Viasat (VSAT) Boosts Maritime Communications With NexusWave

Inmarsat Maritime, a subsidiary of Viasat Inc. VSAT, has revolutionized maritime communications by introducing NexusWave, a comprehensive connectivity service. This cutting-edge solution merges multiple high-speed networks to deliver unparalleled global coverage, unlimited data and robust security.

NexusWave integrates Global Xpress (GX) Ka-band, low-Earth orbit (LEO) services and coastal LTE networks, with an added layer of L-band for resilience, ensuring fast and reliable connectivity. This unified service provides consistent performance, eliminating the need for multiple disjointed solutions traditionally used in maritime operations. Additionally, it features enterprise-grade firewall security, trusted by global enterprises and governments, enhancing cybersecurity across maritime communications.

One of NexusWave’s standout features is its future-proof design. It is set to incorporate the next-generation ViaSat-3 Ka-band service, anticipated to be operational in 2025. This integration will further boost its capacity and speed, keeping pace with the evolving demands of maritime operators. By offering a managed service with transparent costs and no unexpected charges, NexusWave supports the digital transformation of maritime operations, allowing ships to function as floating offices and homes.

The launch of NexusWave positions Viasat as a leader in the maritime communications sector. The service addresses the growing demand for high-speed data and seamless connectivity in the maritime industry. Maritime operators benefit from a streamlined, secure and efficient communication solution, giving them a competitive edge.

By enhancing its service offerings and expanding its market presence, Viasat is poised to capture a larger share of the maritime communications market. The continuous enhancement of NexusWave, supported by Viasat's and Inmarsat's combined expertise and network assets, ensures sustained growth and customer satisfaction.

Viasat’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. Its Satellite Services business is progressing well, with key metrics, including steady growth of average revenue per user (ARPU) and revenues showing impressive growth. ARPU is growing on the back of a solid retail distribution network, accounting for a rising proportion of high-value and high bandwidth subscriber base. Further, the growing adoption of in-flight Wi-Fi services in commercial aircraft is benefiting the business.

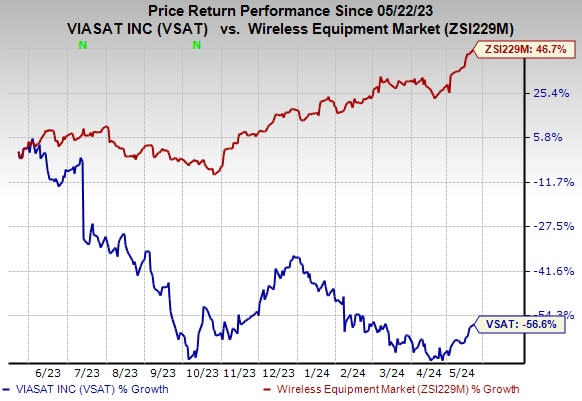

The stock has lost 56.6% in the past year against the industry’s 46.7% rally.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Viasat currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Ubiquiti Inc. UI, carrying a Zacks Rank #2 (Buy) at present, is a key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices.

It boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

NVIDIA Corporation NVDA, carrying a Zacks Rank #2, is another key pick in the broader industry. It is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, the company’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing, gaming and virtual reality platforms.

The company’s GPU platforms are playing a major role in developing multi-billion-dollar end-markets like robotics and self-driving vehicles. NVIDIA has a long-term earnings growth expectation of 30.9% and delivered an earnings surprise of 20.2%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Viasat Inc. (VSAT) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance