Why These 5 Oil Services Stocks Rocketed Up as Much as 48% in January

What happened

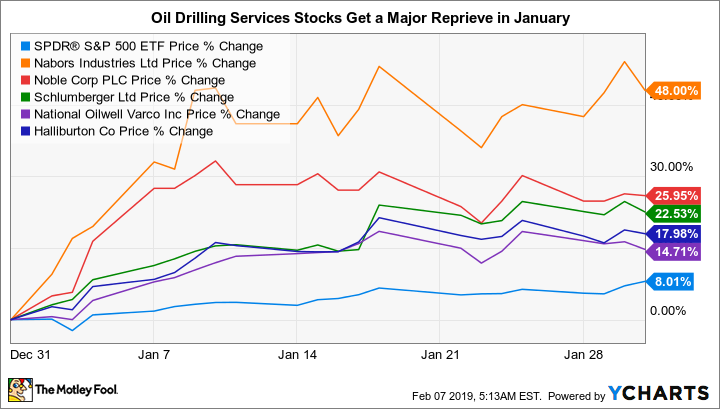

The shares of Nabors Industries (NYSE: NBR) rose an incredible 48% in January, according to data provided by S&P Global Market Intelligence. That increase easily topped this group of oil drilling services stocks, almost making the 25% and 22% gains, respectively, at peers Noble (NYSE: NE) and Schlumberger (NYSE: SLB) look tame by comparison.

Image source: Getty Images.

Trailing behind these three were Halliburton (NYSE: HAL) and National Oilwell Varco (NYSE: NOV), which came in with 18% and 14% stock advances, respectively. When a one-month gain of 14% looks like chump change, you know something big is going on.

So what

What's interesting here is that the gains work out pretty much in reverse order of the losses these companies experienced in 2018. For example, Nabors, the biggest winner in January, was the biggest loser of the five in 2018, with its value plummeting 70%. Most of the pain came in the last few months of the year when oil prices hit a downdraft, quickly slipping into a bear market. In fact, in less than two weeks, that oil price decline wiped out a full year of oil price advances.

Which helps explain the pain this group felt at the end of 2018. The last big oil downturn, which started in mid-2014, was particularly hurtful. Iconic Halliburton went from making around $4.10 a share in 2014 to a loss of nearly $0.80 in 2015. And it got really bad in 2016, when the company lost more than $6.50 a share. In fact, it was still bleeding red ink in 2017. It didn't get back into the black until 2018, when it posted earnings of $1.89 per share.

Halliburton's experience wasn't unusual; all of the drilling services companies took a huge hit the last time oil prices nose-dived. The reason is pretty simple: Oil companies tend to pull back on drilling when oil prices are depressed. So investors run for the hills whenever oil prices move sharply lower, like they did in late 2018. And when oil prices picked up again in January, that brought investors back to this group. This type of up and down in oil prices isn't out of the ordinary -- it's actually par for the course.

During the fourth quarter conference call, Halliburton CEO Jeff Miller (in something of an understatement) said, "... short-term oil and gas demand changes are hard to call with precision." When you combine oil's price volatility with the overall mood on Wall Street -- which was risk-off in late 2018 and risk-on in early 2019 -- it only helps to exacerbate the price swings in this already highly cyclical group.

Two of the big issues separating these companies, meanwhile, are scale and leverage. For example, Nabors' market cap is around $1 billion following the big January advance (it was only around $500 million at the end of 2018). That's tiny compared with $28 billion Halliburton. Both companies have elevated debt-to-equity ratios higher than 1, but Nabors lacks the scale of Halliburton. Thus, investors are much more likely to dump Nabors when things get tough.

Conversely, speculators looking to leverage their upside bets are also more likely to buy Nabors when times are improving -- another reason that the ups and downs of oil prices have a big impact on this group. But you also need to look at the differences among the companies to fully understand their individual stock moves, which can often be notably more dramatic for small and leveraged companies.

Now what

If one thing is certain, it's that oil prices will change, often quickly and dramatically. The January upturn that lifted the oil-field services sector could just as easily shift into reverse. Unless you have a very strong feeling about oil prices, most of the names in this sector should probably be avoided.

But if you do venture into the space, you might be best off leaning toward the largest players. The ups may not be as exciting, but the downs shouldn't be quite as bad, either. And if all you want is exposure to oil, then you might want to stick with conservative, integrated oil majors like ExxonMobil and Chevron.

More From The Motley Fool

Reuben Gregg Brewer owns shares of ExxonMobil. The Motley Fool owns shares of and recommends National Oilwell Varco. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance