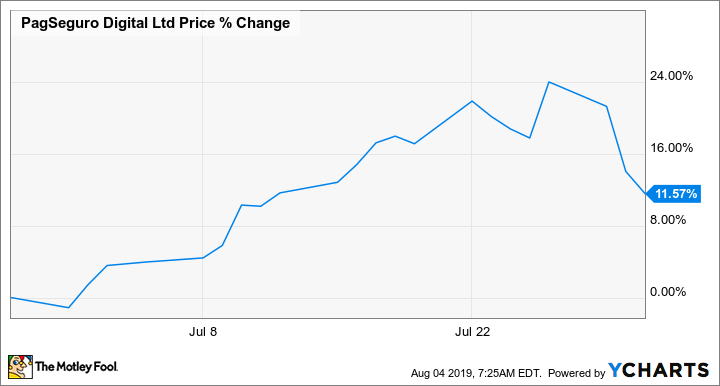

Why PagSeguro Digital Stock Climbed 11.6% in July

What happened

Shares of PagSeguro Digital (NYSE: PAGS) gained 11.6% in July, according to data from S&P Global Market Intelligence. The Brazilian payment processing company's stock has been on a tear in 2019, and saw additional momentum in July on the heels of favorable analyst coverage.

Guggenheim published a report from analyst Jeff Cantwell on July 12, reiterating his buy rating on the stock and raising his one-year price target to $50 -- up from his previous target of $36. Evercore ISI Group also initiated coverage on PagSeguro stock with an outperform rating and a 12-month price target of $65.

Image source: Getty Images.

So what

Guggenheim's $50 price target suggested roughly 15% upside on the stock at the time of publication, while the $65 target from Evercore ISI Group analyst Rayna Kumar represented roughly 42% upside at the time of its publication. PagSeguro has benefited from positive analyst coverage in recent months, with a favorable note from Goldman Sachs also corresponding with a double-digit gain for the stock in June.

Now what

Payment processing services still have a long runway for growth, and PagSeguro currently looks well positioned to benefit from the long-term transition away from cash payment in the Brazilian market. However, it looks like the company and its investors will have to contend with some ongoing lumpiness in the Brazilian economy -- as the country slashed its annual target for growth domestic product from 1.6% to 0.8% in July.

PagSeguro is scheduled to report second-quarter earnings on Aug. 15, and its stock currently trades at roughly 35 times this year's expected earnings.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool recommends PagSeguro Digital. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance