Watch These 5 Stocks That Recently Hiked Their Dividends

Wall Street started September with severe volatility after a disappointing August. The two-month long summer rally from mid-June to mid-August has evaporated as investors are highly concerned about a recession in the near future.

U.S. stock markets ended in green in just two months, March and July, out of the first eight months of 2022. September is historically known as the worst performing month on Wall Street. This year, the situation is more complicated as the Fed has to do a balancing act between combating inflation and maintaining the economy’s stability.

Per CME FedWatch, at present, 74% of the market respondents are expecting a 75 basis-point rate hike in the September FOMC. Thereafter, there is a 72.3% probability of a rate hike of 50 basis points in the November FOMC and a 71% probability of another 25 basis-point rise in the December FOMC.

In second-quarter 2022, earnings results came in better than expected despite the margin squeeze. However, we are seeing a significant drop in earnings projection for the third quarter. As of Sep 7, our estimate projected 1.4% growth in earnings per share, well below the 7.2% improvement projected on Jul 6.

Stocks to Watch

At this stage, investors should remain cautious and stay invested in dividend-paying stocks to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments. Five such companies are — Verizon Communications Inc. VZ, Stewart Information Services Corp. STC, Citizens Financial Services Inc. CZFS, Avnet Inc. AVT and Brady Corp. BRC.

Verizon plans to accelerate the availability of the 5G Ultra-Wideband network with C-Band deployment, focusing on 5G mobility, nationwide broadband, mobile edge computing and business solutions. VZ offers various mix-and-match pricing in both wireless and home broadband plans that lead to solid customer additions. The company carries a Zacks Rank #3 (Hold).

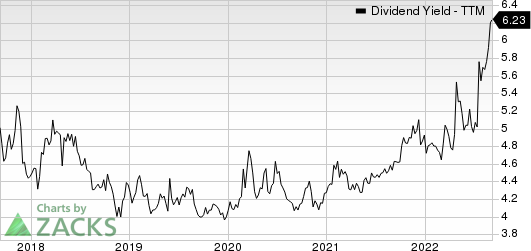

On Sep 7, 2022, Verizon declared that its shareholders would receive a dividend of $0.6525 per share on Nov 1, 2022. VZ has a dividend yield of 6.4%. Over the past 5 years, Verizon has increased its dividend six times, and its payout ratio presently stays at 48% of earnings. Check VZ’s dividend history here.

Verizon Communications Inc. Dividend Yield (TTM)

Verizon Communications Inc. dividend-yield-ttm | Verizon Communications Inc. Quote

Stewart Information Services is primarily engaged in title insurance. STC issues policies through issuing locations on homes and other real property located in all 50 states, the District of Columbia and several foreign countries. Stewart also sells computer-related services and information, as well as mapping products and geographic information systems to domestic and foreign governments and private entities. The company currently carries a Zacks Rank #3.

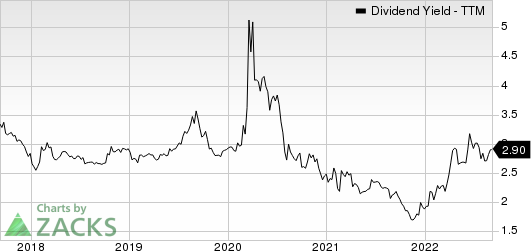

On Sep 2, 2022, Stewart declared that its shareholders would receive a dividend of $0.45 per share on Sep 30, 2022. STC has a dividend yield of 3.5%. Over the past 5 years, Stewart has increased its dividend three times, and its payout ratio presently stays at 14% of earnings. Check STC’s dividend history here.

Stewart Information Services Corporation Dividend Yield (TTM)

Stewart Information Services Corporation dividend-yield-ttm | Stewart Information Services Corporation Quote

Citizens Financial Services operates as the bank holding company for First Citizens Community Bank that provides various banking products and services for individual, business, governmental, and institutional customers. CZFS presently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

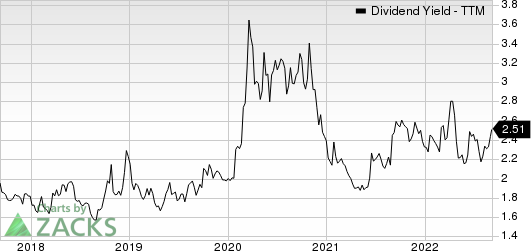

On Sep 1, 2022, Citizens Financial declared that its shareholders would receive a dividend of $0.48 per share on Sep 30, 2022. CZFS has a dividend yield of 2.3%. Over the past 5 years, Citizens Financial has increased its dividend 15 times, and its payout ratio presently stays at 27% of earnings. Check CZFS’s dividend history here.

Citizens Financial Services Inc. Dividend Yield (TTM)

Citizens Financial Services Inc. dividend-yield-ttm | Citizens Financial Services Inc. Quote

Avnet is one of the world’s largest distributors of electronic components and computer products. AVT’s customer base includes original equipment manufacturers, electronic manufacturing services providers, original design manufacturers and value-added resellers. The company carries a Zacks Rank #3 at present.

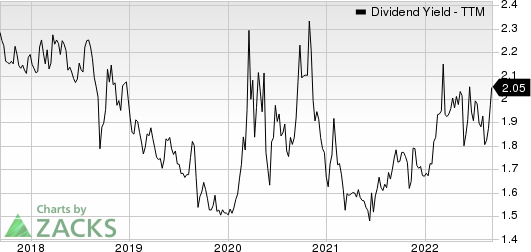

On Aug 31, 2022, Avnet declared that its shareholders would receive a dividend of $0.29 per share on Sep 28, 2022. AVT has a dividend yield of 2.7%. Over the past 5 years, Avnet has increased its dividend seven times, and its payout ratio presently stays at 15% of earnings. Check AVT’s dividend history here.

Avnet, Inc. Dividend Yield (TTM)

Avnet, Inc. dividend-yield-ttm | Avnet, Inc. Quote

Brady is a world leader in complete identification solutions that help companies improve productivity, performance, safety and security. BRC's products help customers increase safety, security, productivity and performance and include high-performance labels, signs, safety devices, printing systems and software. Currently, the company carries a Zacks Rank #3.

On Aug 31, 2022, Brady declared that its shareholders would receive a dividend of $0.23 per share on Oct 28, 2022. BRC has a dividend yield of 2%. Over the past 5 years, Brady has increased its dividend six times, and its payout ratio presently stays at 29% of earnings. Check BRC’s dividend history here.

Brady Corporation Dividend Yield (TTM)

Brady Corporation dividend-yield-ttm | Brady Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avnet, Inc. (AVT) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Stewart Information Services Corporation (STC) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

Citizens Financial Services Inc. (CZFS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance