Wesfarmers profits dive 69% as it writes off Target

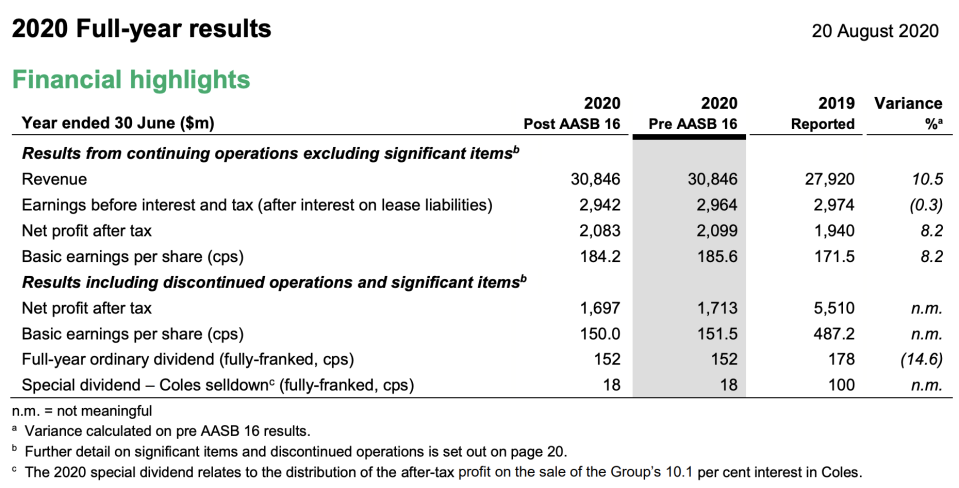

Wesfarmers has posted net profit after tax (NPAT) of $1.7 billion in the 2020 financial year, barely 31 per cent of the $5.5 billion it raked in during the previous financial year.

Wesfarmers is the parent company of Kmart, Officeworks, Target, Bunnings as well as Catch.com.au and a number of other industrial businesses.

The $5.5 billion profit posted in 2019 encompassed gains made off the demerger from Coles, Coles’ high earnings and the sale of other Wesfarmers businesses.

Also read: Woolies chairman says further penalty rate cuts would create more jobs

Also read: $315 million: Woolworths staff underpayment worsens

The group’s bottom line for the 2020 financial year was hampered by the writing off of the Target brand, which cost $525 million.

But NPAT from continuing businesses and excluding significant items rose by 8.2 per cent to $2.1 billion.

Restructures to Kmart gave the company’s bottom line a boost, which helped to offset losses from Target.

Earlier this year, Wesfarmers had flagged its intention to double down on Kmart businesses while scaling back Target due to its “unsustainable financial performance”.

The conversion of Target stores to Kmart stores and a further slimming-down of the Target brand saw the Kmart brand deliver $635 million.

The business delivered fully-franked dividends of $1.70 to its shareholders for the financial year.

“Bunnings, Kmart, Officeworks and Catch delivered strong sales growth for the year,” said Wesfarmers managing director Rob Scott.

“Earnings in Bunnings and Officeworks were particularly strong and demonstrated the ability of these businesses to rapidly adapt to the changing needs of their customers.”

Earnings across the whole business were boosted by the brands’ online shopping capabilities, he added.

The group’s retail businesses delivered online sales growth of 60 per cent in the year excluding Catch.com.au. Including Catch.com.au, total online sales across the group rose to $2.1 billion.

“This reflects the significant investment in digital capabilities over recent years, as well as the continued change in customer preferences towards online shopping,” said Scott.

During the peak of the pandemic, however, interruptions to supply chains meant Kmart was hampered by its inability to deliver some products.

Earlier this month, Wesfarmers announced it would continue to pay its workers even if there was no work available.

Wesfarmers is not on the JobKeeper scheme.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance