Why These Single-Family-Home REITs Rallied in January

What happened

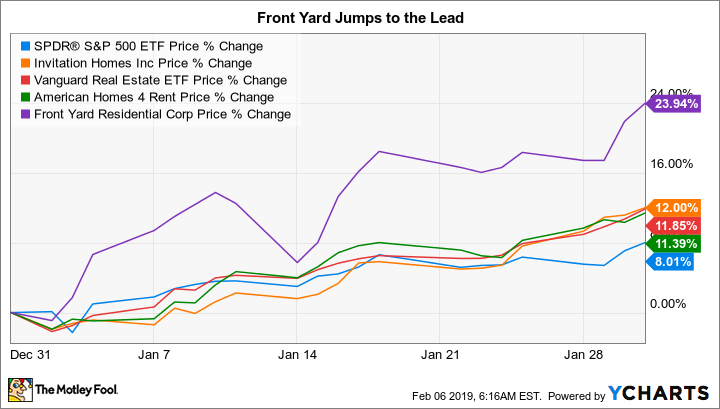

The shares of real estate investment trust Invitation Homes (NYSE: INVH) rose 12% in January, according to data provided by S&P Global Market Intelligence. Peer American Homes 4 Rent (NYSE: AMH) saw its stock advance around 11.5% last month. Both basically tracked the broader REIT sector, which, using exchange traded fund Vanguard Real Estate ETF (NYSEMKT: VNQ) as a proxy, was up just under 12%. And all three of these securities beat the S&P 500 Index's gain of around 8% in the first month of 2019.

Image source: Getty Images.

That said, one single-family-home REIT stood out on the upside. Front Yard Residential (NYSE: RESI) jumped an incredible 24% in January. That was roughly three times the gain of the S&P 500 and about twice the gain of its peers Invitation Homes and American Homes 4 Rent in this relatively small and new niche in the REIT space.

So what

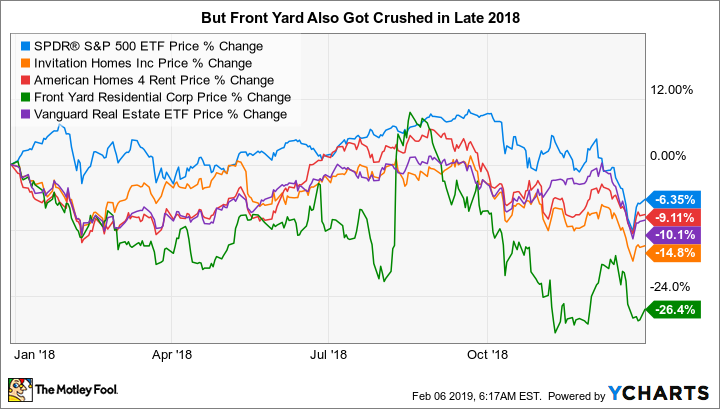

The January gains at these three REITs -- which rent single-family homes -- came on the heels of notable declines at the end of 2018. The final months of last year pushed the S&P 500 down around 6% for the full year, with Invitation Homes off by nearly 15% and American Homes 4 Rent off by 9%. Neither of the REITs, however, were particularly out of line with the 10% decline in the Vanguard Real Estate ETF. So it shouldn't be too much of a surprise that they came back a little stronger than the S&P 500 in January, but didn't outdistance the REIT space.

The big January move at Front Yard Residential shouldn't be any more surprising for essentially the very same reason. The stock was down a painful 26% in 2018, with a steep drop in the last couple of months of the year. The fact that it came roaring back in January, as investors were getting more positive, is no different from what transpired with its peers...just more dramatic, since the downturn was also so much more dramatic.

And since there was no real news in January out of these three single-family-home owners, the big issue was investor sentiment. Investors ended 2018 in a particularly dour mood and shifted to a far more positive stance in January. So don't read too much into the January uptick from a fundamental perspective -- it was just the market's typical, and often extreme, gyrations that did most of the work.

That said, there was a little bit of news out of Invitation Homes worth noting. The CEO had been on personal leave since late in 2018, with the company announcing in mid-January that it had selected a replacement. That helped to clarify a little management uncertainty. Invitation Homes also announced that it would settle a convertible security in stock, which would help its deleveraging efforts and lower its interest costs. Both were net positives, but neither was likely behind the January stock price gain.

American Homes 4 Rent, meanwhile, issued roughly $400 million in bonds. The proceeds will largely be used to pay down a revolving credit facility, so there's no material change from this other than extending the duration of the debt involved and freeing up some room on the credit facility. Again, not really a big enough event to move the stock. Front Yard, the stock that made the biggest monthly move, literally released no news in January.

Now what

Market moves -- up or down -- are swift and extreme sometimes. The last couple of months are clear evidence of this. That said, it doesn't appear that anything fundamental changed in January at Invitation Homes, American Homes 4 Rent, and Front Yard Residential that would justify their drastic stock moves. The gains were, in the end, just investor sentiment shifting from negative to positive. Fickle investors could switch again just as quickly.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance