Webster Financial (WBS) Beats on Q3 Earnings, Stock Down 7.9%

Shares of Webster Financial WBS delivered a positive earnings surprise of 1% in third-quarter 2019. Adjusted earnings of $1.01 per share surpassed the Zacks Consensus Estimate of $1. Also, the reported figure increased 3.1% from the prior-year quarter.

Results were driven by improvement in revenues as well as growth in loan and deposit balances. Also, capital ratios were impressive. However, higher non-interest expenses and provision for loan losses, along with contracting net interest margin (NIM), acted as major headwinds. Due to these concerns investors are likely skeptical about the company’s future performance. Thus, following the earnings release, the stock has declined 7.9%.

Excluding non-recurring items, the company reported earnings applicable to common shareholders of $91.4 million, down from the prior-year quarter’s $97.5 million.

Revenue Growth Offsets Higher Expenses, Loans & Deposits Increase

Webster Financial’s total revenues increased 2.6% year over year to $310.5 million. However, the top line missed the Zacks Consensus Estimate of $314.1 million.

Net interest income grew 4.4% year over year to $240.5 million. Moreover, NIM contracted 12 basis points (bps) to 3.49%.

Non-interest income was $69.9 million, down 3.3% year over year. The fall mainly resulted from decline in loan and lease related fees.

Non-interest expenses of $179.9 million inched up 0.6% from the year-ago quarter. This upswing mainly resulted from rise in all components except deposit insurance and occupancy costs.

Efficiency ratio (on a non-GAAP basis) came in at 56.60% compared with 57.41% as of Sep 30, 2018. A lower ratio indicates improved profitability.

The company’s total loans and leases as of Sep 30, 2019 were $19.6 billion, up 1.5% sequentially. Also, total deposits increased 3% from the previous quarter to $23.3 billion.

Credit Quality Deteriorates

Total non-performing assets were $166.7 million as of Sep 30, 2019, up 5.5% from the year-ago quarter. In addition, the ratio of net charge-offs to annualized average loans came in at 0.28%, up 15 bps year over year. Also, the provision for loan and lease losses increased 7.6% to $11.3 million as of Sep 30, 2019.

However, allowance for loan losses represented 1.07% of total loans as of Sep 30, 2019, down 9 bps from Sep 30, 2018.

Improved Capital Ratios, Decline in Profitability Ratios

As of Sep 30, 2019, Tier 1 risk-based capital ratio was 12.29% compared with 11.96% as of Sep 30, 2018. Additionally, total risk-based capital ratio came in at 13.65% compared with the prior-year quarter’s 13.44%. Tangible common equity ratio was 8.34%, up from 7.86% as of Sep 30, 2018.

Return on average assets was 1.27% in the reported quarter compared with the year-ago quarter’s 1.47%. As of Sep 30, 2019, return on average common stockholders' equity came in at 12.36%, down from 14.74% as of Sep 30, 2018.

Our Viewpoint

Backed by increasing revenues aided by rise in loan and deposit balances, Webster Financial remains well positioned for growth. Further, the company has a robust capital position. Nonetheless, mounting expenses and falling NIM might dampen its bottom-line growth in the near term. Also, lack of loan diversification is a concern.

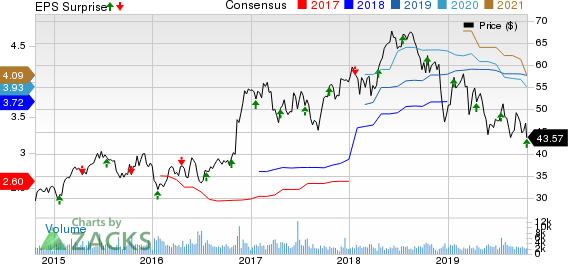

Webster Financial Corporation Price, Consensus and EPS Surprise

Webster Financial Corporation price-consensus-eps-surprise-chart | Webster Financial Corporation Quote

Webster Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

SunTrust Banks' STI third-quarter 2019 adjusted earnings of $1.40 per share were in line with the Zacks Consensus Estimate. However, the figure reflected a decline of 1.4% from the year-ago quarter’s number.

BancorpSouth’s BXS third-quarter net operating earnings of 69 cents per share beat the Zacks Consensus Estimate of 61 cents. Also, the bottom line increased 23.2% from the prior-year quarter.

Driven by top-line strength, U.S. Bancorp’s USB third-quarter 2019 earnings per share of $1.15 surpassed the Zacks Consensus Estimate of $1.11. Also, the reported figure moved up 8.5% from the prior-year quarter.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

U.S. Bancorp (USB) : Free Stock Analysis Report

SunTrust Banks, Inc. (STI) : Free Stock Analysis Report

Webster Financial Corporation (WBS) : Free Stock Analysis Report

BancorpSouth Bank (BXS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance