-quarter results in late November, with comparable-store sales predicted to rise by between 9% and 11% on top of a 17% spike in the prior-year period. If the retailer continues meeting, or exceeding, its aggressive targets, investors are bound to once again turn optimistic about this quickly growing business.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool recommends Ulta Beauty. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance