Are these the weakest property markets in Australia?

Although the headlines focus on the waning Sydney and Melbourne markets, their challenges pale in comparison to those in outback Australia.

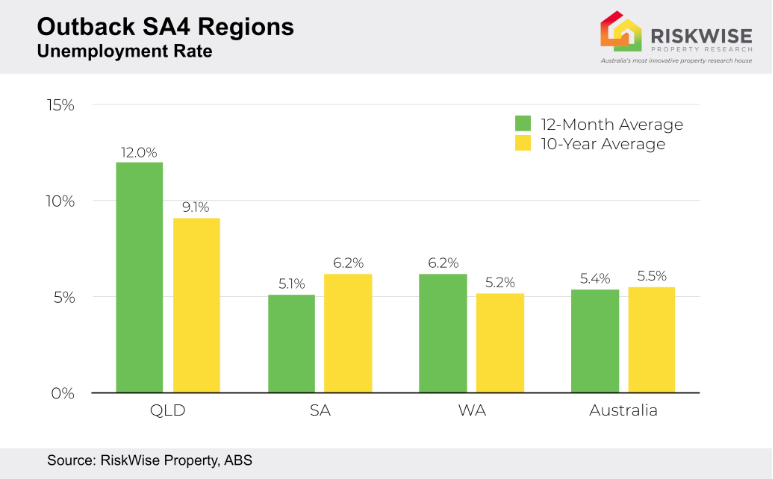

Some outback regions, like outback Queensland, have unemployment rates more than double the average unemployment rate across the country, RiskWise Property Research CEO Doron Peleg said this week.

That combined with a 10-year population growth rate of just 1.7 per cent, compared to the 18.3 per cent average means regions like the Queensland Outback, home to areas like Mount Isa and Winton, are in a weak position.

The Western Australian outback region includes towns like Esperance, Pilbara and Kimberley, while the South Australian outback region includes areas like the Eyre Peninsula.

What goes down doesn’t always go back up

“Outback markets are weak, and this is across a number of states, particularly, but not only, the mining states,” Mr Peleg said.

“People seem to think that since there have been strong price reductions in many of these areas, that the price has reached the bottom and must go up – and quickly – but that is definitely not the case.

“The most important drivers for price growth are strong employment and population growth and for these regions these simply are not present, so even if there is limited new supply coming on to the market do not expect significant growth as this is not enough to drive prices up.”

He said strong construction work is a critical element for economic activity and job creation but has been largely absent from these outback regions. The same goes for employment.

“Where there is no work, the population either recedes or the growth is very poor. Therefore, there is less demand for housing and prices decrease,” he said.

“The solution is to encourage government investment and development of larger regional areas and ensure they are well serviced by infrastructure and jobs to attract people away from the traditional employment hubs.”

Naturally, people will go where the jobs are. The South Australian, Central Queensland and Western Australian outback regions have anaemic population growth due to their weak job markets.

“It follows that if they grow the economy in those areas, and back it up with infrastructure, it will attract people to move there and, as a flow-on effect, will reduce the population concentration in Sydney and Melbourne, improving housing affordability in those capital cities.

“Compared to the Australian five-year growth of 34.6 per cent, these areas have experienced incredibly weak markets.”

He warned that if nothing is done, the gap between outback regions and capital cities will continue to widen.

This could be bad news for investors convinced the only way is up for outback regions.

“With a very volatile job market, leading to a high level of uncertainty, it’s no wonder the markets in these regions are weakened.”

Now read: Eight things that make it easier to get a home-loan

Now read: Why now is an opportune time for property buyers and investors

Now read: ‘Nuclear bomb’ headed for Aussie property

Now read: Australia’s most reliable property market revealed

Yahoo Finance

Yahoo Finance