Volatility to Aid Schwab (SCHW) Q2 Earnings Amid Low Rates

Charles Schwab SCHW is scheduled to report second-quarter 2020 results on Jul 16, before market open. Its revenues and earnings are likely to have declined in the quarter on a year-over-year basis.

In the last reported quarter, the company’s earnings lagged the Zacks Consensus Estimate. Lower revenues and a rise in expenses hurt the results.

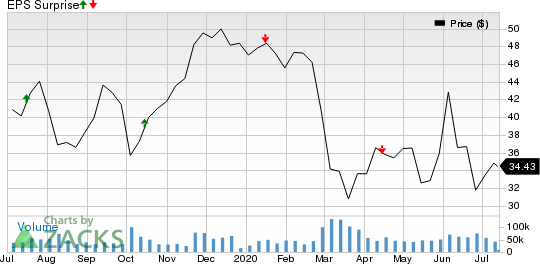

Schwab does not have an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in one, matched in one and lagged in two of the trailing four quarters, with a positive surprise of 1.1%, on average.

The Charles Schwab Corporation Price and EPS Surprise

The Charles Schwab Corporation price-eps-surprise | The Charles Schwab Corporation Quote

Nevertheless, activities of the company during the second quarter encouraged analysts to revise earnings estimates upward. Over the past seven days, the Zacks Consensus Estimate for its earnings for the to-be-reported quarter has been revised 7.8% upward to 55 cents. However, the figure indicates a decline of 16.7% from the year-ago reported number.

The Zacks Consensus Estimate for second-quarter sales is pegged at $2.46 billion, which suggests an 8.3% decline from the year-ago quarter’s reported figure.

Major Developments During the Quarter

In May, Schwab completed the acquisition of the assets of USAA’s Investment Management Company, including its brokerage and managed portfolio accounts. The company entered the deal in July 2019, with an aim to diversify revenues.

In June, Schwab acquired Motif’s technology and intellectual property assets, with the aim of bolstering its existing capabilities and speeding up the development of thematic and direct indexing solutions for its retail investors, as well as registered investment advisor (“RIA”) clients.

Now, before we take a look at what our quantitative model predicts for the to-be-reported quarter, let’s check the factors that are likely to have impacted Schwab’s performance.

Continued uncertainty related to the coronavirus outbreak resulted in a significant rise in market volatility along with an increase in client activity in the second quarter.

Although investors have become wary of entering the markets due to the concerns related to the impact of the virus outbreak on the economy, Schwab opened 201,000 new brokerage accounts in April, up 37% year over year, and 1.25 million accounts in May, up significantly year over year. Moreover, the Zacks Consensus Estimate for the company’s active brokerage accounts of 13,437 for the second quarter suggests an improvement of 12.3% from the previous year’s reported number.

Thus, driven by rise in volatility along with increased client activity, Schwab’s trading revenues are expected to have improved in the quarter.

Also, the company is expected to have witnessed a rise in total client assets and average interest-earning assets in the to-be-reported quarter.

The Zacks Consensus Estimate for total client assets is pegged at $4.1 trillion, indicating 10.4% growth from the previous year’s reported figure. Moreover, the consensus estimate for average interest-earning assets is pegged at $351 billion, which suggests growth of 32% year over year. Despite expected growth in assets, Schwab’s net interest revenues are not likely to have witnessed much improvement in the quarter because of lower interest rates.

Notably, the Federal Reserve’s move to cut interest rates to near-zero in March to support the U.S. economy from the coronavirus-induced slowdown is expected to have hurt the company’s interest revenues further in the second quarter.

Management expects net interest margin in the second quarter to be under pressure, given the full effect of Fed rate cuts, expected normalization of LIBOR and significant balance sheet growth during March.

Schwab’s operating expenses have remained elevated over the past few quarters. Moreover, because of continued regulatory spending as well as ongoing investments to drive operating efficiency, overall expenses are expected to have remained high in the to-be-reported quarter.

What the Zacks Model Unveils

According to our quantitative model, chances of Schwab beating the Zacks Consensus Estimate this time are low. This is because it does not have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or better — which is required to be confident of an earnings surprise call.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Schwab is -1.22%.

Zacks Rank: The company currently carries a Zacks Rank #3.

Stocks Worth a Look

Here are some finance stocks that you may want to consider as these have the right combination of elements to post an earnings beat in their upcoming releases, per our model.

The Earnings ESP for PNC Financial PNC is +37.70% and it carries a Zacks Rank of 3 at present. The company is slated to report quarterly numbers on Jul 15.

BlackRock, Inc. BLK is scheduled to release earnings figures on Jul 17. The company, which sports a Zacks Rank #1 (Strong Buy) at present, has an Earnings ESP of +5.59%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for Associated Banc-Corp ASB is +7.31% and the stock carries a Zacks Rank #3, currently. It is scheduled to report quarterly numbers on Jul 23.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Associated BancCorp (ASB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance