Why Anaplan Stock Skyrocketed 90% in the First Half of 2019

What happened

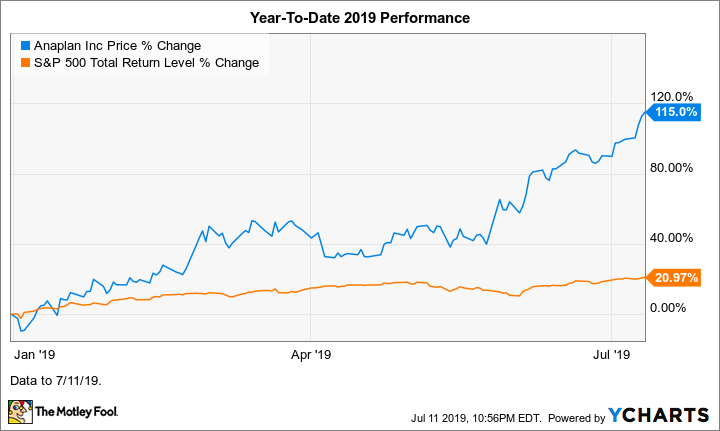

Anaplan (NYSE: PLAN) stock soared 90% higher in the first half of the year, according to data from S&P Global Market Intelligence. The S&P 500 returned 18.4% over this period.

Shares of the cloud-based business planning software provider have continued to climb this month, bringing their gain to 115% in 2019 through Thursday, July 11. The broader market has returned 21% so far this year.

Buying shares of the San Francisco-based company at its October 2018 initial public offering turned out to be a great plan. Since the IPO, Anaplan stock has surged 236% through July 11.

Image source: Getty Images.

So what

We can attribute Anaplan stock's market outperformance in the first half of the year to investor enthusiasm about the company's early financial results as a public company and its long-term growth potential.

Data by YCharts.

In May, Anaplan reported its first-quarter results for fiscal 2020. In Q1, total revenue surged 47% year over year to $75.8 million, while subscription revenue jumped 45% to $65.1 million.

As is typical for a newly public company, Anaplan is not profitable, largely because it's heavily investing in growth initiatives. In the first quarter, its total net loss expanded 42% year over year to $37.2 million. On a per-share basis, its loss narrowed 303% to $0.30. On a non-generally accepted accounting principles (GAAP) basis, the loss per share narrowed 36% to $0.16. The per-share losses narrowed only because of the huge increase in the number of shares following the IPO.

Now what

For the full fiscal year 2020, management raised its revenue guidance to between $326 million and $331 million, up from its previous outlook of between $310 and $314 million.

More From The Motley Fool

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance