Werner (WERN) Rides on Segmental Growth Amid Rising Expenses

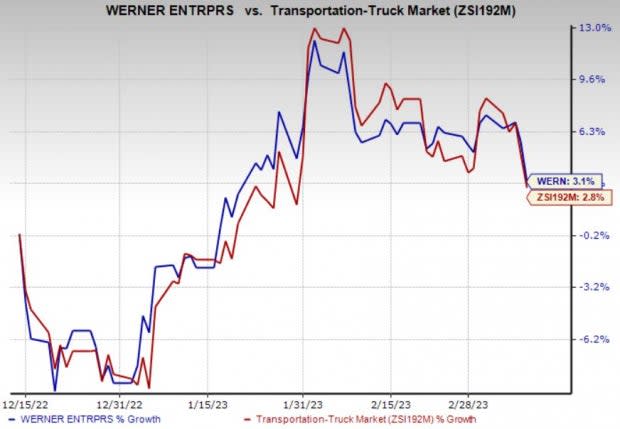

Werner Enterprises, Inc. WERN is benefiting from segmental growth and shareholder-friendly initiatives adopted by the company. Notably, shares have gained 3.1% over the past three months, outperforming the 2.8% rise of the industry it belongs to.

Image Source: Zacks Investment Research

The company recently reported fourth-quarter 2022 earnings of 99 cents per share, which surpassed the Zacks Consensus Estimate of 92 cents. However, the bottom line fell 13% on a year-over-year basis. Total revenues of $861.5 million outperformed the Zacks Consensus Estimate of $843.7 million. The top line increased 13% on a year-over-year basis.

How is Werner Placed?

We are impressed with Werner’s efforts to boost its shareholder value via dividend payouts and shares repurchases are commendable. During 2022, Werner paid $32.2 million in dividends and repurchased shares worth $110.40 million. In 2021, Werner paid $29.08 million in dividends and repurchased shares worth $104.44 million. As of Dec 31, 2022, WERN had 2.3 million shares available under its share repurchase authorization. Such shareholder-friendly moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business.

Werner’s top line is benefiting from higher revenues in the Truckload Transportation Services (TTS) and Logistics segments. Notably, Werner’s TTS and Logistics segments fourth-quarter 2022 revenues increased 13% and 15%, year over year, respectively.

On the flip side, Werner’s total operating expenses (on a reported basis) increased 15.9% to $773.11 million in fourth-quarter 2022. This metric was primarily driven by increased salaries, wages and benefits (up 5.9%), fuel (up 55.1%) and rent and purchased transportation expenses (up 13.7%). Rising expenses are likely to keep the bottom line under pressure.

Further, Werner exited the fourth quarter of 2022 with cash and cash equivalents of $107.24 million, way below the long-term debt (net of current portion) of $687.50 million. This implies that the company does not have enough cash to meet its debt levels.

Zacks Rank & Stocks to Consider

Currently, Werner carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader Zacks Transportation sector are Copa Holdings, S.A. CPA, Alaska Air Group, Inc. ALK and American Airlines AAL. Copa Holdings presently sports a Zacks Rank #1(Strong Buy), while Alaska Air and American Airlines currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Copa Holdings has an expected earnings growth rate of 39.83% for the current year. CPA delivered a trailing four-quarter earnings surprise of 33.35%, on average.

The Zacks Consensus Estimate for CPA’s current-year earnings has improved 21.1% over the past 90 days. Shares of CPA have soared 13.3% over the past three months.

Alaska Air has an expected earnings growth rate of 32.64% for the current year. ALK delivered a trailing four-quarter earnings surprise of 8.98%, on average.

The Zacks Consensus Estimate for ALK’s current-year earnings has improved 11.4% over the past 90 days. Shares of ALK have soared 0.8% over the past three months.

AAL has an expected earnings growth rate of more than 100% for the current year. AAL delivered a trailing four-quarter earnings surprise of 7.79%, on average.

The Zacks Consensus Estimate for AAL’s current-year earnings has improved 31.1% over the past 90 days. Shares of AAL have gained 15.8% over the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Werner Enterprises, Inc. (WERN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance