Visa and Mastercard: Holding Both Is Wise

Visa Inc. (NYSE:V) and Mastercard Inc. (NYSE:MA) are in a constant battle for advancement in the payments industry. However, they are both equally compelling investments for a range of contrasting reasons. My analysis revealed that Mastercard presents more forward growth prospects, but Visa has a stable and stalwart-like nature that is compelling for risk-averse investors.

Visa is dominant

Visa's network spans over 200 countries. A large part of the company's domination results from its entrenched global operational capabilities, which are unmatched by Mastercard. Three main areas could be considered when analyzing Visa's dominant position in its industry: a highly advanced network, strong institutional relationships and acquisitions and partnerships.

The company's advanced network is often referred to as VisaNet. Arguably this is the center of its operational dominance. The network can handle more than 65,0000 transaction messages per second. According to the company's website, the "technology infrastructure powers more than 138 billion payments annually, each in just a few milliseconds." Over the last five years, Visa has invested close to $9 billion to further strengthen core technologies and launch new projects.

Visa partners with banks and credit unions across the globe. The purpose of this is to issue Visa-branded credit, debit and prepaid cards. Major specific partnerships include Bank of America, offering the Bank of America Customized Cash Rewards credit card, and Chase, offering the Chase Sapphire Preferred and Chase Sapphire Reserve cards. According to CardRates, as of November 2023, Visa has over 312 million cards in circulation, which are accepted by over 40 million merchants.

The company has made over 30 acquisitions in total. I am going to focus on three crucial acquisitions to give readers an understanding of the effectiveness of Visa's acquisition strategy. Visa Europe was reacquired in 2016 for $23.4 billion. This reacquisition streamlined Visa's operations and global presence, specifically providing uniformity. CyberSource was acquired in 2010 for around $2 billionn. This provided Visa with a strong position during the e-commerce boom with online payment and fraud management. Tink was acquired in 2021 for 1.8 billion euros ($1.97 billion). This bolstered Visa's open banking and financial data capabilities, contributing to its advancement in digital finance.

Mastercard is smaller but faster

Mastercard operates in over 210 countries. However, the company is notably smaller than Visa with a market cap of around $385 billion compared to Visa's market cap of $520 billion. Mastercard's relatively smaller size arguably gives it more room to innovate. There are three core areas I have selected to compare the two companies: the operational advancements that Mastercard is focusing on, the difference in growth rates and both companies' dependence on U.S. versus international markets.

The company's noteworthy investments in advanced financial services include blockchain, artificial intelligence and cybersecurity. It is worth noting that both companies are going to have competitive crossover in almost all areas, but specific patents and acquisitions will be what differentiate the two operationally.

For example, Mastercard has unique patents for maintaining transaction privacy using blockchain. Some of the patents it owns related to blockchain include fraud prevention, anonymous transactions and payment card verification. The company currently has around 90 blockchain patents with around 300 blockchain patents pending.

Mastercard has incorporated AI into its cybersecurity efforts for over 10 years. Safety Net, a worldwide tool to strengthen cybersecurity, utilizes AI and has prevented over 100 million attempted fraudulent transactions in the first half of 2023, according to Mastercard's own reports. A biometric checkout program is currently in a pilot phase, which will eventually allow shoppers worldwide to make payments through facial or hand recognition.

Both Visa and Mastercard are competing on all of these technological advancements. The room for innovation here could potentially see Mastercard edge closer to a more dominant position if it effectively advances its technologies in ways favored by consumers.

However, the main selling point of Mastercard stock versus Visa is arguably in the revenue growth rates of the companies compared. Mastercard has slightly stronger revenue growth on a five-year and a one-year basis. Compare 12.60% for Mastercard's five-year revenue growth rate with Visa's 11.70%, or 15.60% for Mastercard's one-year revenue growth rate against Visa's 14.10%.

Even more interesting is the average growth of transaction volumes. Based on a report by Khaveen Investments, Mastercard saw an average growth rate in transaction volumes of 9.1% from 2016 to 2019, while Visa only had a transaction volume growth rate of 4.9% over the same period.

In 2022, Mastercard recoreded North American revenue of $7.81 billion and international revenue of $14.43 billion, meaning 35% of all revenue came from the U.S. Visa had a North American revenue of $12.85 billion and international revenue of $14.64 billion, meaning 44% of all revenue came from the U.S. For that reason, Visa may be slightly more suitable for risk-averse investors, as the U.S. market is generally more stable than its foreign counterparts.

Detailed financial comparison

The GF Score ranks both companies as 97 out of 100, indicating high outperformance potential. However, there are key differences that mark both investments as worthy on slightly different parameters.

Visa has a higher gross and operating margin than Mastercard, with a gross margin of 79.89% compared to Mastercard's 75.89%. Visa's operating margin is 67.15% and Mastercard's is 57.96%.

This reveals an interesting story, with Mastercard presenting higher top-line growth and Visa showing stronger overall profit margins. In some sense, these factors equally balance both companies in terms of financial merit related to income and profit. Due to Visa's size and dominance, it arguably has more ability to be capital efficient, hence slower revenue growth, but more effective profit strategies.

When analyzing credit ratios, Mastercard is in a worse position with a cash-to-debt ratio of 0.48 compared to Visa's 0.98. Mastercard's cash-to-debt ratio has been in a long-term downtrend since 2009. Visa's cash-to-debt ratio has also been in a long-term downtrend, but also has a five-year uptrend, rising from 0.7 to 0.98 today.

Visa has considerably less total liabilities than Mastercard. As of September, Visa has total liabilities of 57.2% and total equity of 42.8%, whereas as of December 2022, Mastercard has total liabilities of 83.53% and total equity of 16.47%. Part of this is likely because, with higher market saturation, Visa can afford to take on less debt and remain competitive, whereas Mastercard is still racing to expand and grow to levels Visa has already reached.

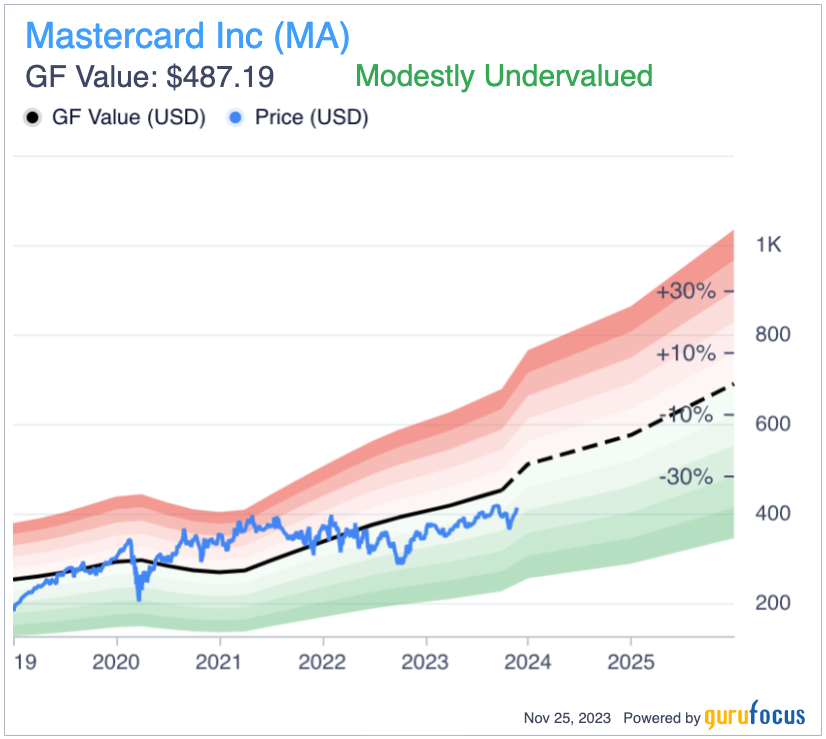

The valuation standing of both companies is more nuanced. The GF Value chart shows Mastercard to be modestly undervalued.

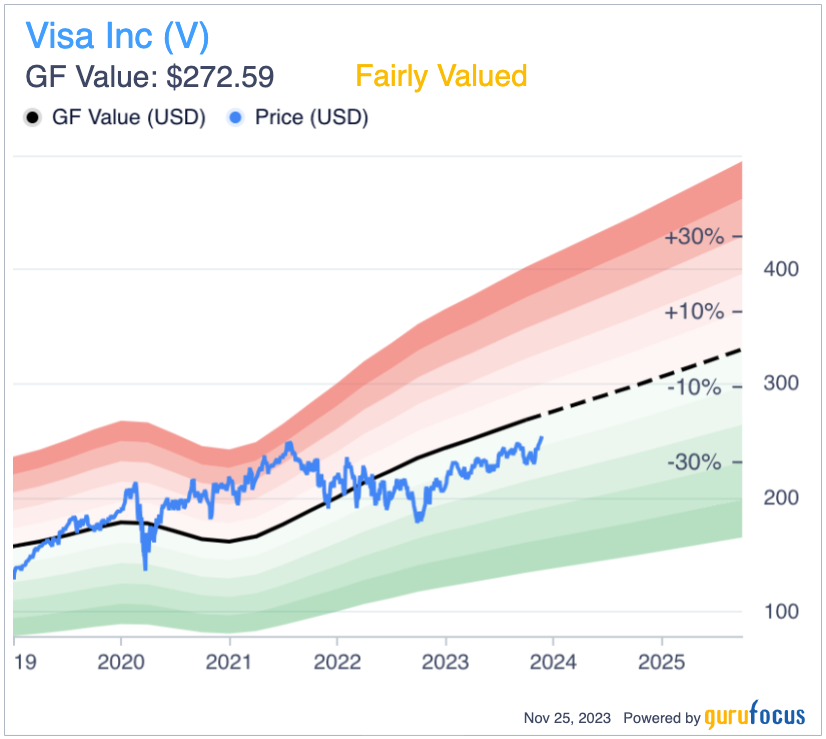

The GF Value chart shows Visa to be fairly valued.

This seems correct to me and perhaps presents a slightly more compelling reason to invest in Mastercard right now over Visa. Still, there are further considerations that warrant analysis that make me confident in owning both companies.

For example, while Mastercard's current stock price is slightly below its all-time high, it has a price-earnnings ratio of 35.74, which is worse than 82.46% of companies in the credit services industry. Visa, on the other hand, has a price-earnings ratio of 30.61, which is worse than 78.27% of competitors

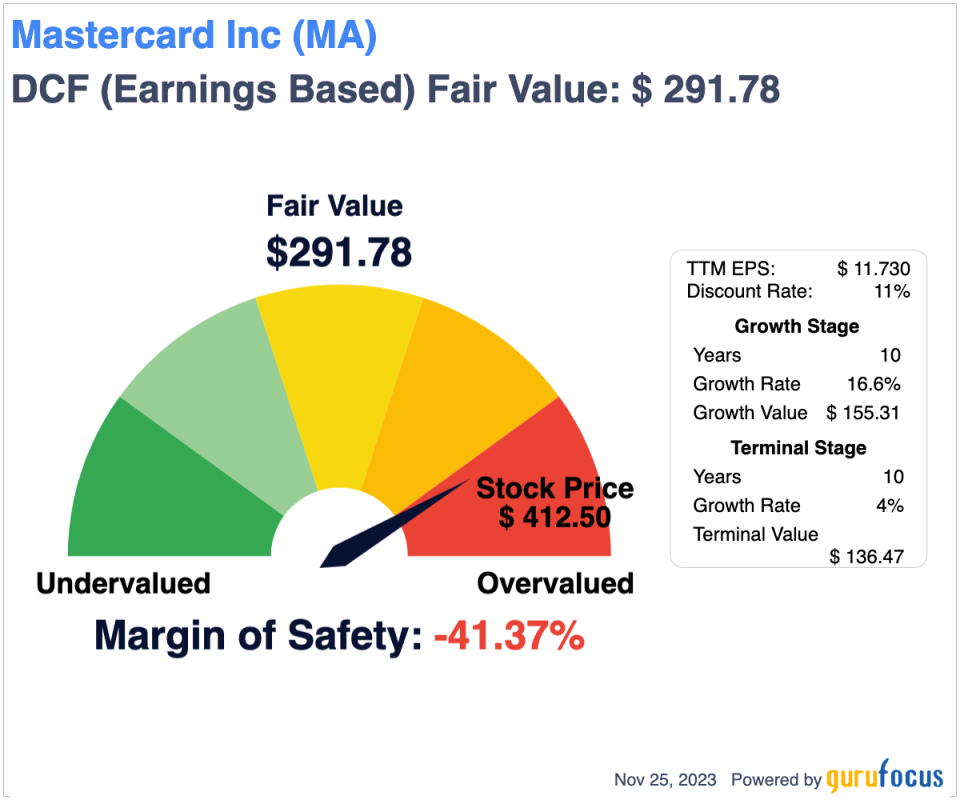

By discounted cash flow analysis using earnings per share without non-recurring items, Visa is closer to intrinsic value than Mastercard.

While Visa and Mastercard are certainly not value investments, their relative values related to growth and operational competition make them almost equal by my analysis, as confirmed by GuruFocus' innate data tools.

Holding both is wise

A thorough operational and financial comparison of Visa and Mastercard reveals to me that both are almost equal counterparts. Visa offers more stability, milder inflated value and the dominant position with margin power. Mastercard offers higher growth rates and operational agility, but also comes with a more grandiose valuation and more international dependence, hence more overall risk, in my opinion.

Since I am quite a risk-averse investor, I hold Visa in my portfolio at about double the weight of my Mastercard shares. That being said, I can see a strong argument that Mastercard could present better overall long-term growth, and I do not doubt that both investments are relatively stable enough to hold either on their own.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance