What's in the Cards for Annaly Capital (NLY) in Q1 Earnings?

Annaly Capital Management Inc. NLY is scheduled to report first-quarter 2020 results on Apr 29, after market close. The company’s results are expected to reflect a year-over-year decline in earnings.

In the last reported quarter, this mortgage real estate investment trust (REIT) posted core earnings, excluding premium amortization adjustment, of 26 cents per share, beating the Zacks Consensus Estimate of 24 cents and rising from the prior quarter’s 21 cents. Nonetheless, net interest income (NII) was $454.2 million, marking a surge from the prior quarter’s $152.4 million as well as the year-ago period’s $272.9 million.

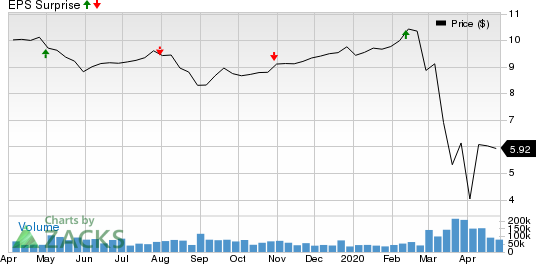

Over the last four quarters, the company’s earnings beat the Zacks Consensus Estimate on one occasion, missed in the other two and met the mark in another quarter. The average negative surprise was 2.9%. The graph below depicts this surprise history:

Annaly Capital Management Inc Price and EPS Surprise

Annaly Capital Management Inc price-eps-surprise | Annaly Capital Management Inc Quote

Let’s see how things are shaping up prior to this announcement.

The liquidity-driven market mayhem, triggered by the ongoing coronavirus crisis, resulted in significant dislocations in the mortgage and credit markets. Specifically, as the economic impact of the pandemic became clear, cash preservations and concerns over the failure of meeting mortgage payments resulted in a risk-off approach by investors, who started indiscriminately shedding risky assets. With investors fleeing from residential and commercial debt, the mortgage market also felt the brunt of the selloff. This resulted in pricing pressures on mortgage backed securities (MBS). As prices of the securities declined, mREITs — which hold the securities — experienced a fall in book values. Impacts of these developments are expected to get reflected in the company’s quarterly results.

Additionally, with so much uncertainty in the credit markets, credit-sensitive assets and non-Agency MBS (not backed by Fannie Mae and Freddie Mac) were severely impacted, driving margin calls from repo lenders. To meet the margin calls and control leverage levels, mREITs are expected to have resorted to asset sales, even in unfavorable market conditions.

In fact, Annaly shrunk its investment portfolio from $128.7 billion at Dec 31, 2019, to nearly $99 billion at Mar 31, 2020. Accordingly, repo balance was reduced from $101.7 billion to $72.6 billion during the same period.

Moreover, the company sees a decline in its first-quarter book value. Annaly’s estimates preliminary book value per share of $7.40-$7.60 as of Mar 31, 2020, down from $9.66 as of Dec 31, 2019.

Amid the challenging environment, Agency MBS reached low levels, which is concerning for the company as around 93% of its assets comprised of Agency MBS as of the first-quarter end.

Further, its Residential Credit Group investment portfolio, which consists of non-Agency residential mortgage assets, is also expected to have been impacted.

Amid high volatility and decreasing interest rates, derivatives and hedging instruments used by mREITs witnessed enormous losses in the quarter under review, further eroding their book values. This is concerning for Annaly that had an $85-billion hedge portfolio as of Dec 31, 2019.

Additionally, the company’s activities during the March-end quarter were inadequate to gain analyst confidence. Consequently, the Zacks Consensus Estimate for first-quarter earnings per share has been unchanged at 20 cents in a week, indicating a 31% decline year over year. This is in line with the company’s projected preliminary core earnings (excluding PAA) per share of 20-21 cents, as announced on Apr 7.

Nonetheless, its robust balance sheet and prudent risk-management efforts have supported its performance amid such extremely challenging market conditions. In fact, the company was able to reduce its economic leverage and maintain a strong liquidity position, with cash and unencumbered Agency MBS of $4.6 billion as of Mar 31, 2020.

Also, it is expected to have continued with its securitization measures within the residential credit business during the March-end quarter. In fact, during the quarter, it priced an additional $374.6-million securitization that represents the company’s 9th non-Agency securitization since the beginning of 2018.

Earnings Whispers

Our proven model does not predict an earnings beat for Annaly this time around. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), which is not the case here as you will see below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Annaly’s Earnings ESP is 0.00%.

Zacks Rank: The company currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Hannon Armstrong Sustainable Infrastructure Capital, Inc. HASI, scheduled to release earnings on May7, has an Earnings ESP of +5.52% and a Zacks Rank of 3 at present.

KKR Real Estate Finance Trust Inc. KREF, slated to report quarterly figures on Apr 28, currently has an Earnings ESP of +7.50% and a Zacks Rank of 3.

SBA Communications Corporation SBAC, set to report quarterly numbers on May 5, currently has an Earnings ESP of +0.63% and a Zacks Rank of 3.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Annaly Capital Management Inc (NLY) : Free Stock Analysis Report

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) : Free Stock Analysis Report

KKR Real Estate Finance Trust Inc. (KREF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance