Waste Management (WM) Shares Gain 30% in 6 Months: Here's How

Waste Management, Inc. WM has had an impressive run over the past six months. The stock has gained 33%, outperforming the 28% and 19% growth of the industry it belongs to and the Zacks S&P 500 composite, respectively.

What’s Diving the Stock

The services that Waste Management provides usually cannot be delayed and are required on a scheduled basis, allowing the company to achieve a steady flow of revenues. Being a leading provider of comprehensive waste management environmental services, it is benefiting from ongoing trends like increasing environmental concerns, rapid industrialization, a rise in population and active government measures to reduce illegal dumping. WM’s top line improved 5.7% year over year in the fourth quarter of 2023.

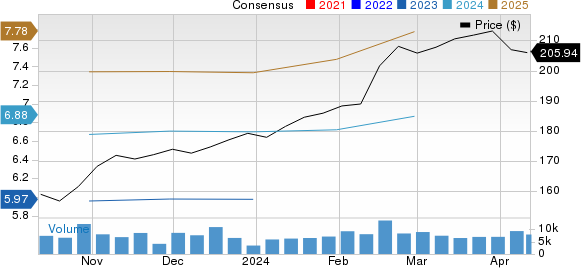

Waste Management, Inc. Price and Consensus

Waste Management, Inc. price-consensus-chart | Waste Management, Inc. Quote

WM continues to execute core operating initiatives targeting focused differentiation and continuous improvement and instilling price and cost discipline to achieve better margins. While differentiation through capitalization of extensive assets ensures long-term profitable growth and competitive advantages, cost control and process improvement help enhance service quality.

Commitment to shareholder returns makes Waste Management a reliable way for investors to compound wealth over the long term. In 2023, 2022 and 2021, the company repurchased shares worth $1.3 billion, $1.5 billion and $1.35 billion, respectively. It paid $1.14 billion, $1.1 billion and $970 million in dividends in 2023, 2022 and 2021, respectively.

Zacks Rank and Stocks to Consider

Waste Management currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are Core & Main CNM and Barrett Business Services BBSI.

Core & Main currently sports a Zacks Rank of 1 (Strong Buy). It has a long-term earnings growth expectation of 12.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

CNM delivered a trailing four-quarter earnings surprise of 1.5%, on average.

Barrett Business Servicescurrently carries a Zacks Rank of 2 (Buy). BBSI has a long-term earnings growth expectation of 14%.

BBSI delivered a trailing four-quarter earnings surprise of 77.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

Core & Main, Inc. (CNM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance