Why Prudent Investors Are Adding AIG to Their Portfolio Now

American International Group, Inc. AIG is well poised to grow on the back of its multi-year transformative program and growing underwriting gains. Also, its fixed maturity securities and loan portfolios are generating higher yields.

American International — with a market cap of $38 billion — is a leading global insurance organization. Building on its long history, AIG provides a wide range of property casualty and different types of liability insurance. AIG also includes multiple types of auto insurance and health products.

Courtesy of solid prospects, this presently Zacks Rank #1 (Strong Buy) stock is worth snapping up at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

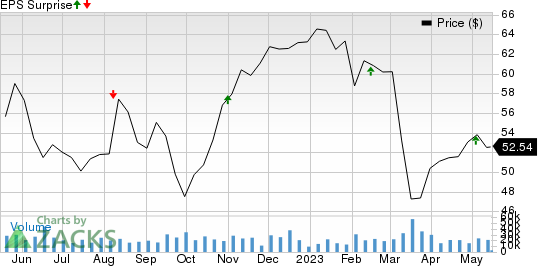

The Zacks Consensus Estimate for American International’s 2023 earnings is pegged at $6.47 per share, indicating a 42.2% rise from the year-ago reported figure. AIG has witnessed three upward estimate revisions in the past week against none in the opposite direction. AIG beat on earnings in three of the last four quarters and missed once, the average surprise being 9.2%.

American International Group, Inc. Price and EPS Surprise

American International Group, Inc. price-eps-surprise | American International Group, Inc. Quote

The consensus estimate for 2023 revenues stands at $48.4 billion, suggesting a 6.6% rise from the year-ago reported figure.

AIG’s transformative program named AIG 200 is enabling the company to make significant cost savings. This multi-year initiative is expected to continue boosting the company’s margins. Last year, it witnessed a major improvement in the expense ratio, which is expected to continue this year as well.

The company’s investment income is expected to continue benefiting from the high interest rate environment. Rising yields generated from fixed maturity securities and loan portfolios continue to support its net investment income growth.

AIG’s prudent capital allocation to buyouts and shareholder value addition is a major positive. It makes strategic acquisitions to scale businesses like Validus Holdings and Glatfelter Insurance Group, which are strengthening AIG’s global General Insurance business. It also does not shy away from divesting non-core assets to increase profitability.

Its capital-deployment efforts are likely to enhance shareholder value through share buybacks and dividend payouts. In the first quarter of 2023 alone, the company rewarded its shareholders with $603 million in repurchases and dividends worth $241 million. It recently boosted its quarterly cash dividend by 12.5% to 36 cents per common share. The company had $3 billion remaining under its share repurchase authorization as of Apr 28, 2023.

Risks

There are a few factors that might mar American International’s prospects.

American International's return on equity of 8.6% is lower than the industryaverage of 9.8%. This reflects AIG's relative inefficiency in utilizing its shareholders’ funds to generate profits. Also, its high leverage ratio (net debt-to-capital of 48% against the industry average of 3.1%) is concerning. Nevertheless, we believe that a systematic and strategic plan of action will drive AIG’s long-term growth.

Other Key Picks

Some other top-ranked stocks in the broader finance space are Allianz SE ALIZY, Lemonade, Inc. LMND and Rithm Capital Corp. RITM, each carrying a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for Allianz’s 2023 earnings is pegged at $2.53 per share, indicating 48% year-over-year growth. Over the past 60 days, ALIZY has witnessed one upward estimate revision against none in the opposite direction.

The Zacks Consensus Estimate for Lemonade’s 2023 earnings suggests 15.9% year-over-year growth. Also, the consensus mark for LMND’s revenues in 2023 suggests a 53.6% year-over-year rise.

The Zacks Consensus Estimate for Rithm Capital’s 2023 bottom line is pegged at $1.39 per share, implying 6.1% year-over-year growth. Also, the consensus mark for its revenues indicates a 2.8% increase.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Allianz SE (ALIZY) : Free Stock Analysis Report

Lemonade, Inc. (LMND) : Free Stock Analysis Report

Rithm Capital Corp. (RITM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance