Why Investors Need to Keep an Eye on Watts Water (WTS) Stock

Watts Water Technologies WTS is a stock, which investors may consider adding to their portfolio to combat the highly-volatile market environment and make some gains from its upside potential. The company currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street has been witnessing high volatility since the beginning of 2022, due to the pandemic and supply chain woes. Inflation, increasing crude oil prices and rate hike by the Federal Reserve and the ongoing Russia-Ukraine war has made investors apprehensive about the global economic recovery.

The macroeconomic and geopolitical uncertainties are likely to continue weighing on investors’ sentiments, resulting in more volatility in the U.S. equity market. The fears of a recession are looming large.

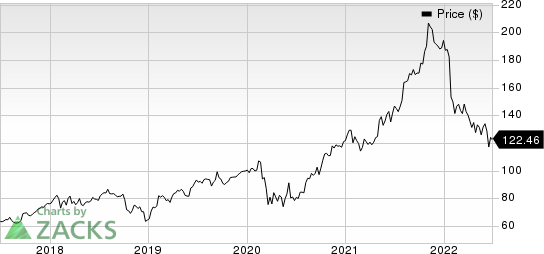

Watts Water Technologies, Inc. Price

Watts Water Technologies, Inc. price | Watts Water Technologies, Inc. Quote

Keep an Eye on WTS

Watts Water has emerged as more resilient to volatility than the Zacks sub-Industry it belongs to. The company’s shares have lost 16.1% of their value compared with industry’s decline of 22.7%.

The stock is down 42.2% from its 52-week high level of $212.00 reached on Nov 11, 2021, making it more affordable for investors.

Apart from having solid fundamentals, Watts Water has the favorable combination of a VGM of B and a Zacks Rank #2. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 or #2 and a VGM Score of A or B offer solid investment opportunities.

Watts Water has an impressive earnings surprise history. The company outpaced estimates in all the trailing four quarters, delivering an average earnings surprise of 11.2%. The stock has an impressive long-term earnings per share (EPS) growth expectation of 8%.

The Zacks Consensus Estimate of $6.11 per share for 2022 earnings suggests growth of approximately 10.7% from the year-ago period. For 2023, the consensus mark for earnings is pegged at $6.54, indicating a year-over-year increase of 7%.

In the last reported quarter, Watts Water posted adjusted earnings of 1.63 per share in first-quarter 2022, which increased 31% on a year-over-year basis while quarterly net sales rose 12% year over year to $463.2 million. Organic sales increased 14% year over year.

The company expects organic sales growth in the range of 5-10% for second-quarter 2022. For full-year 2022, Watts Water expects organic sales growth to be in the range of 3-8%. The company raised its adjusted operating margin outlook for 2022, driven by strong first-quarter results.

The adjusted operating margin is now estimated to be between 14.5% and 14.9%, with adjusted margin growth between 20 bps and 60 bps. The company had guided the adjusted operating margin to be between 14.3% and 14.7%, with adjusted margin growth between 0 bps and 40 bps.

Strong Fundamental Drivers

Headquartered in North Andover, MA, Watts Water designs, manufactures and sells various water safety and flow control products for the water quality, water conservation, water safety, and water flow control markets.

The company’s performance is driven by organic growth in all regions. Watts Water is focused on enhancing organic growth, expanding margin and reinvesting in productivity initiatives. The company’s performance is gaining from proper management of sourcing and operations amid supply chain troubles.

An augmented geographic footprint, aggressive cost reduction actions and a strong balance sheet are major tailwinds. Focus on differentiated product offerings provides a greater opportunity to augment its market position.

Pandemic-induced supply chain disruptions continue to affect its markets, customers and suppliers. Adverse foreign currency translation and geopolitical instability in Europe are other concerns.

Other Stocks to Consider

Some other top-ranked stocks from the broader technology sector worth consideration are InterDigital IDCC, PTC PTC and Vishay Intertechnology VSH. While PTC and InterDigital sport a Zacks Rank #1, Vishay Intertechnology carries a Zacks Rank #2.

The Zacks Consensus Estimate for Vishay Intertechnology’s 2022 earnings is pegged at $2.68 per share, rising 10.3% in the past 60 days. The long-term earnings growth rate is anticipated to be 22.7%.

Vishay Intertechnology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 5%. Shares of VSH have declined 19.2% in the past year.

The Zacks Consensus Estimate for InterDigital 2022 earnings is pegged at $3.33 per share, up 46.1% in the past 60 days. IDCC’s long-term earnings growth rate is pegged at 15%.

InterDigital’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 141.1%. Shares of IDCC have lost 15.3% of their value in the past year.

The Zacks Consensus Estimate for PTC’s fiscal 2022 earnings is pegged at $4.55 per share, rising 2.9% in the past 60 days. The long-term earnings growth rate is anticipated to be 11.8%.

PTC’s earnings beat the Zacks Consensus Estimate in all of the last four quarters, the average being 29.4%. Shares of PTC are down 24.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

PTC Inc. (PTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance