Vulcan Enhances Growth Strategy With Wake Stone Acquisition

Vulcan Materials Company VMC has entered into a definitive agreement to acquire Wake Stone Corporation, a major aggregates supplier in the Carolinas. This acquisition aligns with VMC's aggregates-led strategy of expanding its presence in high-growth regions across the United States. The deal is expected to add more than 60 years of hard rock reserves, particularly benefiting key markets like Raleigh, NC.

Wake Stone has built a strong aggregates franchise since its establishment in 1970, sharing many values with Vulcan. VMC leverages its selling and operating methods to enhance profitability and integrate new operations. The company's financial strength and flexibility support ongoing growth and position VMC to deliver value to its shareholders and customers.

Acquisition Synergies to Fuel Growth for VMC

Vulcan has followed a systematic inorganic strategy for expansion since 1956 and has wrapped up various bolt-on acquisitions that have contributed significantly to its growth. The company unveiled its strategy of reinvesting in the business, pursuing growth through M&A and Greenfields and returning cash through sustainable dividends.

In the first six months of 2024, the company made three strategic bolt-on acquisitions for a total consideration of $193.4 million. It acquired an aggregates operation in North Carolina, aggregates, asphalt mix and construction paving operations in Alabama, and asphalt mix and construction paving operations in Texas.

In the second quarter of 2024, the company invested $181 million in strategic bolt-on acquisitions and returned $111 million to its shareholders through quarterly dividends and common stock repurchases. VMC continues to expect to spend $625-$675 million on capital expenditures in 2024.

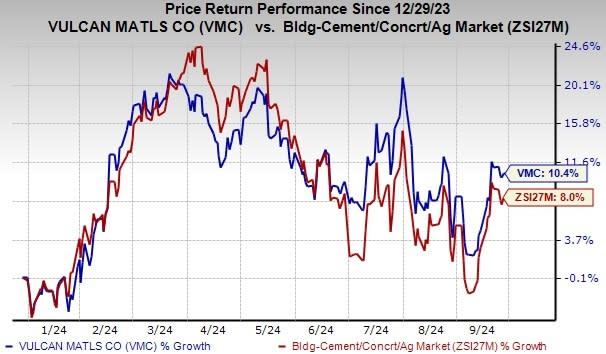

Vulcan’s Stock Performance

Image Source: Zacks Investment Research

This construction-aggregates producer’s shares have gained 10.4% year to date compared with the Zacks Building Products - Concrete and Aggregates industry’s 8% growth. The company is benefiting from the solid public infrastructure demand trends, reflecting increased contract flow, and efficient execution of its core enhancing and reach-expanding strategy. Also, it showcased resilience through accretive buyouts, favorable pricing and cost management.

VMC’s Zacks Rank & Key Picks

Currently, Vulcan carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are:

Howmet Aerospace Inc. HWM presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

HWM has a trailing four-quarter earnings surprise of 10.9%, on average. The Zacks Consensus Estimate for HWM’s 2024 sales and earnings per share (EPS) indicates a rise of 12.6% and 40.8%, respectively, from the prior-year levels.

Sterling Infrastructure, Inc. STRL presently carries a Zacks Rank #2 (Buy). Sterling Infrastructure has a trailing four-quarter earnings surprise of 17.4%, on average.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates a rise of 9.7% and 26.6%, respectively, from the prior-year levels.

M-tron Industries, Inc. MPTI currently carries a Zacks Rank #2. It has topped earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 9.2%.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates a rise of 16.1% and 76.6%, respectively, from prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance