Why is FX Volatility So Low, and How do we Trade Inevitable Return?

- Forex volatility prices/expectations fall near their lowest levels on record

- Two key factors explain the current lows in volatility

- We present our strategy for trading current conditions and the inevitable shift

Forex volatility has fallen near record-lows, and it seems that major currency pairs are likely to stick to tight trading ranges through the foreseeable future. But what’s driving the tumble in volatility, and more importantly, how might we trade current market conditions and the inevitable return to volatility?

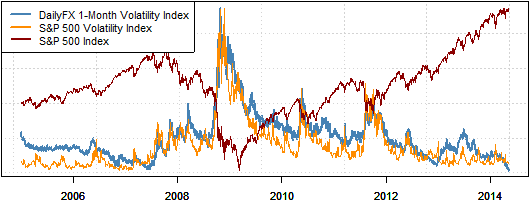

Forex Volatility Prices Fall near Record-Lows Seen in 2006

Data source: Bloomberg, DailyFX Calculations

Why is Volatility so Low, and what does it Tell Us about Future Conditions?

The simplest explanation is that low volatility feeds on itself. Or in other words: the fact that markets aren’t moving discourages traders from positioning themselves for big moves. This helps explain two key concepts in historical volatility trends: it tends to cluster and is mean-reverting.

Volatility clustering is simple: if volatility is low today/this week/this month, markets are likely to remain quiet tomorrow/next week/next month and so on. The opposite is true, and high volatility tends to breed much of the same.

Mean reversion is similarly easy to understand: volatility does not remain extremely low or extremely high forever. Instead we see that periods of especially slow market movement are often followed by a reversion to the mean—fast-moving markets typically follow as volatility remains near its long-term average.

These two simple concepts in volatility tell us two key things: volatility is likely to remain low until an abrupt shift in market conditions, and any subsequent change in dynamics is likely to lead to a sharp and sustained jump in volatility. Yet that leaves us looking for a catalyst.

What could force volatility sharply higher?

We see a number of obvious potential sources of a sharp jump in financial market and FX volatility. Some of them include the real risk of further escalation in the Russia/Ukraine standoff, a material slowdown in Chinese economic growth, and an otherwise-isolated turn lower in the high-flying S&P 500 and broader equity markets. But if these are so obvious, why haven’t they affected stock markets and currencies to date?

Forex Volatility Tumbles as S&P 500 Volatility Index Extremely Low, S&P itself near Record Highs

Data source: Bloomberg, DailyFX Calculations

Put simply: fear is a much stronger emotion than greed. Currently the fear we see in markets is underperformance. With the S&P 500 and broader equities trading to fresh record peaks on a regular basis, money managers are afraid that staying out of the market will mean that their funds will sharply underperform other managers.

We might term this the “careerist” mentality—consistently lagging the S&P’s performance is often the kiss of death for portfolio managers and will leave managers out of a job. We’ve seen traders say they’re “nervously long” stocks on account of the clear uptrend. And yet fear could manifest itself quite rapidly in the opposite direction: many of these investors would quite quickly dump stock holdings at the first sign of trouble.

It’s impossible to know exactly what might force such a flare-up in market tensions, but that’s exactly what we saw almost precisely five years ago when the “Flash Crash” sent the Dow Jones Industrial Average nearly 1000 points lower in mere minutes. Currency moves in that instance tell a clear story: the safe-haven US Dollar, Japanese Yen, and Swiss Franc surged versus major counterparts.

Correlations Suggest US Dollar Would Rally Sharply on Return to Forex Volatility

Data source: Bloomberg, DailyFX Calculations

How do we Trade Low Volatility Markets and the Inevitable Surge in Volatility?

Absent a significant change in conditions we need to remain realistic about trading strategies and currency trends. The obvious temptation is to go “long volatility” as it trades near record-lows. Derivatives traders might call this going “long gamma”, while spot FX traders would likely buy currencies that tend to do well as volatility recovers.

Going long the US Dollar is an obvious choice if you believe volatility will jump. Yet our Senior Technical Strategist notes that the DJ FXCM Dollar Index sees a “Huge Test” at nearby support. Our retail FX trader positioning data likewise shows the perils of buying into a clear downtrend.

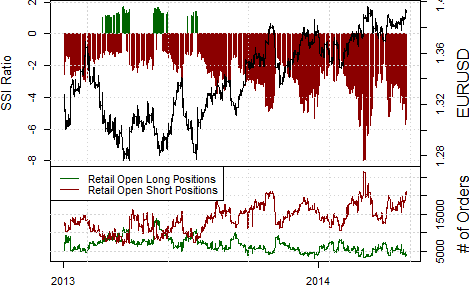

Crowds have been long the US Dollar versus the Euro (short EURUSD) since the Euro crossed above $1.28. Until sentiment shifts we see little reason to call for an important price reversal, and indeed our proprietary retail data has given steady contrarian signal to stay short USD.

Retail FX Traders at Most Short Euro Since it Traded to Multi-Year Highs

Data source:FXCM Execution Desk data, Prepared by David Rodriguez

In short: it seems wise to remain positioned for low volatility until we see signs of a turnaround. In concrete terms this means that the US Dollar remains a sell against major counterparts. And yet it remains similarly important to keep a close eye on broader markets; conditions can and likely will change quite rapidly.

Our Senior Strategist notes that volatility in the G10 FX space could potentially return with a vengeance headed into the coming months based on key long-term timing relationships. We’ll keep our eyes on conditions and update our trading biases/forecasts accordingly.

Sign up for updates on market conditions and Dollar outlook via this author’s e-mail distribution list

Written by David Rodriguez, Quantitative Strategist

DailyFX, the Research Arm of FXCM Inc. (FXCM)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance