Why Ternium Is the World's Best Steel Company

Ternium SA (NYSE:TX) is a leading steel company in Latin America, with a dominant position in Mexico and Argentina, as well as a growing operation in Brazil. Despite its operations in South and Central America, the company is actually headquartered in Luxembourg, a small, business-friendly country in Europe.

I have been accumulating a long position in Ternium, which I believe is the best steel company in the world. The stock is cheap with a price-to-operating cash flow ratio of 3.22 and a price-book ratio of 0.65.

The world's best steel company?

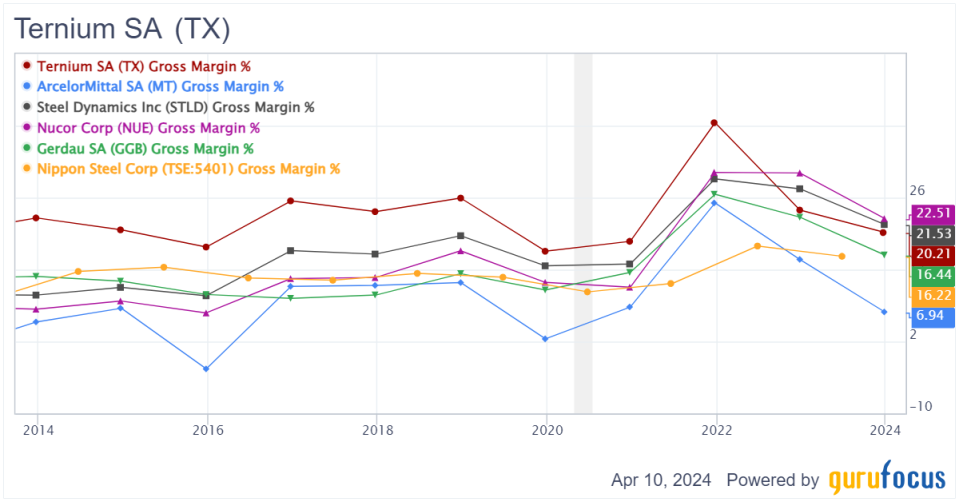

Ternium has been a remarkably profitable company in a tough industry. Over the past 10 years, it has averaged $1.04 billion in net income and a gross margin of 26%. Over the same time frame, steel companies like Gerdau S.A. (NYSE:GGB), ArcelorMittal (NYSE:MT), Nippon Steel (TSE:5401), Steel Dynamics (NASDAQ:STLD) and Nucor Corp. (NYSE:NUE) have averaged gross margins ranging from 12% to 20%, significantly trailing Ternium's 26%.

What makes Ternium so difficult to compete with

Ternium is extremely difficult to compete with, and its advantages go far beyond its leading technology and cost-advantaged position. The company is vertically integrated, from the mining of iron ore to the manufacturing of steel products and the distribution of those same products. Moreover, Ternium builds its steel plants close to its customers and offers a wide selection of high-quality steel, including specialized products that demand higher margins. The company also has an economies of scale position in Latin America, where it enjoys a dominant market share. With its ability to use its own iron ore, the company has bargaining power with its primary iron ore supplier Vale S.A. (NYSE:VALE).

As steel demand collapsed in early 2020, Ternium's competitors were forced to shut down their operations, but it continued operating. During the second-quarter 2020 earnings call, CEO Maximo Vedoya said, "The cost competitiveness of our facilities and the capacity to roughly change the degree of integration among Ternium's mills allows for this quick adaption to change in market environments."

Ternium produced $578 million of free cash flow in the first half of 2020; explaining this outcome, Vedoya said, "We minimized inventory buildups, and reduced purchase of raw material, third-party steel and other items. We work with our supply chain to reduce working capital and we postponed several capital expenditure projects across our facilities."

The company also reduced its wage expense by replacing third-party contractors with its own employees. So not only does Ternium have innate operational advantages, but it also has a razor-sharp management team, which, in my opinion, rounds out its position as the world's best steel company.

The growth of Latin America

Over the past decade, Latin America has not been the best place to invest. But I believe that's exactly what makes it an attractive place to invest in 2024. You see, when an economy is hot, you often get overinvestment and capacity expansion by companies that are extrapolating past prosperity into the future. This certainly does nto seem to be the case in South America, where you have countries like Brazil, whose gross domestic product (measured in U.S. dollars) is actually below what it was in 2010. Meanwhile, Ternium has been increasing its stake in Brazilian steelmaker Usiminas. Why? Because now is the time to invest for future prosperity.

Brazil has a GDP per capita that's roughly one-ninth that of the United States. Mexico, Ternium's primary market, has a GDP per capita that's just one-seventh that of the U.S. This means these countries have ample room for growth and ample room for steel consumption. Total South American steel production is absolutely minuscule compared to that of China and Europe, and is also less than that of the U.S., Japan and India. Ternium plans to take back share from steel importers and do a service to the countries and industries it serves. In my opinion, there is tons of room for growth.

The risks of investment

One of the biggest risks for the stock is Chairman Paolo Rocca and his family own the majority of the common shares. This means regular shareholders do not have much in terms of voting rights. Luckily, Rocca seems to be managing the company for the long term, keeping a very conservative balance sheet with a 3 times current ratio and net cash position. Ternium also has a long history of paying healthy and well-covered dividends. I believe in the power of incentives, and the incentive here is for the company to remain a cash-gushing asset for the Rocca family for decades to come.

Second is the risk of volatile steel prices, as well as the construction of Ternium's new plant in Mexico and upgrades to Usiminas in Brazil, which will temporarily increase its capital expenditures. Capex will increase to an estimated $1.80 billion in 2024 and $2.50 billion in 2025. In comparison, the company had $2.50 billion in cash from operations last year. This means the dividend could be cut in any given year and the share price could be volatile. However, I do not think this will result in an increase in debt, given that Ternium has a net-cash balance sheet. Additionally, this should not affect reported earnings. With earnings per share estimates slightly above $7 in 2024 and 2025, the forward price-earnings ratio is very low.

Valuation

With a cyclical company like Ternium, it is better to look at average earnings than current earnings. As I mentioned earlier, Ternium has averaged $1.04 billion of earnings over the past 10 years, which compares favorably to its market cap of just over $8 billion. But given the company has substantially increased its total assets over this time, one could surmise that normalized earnings are greater than this 10-year average (between $1.10 billion and $2 billion). Analysts' 2024 and 2025 estimates indicate earnings of around $1.40 billion, giving Ternium a forward price-earnings ratio of about 6. When you factor in that Ternium has ample room for reinvestment and growth, the stock looks very cheap here.

Ternium currently trades at 3.22 times operating cash flow and 0.65 times book, which is a substantial discount to the price Nippon Steel offered to pay for U.S. Steel (NYSE:X) (roughly 7.10 times operating cash flow and 1.30 times book). Now, you could argue that U.S. Steel operates in a more politically stable country and deserves this premium. But, you could also say that U.S. Steel is a far inferior business to Ternium and one that relies on import tariffs. Given the choice, I would much rather own all of Ternium than all of U.S. Steel.

Summary

Competitors have shaky knees when they see Ternium coming, and for good reason. The company has a wickedly smart management team and several competitive advantages. Combine this with the long-term vision of its chairman, and Ternium is quite possibly the best steel company in the world.

This only becomes more compelling when you factor in that Ternium operates in Latin America, where GDP per capita is low and steel production is minuscule. The company has shown its propensity to reinvest and grow; whether it's acquiring companies like Usiminas or expanding its operation in Mexico, Ternium looks like an undervalued and underrated compounder. With a market cap of just over $8 billion and $1.4 billion of earnings estimated in 2024 and 2025, I am bullish on the stock.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance