What's in the Offing for Healthpeak's (PEAK) Q4 Earnings?

Healthpeak Properties, Inc. PEAK is slated to report fourth-quarter and full-year 2019 results on Feb 11, after the market closes. The company’s quarterly revenues and funds from operations (FFO) per share are expected to display year-over-year improvement.

In the last reported quarter, this Irvine, CA-based healthcare real estate investment trust (REIT) posted FFO as adjusted of 44 cents per share, surpassing the Zacks Consensus Estimate of 43 cents. Results were supported by decent performance of the company’s life-science and medical-office segments.

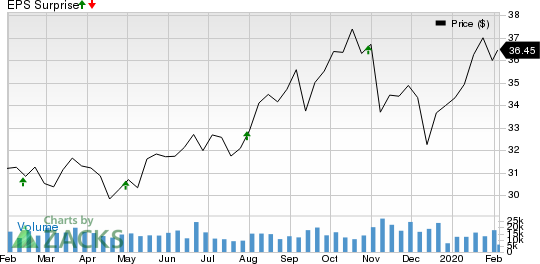

Over the trailing four quarters, the company exceeded estimates on three occasions and met in the other, the average positive surprise being 1.75%. This is depicted in the graph below.

Healthpeak Properties, Inc. Price and EPS Surprise

Healthpeak Properties, Inc. price-eps-surprise | Healthpeak Properties, Inc. Quote

Let’s see how things are shaping up, prior to this announcement.

Factors to Consider

During fourth-quarter 2019, fundamentals of the U.S seniors housing sector were supported by seasonal uptick in occupancy, decent net absorption and moderating new construction. Historically, demand for senior housing space increases in the fourth quarter relative to the third quarter and generally, it is the year’s strongest.

This, along with favorable demand trends, is expected to have aided performance of healthcare REITS in fourth-quarter 2019.

As for Healthpeak, the company has been making strategic efforts to strengthen all three core segments — senior housing, medical office and life science — on the back of acquisitions and portfolio quality-enhancing transactions.

In fact, during the quarter under review, the company announced a series of portfolio transactions with Brookdale Senior Living Inc. related to a 15-campus continuing care retirement community (“CCRC”) joint venture (JV) and the portfolio of 43 senior housing properties that is triple-net leased to Brookdale.

Per this, the company will take full ownership in the JV from Brookdale, sell a portfolio of 18 triple-net leased properties to the operator, and reset lease and management agreements, thereby reducing Brookdale’s concentration in Healthpeak’s portfolio from 15% to 6%.

In December, the company also amended and extended a lease with Amgen on the Britannia Oyster Point ("BOP") campus of the former in South San Francisco. This is expected to have improved leasing revenues for the company during the fourth quarter.

Moreover, Healthpeak is expected to have benefited from transformation of its senior-housing operating portfolio (SHOP) asset quality. Specifically, to gain from stronger demographics and increasing penetration the company has added strategic properties and recycled capital on the back of dispositions. This has likely enabled the company to expand the geographic footprint of its SHOP portfolio in high growth and affluent markets, and enjoy superior gains in RevPOR during the December-end quarter.

These efforts are anticipated to have boosted the company’s rental and related revenue growth during the period in discussion, thereby driving top-line growth. In fact, total revenues for the quarter are pegged at approximately $538.1 million, suggesting year-over-year growth of 21.8%.

In addition, prior to the fourth-quarter earnings release, the company has been witnessing upward estimate revisions. As such, the Zacks Consensus Estimate of FFO per share for the quarter has been revised 2.3% upward to 44 cents over the past week, reflecting analysts’ bullish sentiments. Also, it represents year-over-year growth of 2.3%.

Earnings Whispers

Our proven model predicts a positive surprise in terms of FFO per share for Healthpeak this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a FFO beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Healthpeak’s Earnings ESP is +1.15%.

Zacks Rank: The company currently carries a Zacks Rank of 3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks That Warrant a Look

Here are a few other stocks in the REIT sector that you may want to consider, as our model shows that these too have the right combination of elements to report a positive surprise this quarter:

Ventas, Inc. VTR, slated to release fourth-quarter earnings on Feb 20, has an Earnings ESP of +0.81% and carries a Zacks Rank of 3, at present.

Equinix, Inc. EQIX, set to report quarterly numbers on Feb 12, has an Earnings ESP of +0.53% and carries a Zacks Rank of 3, currently.

Host Hotels & Resorts, Inc. HST, scheduled to release October-December quarter results on Feb 19, has an Earnings ESP of +1.52% and currently holds a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance