Why Should You Hold Gibraltar Industries (ROCK) Stock Now

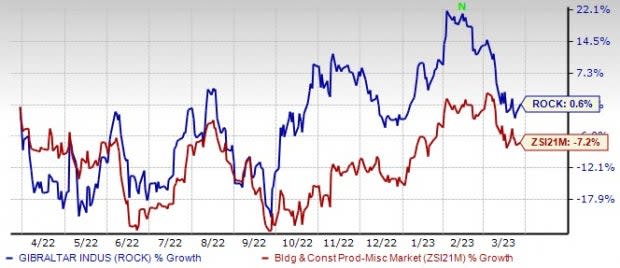

Gibraltar Industries Inc. ROCK is poised to benefit from its solid Three-Pillar strategy and the U.S. administration’s endeavor to boost renewable energy and infrastructure amid material and labor supply challenges, and delays and disruptions in solar project schedules due to panel supply issues. Shares of Gibraltar have gained 0.6% over the past year against the industry’s 7.2% decline.

The Zacks Consensus Estimate for 2023 earnings has remained unchanged, but the same for 2024 earnings increased to $4.29 from $4.27 per share over the past 30 days. The estimated figures indicate 4.4% and 20.7% growth for 2023 and 2024, respectively. The solid growth rate depicts the stock's promising future. We believe that ROCK offers a sound investment opportunity, as evident by its VGM Score of A.

However, supply-chain issues, material and labor supply-related challenges as well as other COVID-associated crises are causes of concern for this Zacks Rank #3 (Hold) company. Notably, the company is still dealing with panel supply issues for the U.S. solar industry, as 80% of key materials and components for panels are produced in China.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Let’s delve deeper into the major driving factors.

Thee-Pillar Strategy: Gibraltar is progressing well, operationally and financially, on the back of its three-pillar growth strategy. The strategy is focused on three core tenets - Business Systems, Portfolio Management and Organizational Development.

The first pillar, Business Systems, combines two of its previous strategic pillars, namely, operational excellence and product innovation. The second strategic pillar comprises Portfolio Management and Acquisitions. Through this pillar, the company is focused on optimizing its business portfolio.

In 2022, the company’s 3.7% revenue growth was mainly attributable to 2% contributions from acquisitions. Lastly, the third pillar of the strategy is Organizational Development. It primarily focuses on talent development, design and structure of an organization.

Strong Renewable & Infrastructure Prospects: The company remains encouraged by the long-term market prospects of the renewable energy business. U.S. solar growth has remained undeterred by solar panel tariffs or supply disruptions.

Although the solar industry continues to be impacted by panel availability, demand for solar remains very robust, which is reflected by project design activity, verbal customer commitments and master supply agreements.

Notably, in 2022, the U.S. installed 20.2 gigawatts (GWdc) of solar PV capacity to reach 142.3 GWdc of total installed capacity. Solar accounted for 50% of all new electricity-generating capacity added in the United States in 2022.

Per the Solar Energy Industries Association, it is the largest annual share in the industry's history and the fourth consecutive year that solar was the top technology with new electric capacity installations. Over the next 10 years, the industry is expected to grow five times larger than it is today, to a total solar fleet of more than 700 GWdc by 2033.

Meanwhile, the Infrastructure segment is also benefiting from increased demand for non-fabricated products. Solid visibility on State Departments’ transportation federal funding bidding activity is encouraging. The company expects to see spending increases as the states take advantage of the additional funding available through the infrastructure investment in Jobs Act in 2023.

Headwinds

The U.S. solar industry continued to contend with panel importation guidelines governed by the Uyghur Forced Labor Prevention Act, which has affected scoping and scheduling of projects. The Renewable business segment revenues and backlog were down 20.8% and 17%, respectively, in the fourth quarter of 2022.

Also, an increase in raw material costs is a growing concern for Gibraltar. During 2022, the company continued to witness higher costs related to labor and material. Also, the company had to face challenges regarding the supply of raw materials as well as logistic management.

The Residential segment’s adjusted operating profit and EBITDA margins declined 320 basis points (bps) and 300 bps, respectively. The decline is subjected to the acquisition of QAP (contributing decline of about 110 bps), increased prices and material costs and alignment of price and material costs.

Better-Ranked Stocks From the Construction Sector

Taylor Morrison Home Corporation TMHC: This Scottsdale, AZ-based homebuilder’s ongoing operational enhancements, acquisition synergies and robust pricing power have more than offset the inflationary pressure and delays in some closings. The company’s well-balanced, diverse mix of portfolio and operating strategy is encouraging. Shares of the company have gained 19.3% in the past three months.

TMHC currently sports a Zacks Rank #1. The Zacks Consensus Estimate for its 2023 earnings has been upwardly revised to $6.46 per share from $4.92 per share over the past 60 days.

NVR Inc. NVR: A disciplined business model and focus on maximizing liquidity and minimizing risks have helped NVR. The lot acquisition strategy helps the company avoid financial requirements and risks associated with direct land ownership and land development. This strategy allows it to gain efficiencies and a competitive edge over its peers.

NVR currently sports a Zacks Rank #1. NVR has seen an upward estimate revision for 2023 earnings over the past 30 days to $394.77 per share from $321.83. Shares of the company have gained 16.3% in the past three months.

Sterling Infrastructure, Inc. STRL currently carries a Zacks Rank #2 (Buy). STRL has a trailing four-quarter earnings surprise of 19.3%, on average. Shares of the company have gained 15.7% in the past three months.

The Zacks Consensus Estimate for STRL’s 2023 sales indicates a 0.8% decline, while that for earnings per share suggests 10.8% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance