Why PagSeguro Digital Stock Gained 22.9% in May

What happened

Shares of PagSeguro (NYSE: PAGS) gained 10.5% in April, according to data from S&P Global Market Intelligence. The company's stock managed to defy sell-offs hitting both the Brazilian and U.S. stock markets thanks to its impressive earnings results, and it closed out the month with strong double-digit gains.

PagSeguro reported its first-quarter results on May 14, delivering solid sales and earnings beats that helped push the stock to fresh highs for the year. The company provides payment processing hardware, software, and services for businesses -- reminiscent of what Square is doing but focused on the Brazilian market. Strong business performance and a long runway for growth have helped PagSeguro's share price nearly double since market close on the day of its January initial public offering.

So what

Revenue for the quarter climbed 34.8% to hit roughly 1.25 billion Brazilian reals, or roughly $315 million. Total payment volume through the company's platform increased nearly 70% year over year, and PagSeguro added an impressive 280,000 new merchant partners compared to the prior-year period. Adjusted net income for the period came in at BRL325 million, an increase of 50% year over year -- although just 1% due to some seasonality with the business.

The company is also rolling out a range of new products including a cash card, a credit card, instant payment, and a paycheck depositing service. PagSeguro seems to be following -- and succeeding with -- the established playbook of building its customer base and introducing new services and features in order to increase average sales to its merchant partners.

Now what

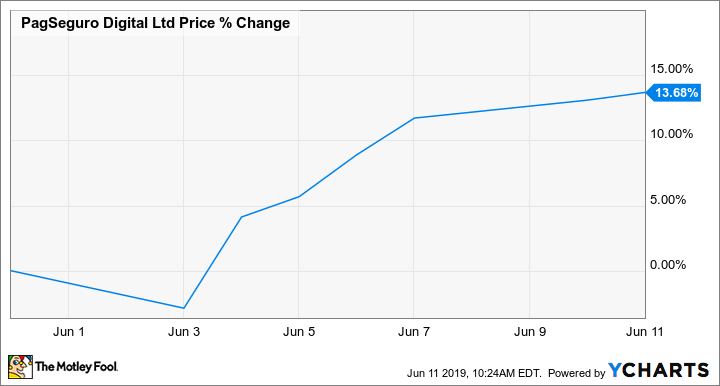

PagSeguro stock's impressive run has continued in June, with shares up 13.7% in the month so far as of this writing.

Shares now trade at roughly 30 times this year's expected earnings. Brazil seems to be making progress on its economic turnaround, and there's still plenty of room for growth in the credit and payment processing space in the country. Investors should proceed with the understanding that the country's economy has been volatile in recent years, and further volatility could disrupt PagSeguro's growth trajectory, but the business is showing great momentum and appears to be on track to continue posting strong results in the near term.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool recommends PagSeguro Digital. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance