Visa's (NYSE:V) Over-Performance is Backed by Fundamentals

This article was originally published on Simply Wall St News

Visa Inc's. (NYSE:V) share price has soared 180% in the last half decade. The share price has popped back 4.4% after the latest market dip. Visa has some very interesting fundamentals, and has been delivering a substantial performance for its shareholders over the years.

As a stock, Visa is an over-performer even on a risk adjusted basis, and has an annual Jensen's Alpha of 5.7% - which means that the stock has performed better than what would be expected from its risk profile. This is important because many stocks rise and look like they are over-performing, but it is entirely a function of the stock's risk.

Visa is moving beyond what you would expect from its risk profile, as measured by a beta.

We will look at the fundamentals, and what can be driving this exceptional performance.

See our latest analysis for Visa

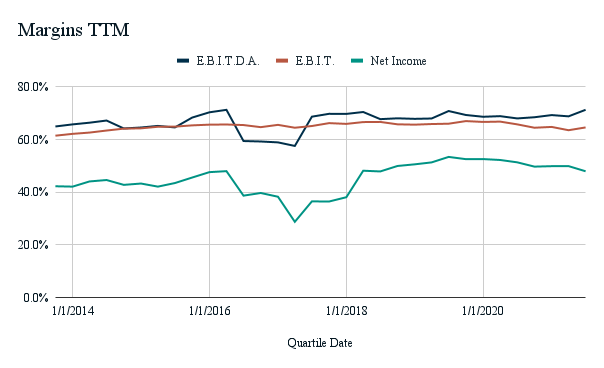

Fundamentals: Margins

One of the most compelling fundamental aspects of Visa are the profit margins. The company has consistently had 60%+ EBIT margins over the years.

The current EBIT margin for Visa is 64.6% and has declined 2% from 12 months ago. The net income margin is also high at 48% and has also dropped 7% from a year ago.

Even though the margins experienced a recent drop, 2020 was an unusual year regarding the economy, but the overall quality of margins remains extremely strong for Visa.

Fundamentals: Earnings Per Share

One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, Visa managed to grow its earnings per share at 17% a year. This EPS growth is slower than the share price growth of 23% per year, over the same period. This suggests that market participants hold the company in higher regard. That's not necessarily surprising considering the five-year track record of earnings growth.

This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 46.62.

You can see how EPS has changed over time in the image below.

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

Fundamentals: Dividends

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital risings, along with any dividends, based on the assumption that the dividends are reinvested.

In the case of Visa, it has a TSR of 189% for the last 5 years. That exceeds its share price return that we previously mentioned. Dividend payments explain 9% of the extra returns.

The stock is also engaged in buybacks and has returned some US$38b in the form of buyback over the last 5 years!

Key Takeaways

Visa shareholders are up 18% for the year (including dividends) and the longer term returns (running at about 24% a year, over half a decade) look better. Examining on a risk adjusted basis, Visa outperformed the return expectations by 5.7% over the last year.

Margins are a significant contributor to performance, and the company managed to sustain 60%+ EBIT margins over the last 6 years.

Analysts estimate that the healthy EPS results will continue to grow by 17.5% annually, which is close to the industry's EPS growth of 18%.

Visa pays a low 0.55% dividend yield, but they seem to be also heavily engaging in buybacks, and has made US$38B of buybacks in the last 5 years.

The company is profitable, stable and the performance seems to be driven by fundamentals! Visa is a market leader in the financial services industry and even though growth may decline because of maturity, the company can still perform because it has already set up a great foundation.

Additionally, we've discovered 1 warning sign for Visa that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance