Why PagSeguro Digital Stock Rose 21.7% in June

What happened

Shares of PagSeguro Digital (NYSE: PAGS) gained 21.7% in June, according to data from S&P Global Market Intelligence. The stock climbed amid broader market momentum and continued to move higher after a Goldman Sachs analyst initiated coverage with a "buy" rating.

Goldman Sachs analyst Tito Labarta published a note on June 10 giving PagSeguro stock a "buy" rating and putting a $40 price target on the stock. In the trading session prior to the publication of the note, the stock closed at $35.77, so Labarta's target suggested roughly 12% upside on the stock within a one-year time frame.

Image source: PagSeguro.

So what

The overall payment processing market looks primed for long-term growth in Brazil and around the world, and Labarta outlined in his note that she saw it PagSeguro would benefit from operating in an "untapped market with less competition." The stock's gains arrived on the heels of strong first-quarter results in May, and its share price has since gone on to move above the Goldman analyst's price target.

Now what

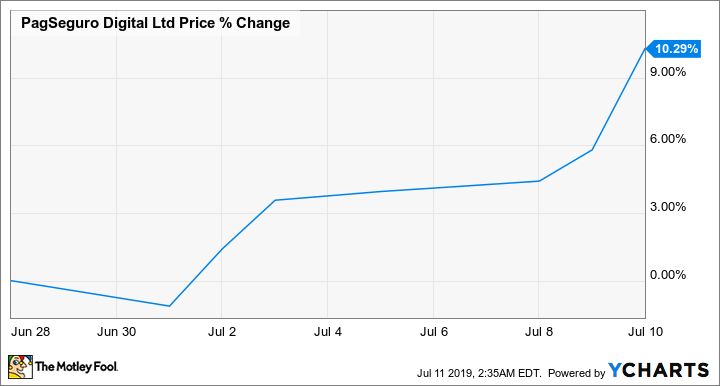

PagSeguro stock has continued to climb in July, with shares trading up roughly 10% in the month and valued at roughly $43 as of this writing.

The Brazilian economy has been volatile in recent years, but payment services are a business category that could continue to see solid growth even if overall macroeconomic conditions in the country were to worsen. If the Brazilian recovery continues over the long term, and PagSeguro continues to deliver quality products and services without facing an influx of new competition, the stock could have a long runway for growth. Shares are priced at roughly 35.5 times this year's expected earnings.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool recommends PagSeguro Digital. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance