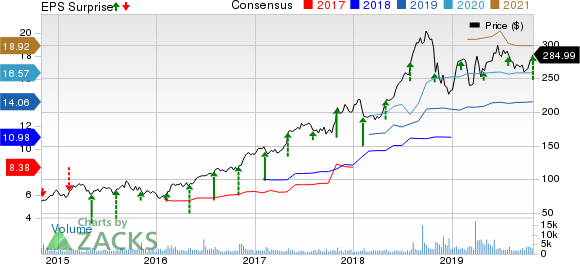

WellCare Health (WCG) Q3 Earnings & Revenues Beat Estimates

WellCare Health Plans, Inc. WCG delivered third-quarter 2019 adjusted operating earnings of $5.50 per share, beating the Zacks Consensus Estimate by 40% on the back of solid revenues. Also, the bottom line soared 65.2 % year over year.

Further, total revenues of the company came in at $7 billion, surpassing the Zacks Consensus Estimate by 4.7%. Moreover, the top line surged 41.2% year over year. This was mainly driven by the company’s 2018 purchase of Meridian and organic growth in all business lines. However, the same was offset to some extent due to the 2019 ACA Health Insurer Fee (HIF) moratorium.

The adjusted selling, general & administrative (SG&A) expense ratio was 7.6% in the reported quarter, down from 8.5% in the year-ago period. This improvement was supported by the company’s operating leverage as a result of its growth.

Q3 Segmental Results

Medicaid Health Plans

As of Sep 30, 2019, membership grew 4.6% to 4.1 million. This upside was driven by net organic growth including more members in the company’s Florida health plan.

Adjusted Medicaid Health Plans premium revenues were $4.8 billion, up 55.2% year over year owing to the Meridian buyout and solid net organic growth including higher membership in Florida health plan.

Adjusted Medicaid Health Plans’ Medical Benefit Ratio (MBR) was 89% compared with 87.8% in the year-ago period, attributable to net organic growth including the health plan in Florida and the Illinois health plan performance. However, the same was offset to some extent by rate increase in a few markets and continued operational execution.

Medicare Health Plans

As of Sep 30, 2019, Medicare Health Plans membership was up 3.5% year over year, driven by steady organic growth.

Medicare Health Plans revenues of $1.8 billion increased 16.4% year over year. This was primarily aided by the company's Meridian acquisition as well as organic growth.

MBR was 83.3% compared with 84.8% in the prior-year quarter. This year-over-year contraction is mainly owing to the 2019 bid positioning and consistent operational excellence.

Medicare PDP

Medicare PDP membership was approximately 1.7 million as of Sep 30, 2019, up 60.7% year over year, attributable to organic growth via the newly-enhanced product offering this year.

Revenues of $241.2 million were up 32.3% year over year, fueled by the company's organic membership improvement through product offering in 2019.

MBR was 75.7% compared with 63.1% in the year-earlier quarter.

Financial Update

As of Sep 30, 2019, unregulated cash and investments were $433.9 million, down 6.2% year over year.

Net cash flow provided by operating activities was $401.1 million compared with the prior-year net cash used of $578.6 million on the back of the advanced receipt of the July 2018 CMS Medicare premiums, payment of the ACA Health Insurer Fee in September 2018 as well as the timing of particular Medicaid premium receivables.

Days in claims payable (DCP) were 51.4 days as of Sep 30, 2019 compared with 54.2 days in the same period last year.

Guidance

The company is not providing any updated outlook due to its pending merger with Centene.

Zacks Rank

WellCare Health carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Players

Among other players from the medical sector having already reported third-quarter earnings, the bottom-line results of UnitedHealth Group Incorporated UNH, Anthem Inc. ANTM and Centene Corporation CNC topped the respective Zacks Consensus Estimate.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Click to get this free report WellCare Health Plans, Inc. (WCG) : Free Stock Analysis Report UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report Centene Corporation (CNC) : Free Stock Analysis Report Anthem, Inc. (ANTM) : Free Stock Analysis Report To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance