Why Should You Hold ServiceMaster (SERV) in Your Portfolio?

ServiceMaster Global Holdings, Inc. SERV is benefiting from diversified revenue streams, strong margin capacity and limited capital expenditure requirements.

The company’s earnings growth for the next five years is pegged at 16.9%, higher than the industry average of 14.4%. Earnings for fiscal 2019 and 2020 are expected to grow 40% and 6.2%, respectively.

Factors that Bode Well

ServiceMaster’s size and scale provide it competitive advantage in terms of purchasing power, operating and marketing efficiencies, and route density. With nationwide presence, its segments are large, growing and highly fragmented.

The company’s capital-light business model is characterized by strong adjusted EBITDA margins and limited capital expenditure requirements. This model enjoys operating leverage from route density and fixed investments in infrastructure and technology. This helps generate productivity and expand margins. The company’s revenue streams are diversified across customers and geographies, allowing it to mitigate risks in any particular customer segment and geography.

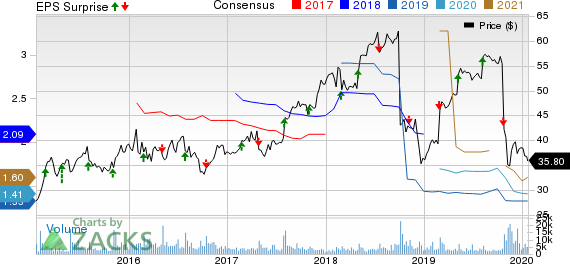

ServiceMaster Price, Consensus and EPS Surprise

ServiceMaster Global Holdings, Inc. price-consensus-eps-surprise-chart | ServiceMaster Global Holdings, Inc. Quote

ServiceMaster is focused on improving business through investments in sales, marketing and advertising, as well as brand awareness and market penetration initiatives. The company has deployed mobility solutions and routing and scheduling systems across many of its businesses in order to enhance overall efficiency and reduce operating costs.

Acquisitions have helped the company enhance offerings, expand geographic footprint and increase talent levels. The recent acquisitions of McCloud and Gregory are likely to enhance its capabilities in commercial pest control.

Some Risks

ServiceMaster has a highly leveraged balance sheet. As of Sep 30, 2019, long-term debt was $1.39 billion while cash and cash equivalents were $140 million. Such a cash position implies that the company needs to generate adequate amount of operating cash flow to service its debt. Also, high debt may limit its future expansion and worsen the risk profile.

The company’s termite damage claim costs are expected to increase in 2020 and keep the bottom line under pressure.

Zacks Rank and Stocks to Consider

ServiceMaster currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are S&P Global SPGI, Accenture ACN and Booz Allen Hamilton BAH, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term expected EPS (three to five years) growth rate for S&P Global, Accenture and Booz Allen is 10%, 10.3% and 13%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

ServiceMaster Global Holdings, Inc. (SERV) : Free Stock Analysis Report

Accenture PLC (ACN) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance