Why Citigroup Is My Favorite Buffett Stock

Citigroup Inc. (NYSE:C) is primarily a global corporate bank, although it also operates a U.S. personal bank. The company just reported earnings and beat estimates on the top and bottom lines. The company has been selling its international consumer businesses, while building capital and investing in its technology. This increased operating expenses, but CEO Jane Fraser now plans to reduce those same expenses in 2024.

Despite having sold all of his Wells Fargo (NYSE:WFC) and JPMorgan Chase (NYSE:JPM) shares in recent years, Warren Buffett (Trades, Portfolio) remains a steadfast shareholder in Citigroup, which was his 10th-largest U.S. holding as of year-end 2023. According to Reuters, Buffett recently told Fraser to "keep going" on her reorganization efforts. It will be interesting to see if the guru increases his stake in the coming quarters.

Citi's stock is trading at a discount to its tangible book value and appears to be underearning. I am bullish on stock and it is my favorite Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) holding.

Is Citigroup currently underearning?

Citi and other banks have very volatile earnings because they are constantly increasing or decreasing their provisions for credit losses. For example, the company drastically increased its provisions for credit losses in 2020, which reduced its net income. Then in 2021, the bank realized it had set aside too much for loan losses that were unlikely to materialize and began reducing its provisions for credit losses, sending its net income soaring. Such volatility makes the use of current earnings a futile way to value a bank.

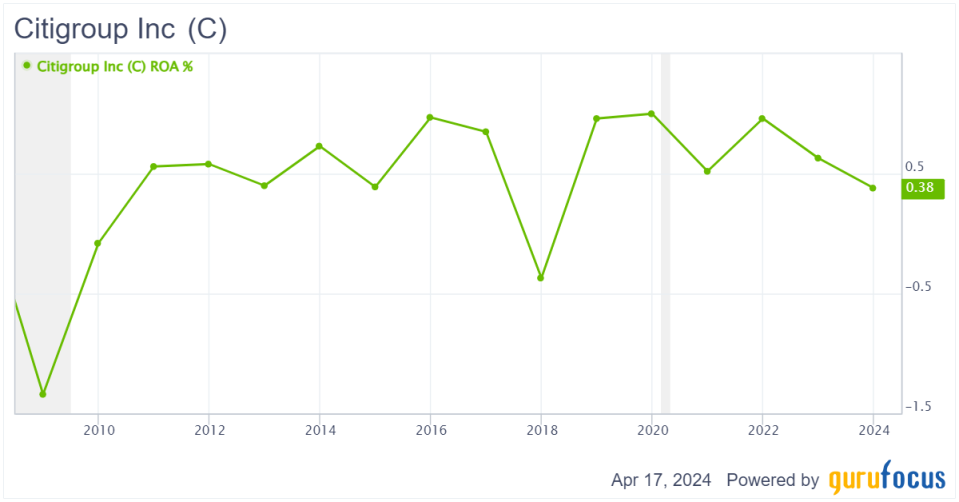

A better method, in my opinion, is to look at the average return on assets over time. Over the past 15 years (2009-2023), Citigroup's average return on assets was 0.56%. Apply this to the company's first-quarter 2024 assets of $2.43 billion, and we get a more normalized earnings figure of $13.62 billion. This gives Citi a normalized price-earnings ratio of just 8.40.

Over the past 12 months, Citigroup's earnings were just $8 billion as a result of increased spending on technology, significant restructing charges, an FDIC special assessment, a devaluation of the Argentine peso and $9.58 billion in total provisions for credit losses expensed. As you can see, the bank had a bad year. A lot of these expenses will fade or disappear in the years ahead, though. I estimate its net income will rocket higher, with the company expecting higher revenue, as well as lower operating expenses in 2024.

Analysts estimate that Citigroup will earn $5.76 per share in 2024, $7.18 in 2025 and $8.32 in 2026. This would give it forward earnings multiples of 10.40 for 2024, 8.30 in 2025 and 7.20 in 2026. I think there is a good chance the company will beat these estimates, making the stock look quite undervalued.

The benefits of Citigroup's global business

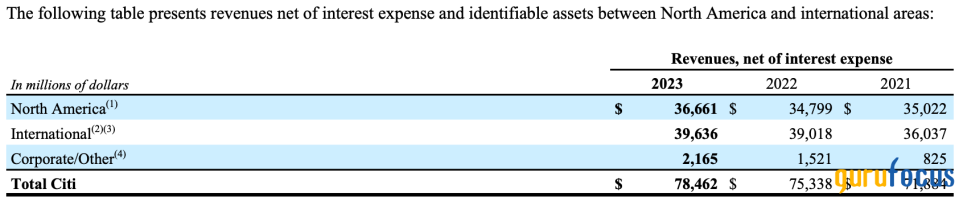

In 2023, a little more than 50% of the bank's revenue came from geographies outside of North America:

While this international exposure has been a drag on Citigroup's relative performance over the past decade, I think this could easily reverse and become a tailwind. If international currencies begin to gain ground against the dollar, the stock could outperform while banks with overwhelming domestic exposure could be left behind.

The U.S. dollar's outperformance and underperformance has historically moved in cycles. From 1984 to 1992, international currencies outperformed the dollar. From 1992 to 2001, the dollar outperformed. From 2001 to 2008, international currencies outperformed again. And finally, from 2008 to 2022, the dollar outperformed.

Today, the U.S. government has a large deficit and record government debt to gross domestic product. For this reason, as well as the history of U.S. dollar cyclicality, I like to own companies with significant international exposure. This includes companies like Citigroup.

The bank's globally diversified business also protects it from deposit runs, like we saw at Silicon Valley Bank. Citigroup's deposit base is extremely diversified and resilient. Despite divesting so many of its international consumer banks, the company's total despoits have managed to grow since year-end 2020.

I believe that Citigroup also has a unique position as a global corporate bank. The company's Services business has grown its revenue at 20% per annum and its profits at 11% per annum over the past two years. The Services business makes money primarily through fees, and its moat would be extremely difficult for a competitor to replicate. This is because it operates in nearly 160 countries around the world and has an extensive technological and on-the-ground footprint that took decades to build.

The risks

The ideal macroeconomic environment for banks is one of moderately high interest rates and low economic uncertainty, while the worst macroeconomic environment for banks is one of low interest rates and high economic uncertainty. When interest rates are high, net interest income also tends to be high. The opposite is the case when interest rates drop. Also, economic uncertainty, like we had in 2008 and 2020, usually causes banks to substaintially increase their provisions for credit losses. Actual economic weakness may cause those losses to be realized.

Recessions are enevitable, but it is hard to predict when one will arrive. If interest rates were to drop, unemployment were to rise and defaults began to spike, Citigroup could report negative earnings or cut its dividend temporarily. This is why it is so important to focus on tangible book value per share and normalized earnings.

This is also why I like to invest in banks with exceptionally strong balance sheets. Citigroup has a CET1 ratio of 13.50%, which easily clears its regulatory requirement. The bank also has an asset-to-equity ratio of 11.80, meaning it is conservatively capitalized, especially compared to its global peers.

Summary

Citigroup's strong balance sheet, globally diversifed business, low valuation to normalized earnings and clear path to earnings improvement make it my favorite stock in Buffett's equity portfolio. The bank appears to have a moat in its services business, where it is seeing strong growth. I think there are ample catalysts for the company to reduce expenses and boost earnings.

I will reasses my position in Citigroup when its valuation gets closer to its tangible book value per share (currently $86.67) or the stock trades at a significantly higher multiple to its normalized earnings.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance