Video Gaming Stocks Q1 Highlights: Roblox (NYSE:RBLX)

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Roblox (NYSE:RBLX) and the rest of the video gaming stocks fared in Q1.

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

The 4 video gaming stocks we track reported a weak Q1; on average, revenues missed analyst consensus estimates by 2.3%. while next quarter's revenue guidance was in line with consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the video gaming stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.7% on average since the previous earnings results.

Roblox (NYSE:RBLX)

Best known for its wide assortment of user-generated content, Roblox (NYSE:RBLX) is an online gaming platform and game creation system.

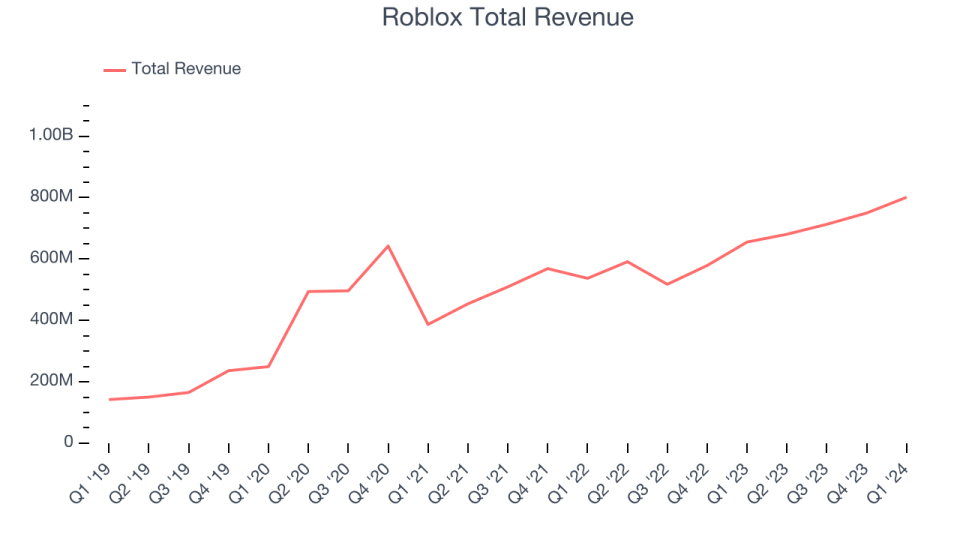

Roblox reported revenues of $801.3 million, up 22.3% year on year, falling short of analysts' expectations by 0.6%. It was a weak quarter for the company, with full-year bookings guidance missing analysts' expectations and a miss of analysts' revenue estimates.

“Our teams have been hard at work identifying opportunities to drive DAUs, Hours, and bookings growth rates back to 20% year-over-year. We began experimenting with changes in our AI-driven discovery algorithm and the positioning of various content types on the Homepage. We reintroduced platform-wide events like The Hunt: First Edition. And, we continued to improve the quality and performance of our app and experiences. Based on results since the middle of April, we believe that these steps are yielding positive results,” said David Baszucki, founder and CEO of Roblox.

Roblox achieved the fastest revenue growth of the whole group. The stock is down 17.1% since the results and currently trades at $32.34.

Read our full report on Roblox here, it's free.

Best Q1: Take-Two (NASDAQ:TTWO)

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ:TTWO) is one of the world’s largest video game publishers.

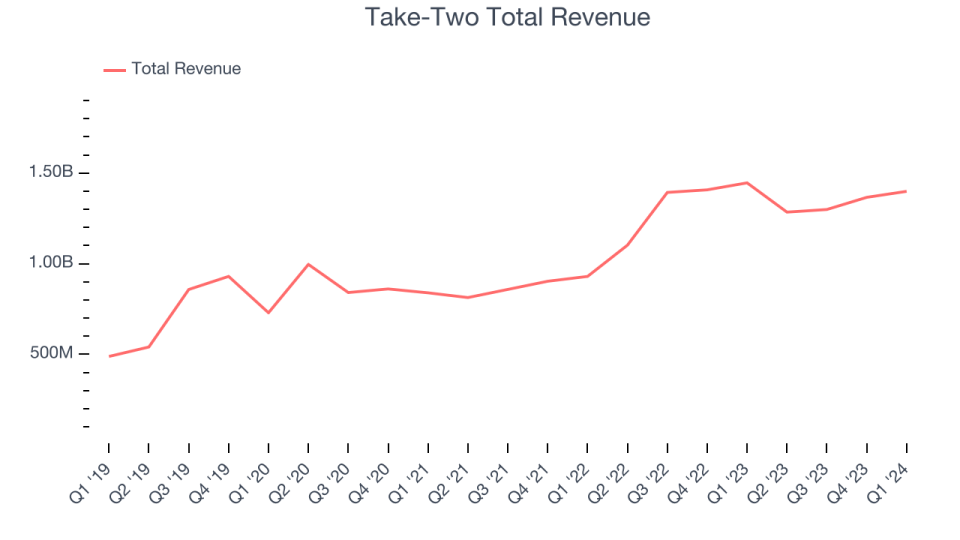

Take-Two reported revenues of $1.40 billion, down 3.2% year on year, outperforming analysts' expectations by 3.4%. It was a decent quarter for the company, with revenue exceeding expectations. Revenue guidance for the next quarter also came in ahead.

Take-Two pulled off the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 3.7% since the results and currently trades at $151.42.

Is now the time to buy Take-Two? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $25.24 million, down 43.1% year on year, falling short of analysts' expectations by 12.6%. It was a weak quarter for the company, with a decline in its users and slow revenue growth.

Skillz had the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 43.5% year on year. The stock is up 1.1% since the results and currently trades at $6.48.

Read our full analysis of Skillz's results here.

Electronic Arts (NASDAQ:EA)

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ:EA) is one of the world’s largest video game publishers.

Electronic Arts reported revenues of $1.78 billion, down 5.1% year on year, in line with analysts' expectations. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and slow revenue growth.

Electronic Arts achieved the highest full-year guidance raise among its peers. The stock is down 1.2% since the results and currently trades at $128.66.

Read our full, actionable report on Electronic Arts here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance