Will Weak MBS Market Mar AGNC Investment's (AGNC) Q1 Earnings?

AGNC Investment Corp. AGNC is scheduled to report first-quarter and 2020 results on Apr 29, after the closing bell. The company’s net spread and dollar roll income per common share,and net interest income (NII) are expected to have improved year over year.

In the last reported quarter, this Bethesda, MD-based mortgage real estate investment trust (REIT), which primarily focuses on leveraged investments in agency mortgage backed securities (MBS), posted net spread and dollar-roll income (excluding estimated catch-up premium amortization benefit) of 57 cents per share, beating the Zacks Consensus Estimate of 53 cents. Further, NII of $287 million was higher than the third-quarter 2019 figure of $119 million.

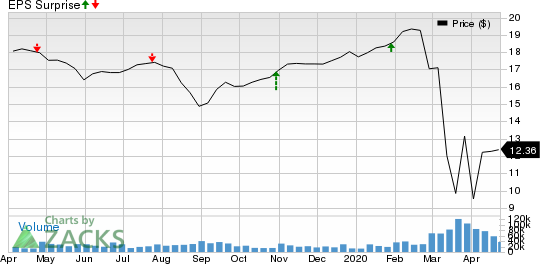

Over the trailing four quarters, the company surpassed the Zacks Consensus Estimate on two occasions and missed on the others. It delivered a positive surprise of 5.33%, on average, for the said period. The graph below depicts this surprise history:

AGNC Investment Corp. Price and EPS Surprise

AGNC Investment Corp. price-eps-surprise | AGNC Investment Corp. Quote

Let’s see how things are shaping up prior to this announcement.

The mREIT sector has been in turmoil in the latter half of the first quarter of 2020. As the economic impact of the coronavirus outbreak became apparent, investors adopted a risk-off approach, shedding risky positions across all asset classes. The distress-selling also rippled through the mortgage market, which experienced high sale of MBSs. This led to a fall in the prices of these securities, resulting in a fall in book values of the mREITs, which hold the securities as assets. This caused high volatility and liquidity crisis in the Agency MBS market.

Although the Federal Reserve backed the Agency MBS market by announcing unlimited quantitative easing in the form of agency MBS purchases, the interference came during the end of the quarter, offering little respite to mREITs’ first-quarter results.

However, the impacts of the financial dislocation and the panic sell were even worse for credit-sensitive assets and non-agency MBS, driving margin calls from repo lenders.

As for AGNC Investment, the company’s investment portfolio included $21 billion of to-be-announced Agency MBS as of Mar 31, 2020. The declining price premiums for higher quality specified pools are expected to have caused a decline in the company’s book value in first-quarter 2020. In fact, AGNC Investment announced tangible net book value per share of $13.60, indicating a decline of 23% since the beginning of the year.

Further, investments of $1.1 billion in non-Agency securities are expected to have impacted the company’s first-quarter performance.

Amid the disruptions in the housing market and mortgage-origination operations caused by the pandemic, prepayment speed for higher-quality specified pools is expected to have been slow. This suggests low premium amortization expenses and low levels of conditional prepayment rate (CPR) in the March-end quarter for AGNC Investment’s agency portfolio, which consists primarily of fixed-rate MBS.

Lastly, the company’s activities during the quarter were inadequate to gain analyst confidence. As such, the Zacks Consensus Estimate of net spread and dollar roll income per common share has been unchanged at 56 cents over the past month, indicating year-over-year growth of 7.7%. The company anticipates first-quarter 2020 net spread and dollar roll income (excluding estimated catch-up premium amortization cost) of 55-58 cents per share.

Further, for the March-end quarter, NII estimate is pinned at $351.3 million, indicating year-over-year growth of 114.2%.

Earnings Whispers

Our proven model does not show that AGNC Investment is likely to beat estimates this quarter. This is because a stock needs to have the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. That is not the case here, as you will see below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: AGNC Investment’s Earnings ESP is 0.00%.

Zacks Rank: The company currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Hannon Armstrong Sustainable Infrastructure Capital, Inc. HASI, scheduled to release earnings on May7, has an Earnings ESP of +2.07% and carries a Zacks Rank of 3 at present.

KKR Real Estate Finance Trust Inc. KREF, slated to report quarterly figures on Apr 28, has an Earnings ESP of +7.50% and currently carries a Zacks Rank of 3.

SBA Communications Corporation SBAC, set to report quarterly numbers on May 5, currentlyhas an Earnings ESP of +0.44% and a Zacks Rank of 2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGNC Investment Corp. (AGNC) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) : Free Stock Analysis Report

KKR Real Estate Finance Trust Inc. (KREF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance