What's Next for Micron Stock Down Over 40% Ahead of Earnings?

Micron Technology, Inc. MU stock has tumbled nearly 45% from its peaks heading its third quarter FY22 financial release on June 30. The memory chip powerhouse topped earnings last quarter and its outlook remains strong.

Some on Wall Street are, however, worried about Micron’s exposure to slowing consumer spending and some of its recent earnings estimates are concerning in the near term.

Micron’s Short Story

Micron is one of the largest makers of memory chips in the world. MU’s offerings are found in PCs, smartphones, and other devices. Micron is also growing through expansion within areas such as data centers, electric and connected vehicles, 5G, artificial intelligence, and more.

The memory industry has historically been even more cyclical compared to the broader semiconductor market and is heavily impacted by pricing. Luckily, Micron has become more resilient to smartphone and other consumer electronic cycles through its success in those new secular growth markets such as data centers and EVs.

Micron's fiscal 2021 sales surged 29% and its adjusted earnings skyrocketed 115%. MU topped estimates in both Q1 and Q2 of fiscal 2022. MU’s outlook has remained relativity stable despite global chip shortages and the economic slowdown because of Micron’s improved pricing power across its portfolio.

Image Source: Zacks Investment Research

Zacks estimates call for Micron’s revenue to climb 21% in 2022 and another 17% in FY23 to reach over $39 billion. Meanwhile, MU’s adjusted EPS are projected to soar 57% and 22%, respectively during this stretch.

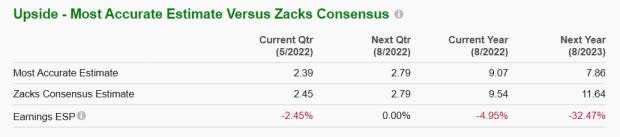

Unfortunately, its FY23 consensus estimates have slid recently and its most recent estimates have come in way below its current consensus for 2023. MU’s most recent EPS estimate for FY23 is 33% below its current consensus, with FY22 down 5%. These downbeat revisions coincide with a rather substantial slowdown in consumer spending and larger recession worries.

Bottom Line

Wall Street remains rather high on Micron for the long haul, with 75% of the brokerage recommendations Zacks has still sitting at “Strong Buys.” Plus, it boasts an impressive balance sheet and it pays a small dividend.

Micron shares have tumbled nearly 45% from their highs amid the wave of nearly-market wide selling. This has helped recalibrate its valuation, with MU trading at a roughly 85% discount to its own 10-year highs at 5.2X forward 12-month earnings.

That said, Micron’s downward earnings revisions help it land a Zacks Rank #4 (Sell) at the moment and it might be best for investors to at least hold off until Micron provides updated guidance amid all of the economic and market unknowns.

Of course, investors with long-term horizons should keep their eyes on Micron as a possible addition later this summer or after its upcoming Q3 release, depending on how things shake out.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance