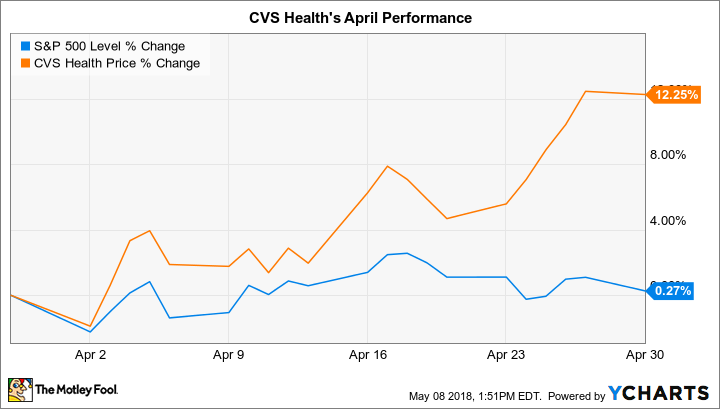

Why CVS Health Stock Gained 12% in April

What happened

CVS Health (NYSE: CVS) beat the market last month, rising 12% compared to a roughly flat S&P 500, according to data provided by S&P Global Market Intelligence.

The rally erased some of the sharp decline shareholders had witnessed since the beginning of the year, but CVS Health continues to trail the market over the past one-year and three-year time frames.

So what

April's bounce came following reports that the drugstore chain might not face an immediate and intense threat from Amazon, Berkshire Hathaway, and JPMorgan Chase, which have announced a joint effort aimed at improving healthcare delivery. CVS Health shares had dropped following news of this strategic partnership, but recovered slightly last month as investors' fears eased.

Image source: Getty Images.

Now what

The retailer announced first-quarter results in early May that included solid sales gains in its retail segment due to a severe flu season. Its pharmacy business enjoyed healthy claim volume, too, even as pricing pressure remained a challenge.

However, thanks to healthy overall demand, CEO Larry Merlo and his team raised their 2018 revenue growth target to between 1.5% and 3%, up from the prior range of between 0.25% and 2%. Executives also believe adjusted earnings will rise by about 21%, due mainly to a lower effective tax rate.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Demitrios Kalogeropoulos owns shares of BRK-B. The Motley Fool owns shares of and recommends AMZN and BRK-B. The Motley Fool recommends CVS Health. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance