VeriSign (VRSN) Q3 Earnings & Revenues Top Estimates, Up Y/Y

VeriSign VRSN reported third-quarter 2019 non-GAAP earnings of $1.36 per share that beat the Zacks Consensus Estimate by a nickel and increased 10.6% from the year-ago quarter.

Revenues increased 0.9% year over year to $308.4 million and came ahead of the Zacks Consensus Estimate of $308.3 million.

Quarter Details

VeriSign ended the reported quarter with 157.4 million .com and .net domain name registrations, up 3.8% year over year. The figure reflects a net increase of 1.27 million registrations during the quarter.

The company processed 9.9 million new domain name registrations for .com and .net compared with 9.5 million in the year-ago quarter.

Notably, renewal rates are not fully measurable until 45 days after the end of the quarter. The final .com and .net renewal rate for the second quarter of 2019 was 74.2% compared with 75% for the same quarter in 2018.

The company expects the renewal rate for third-quarter of 2019 to come around 73.6%. Renewal rate in the third quarter of 2018 was 74.8%.

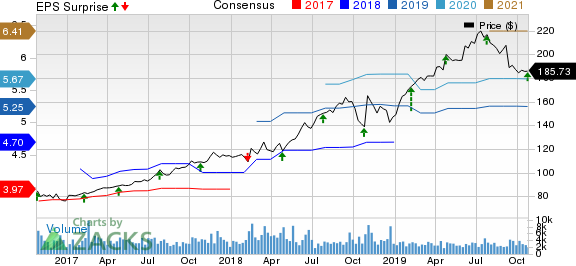

VeriSign, Inc. Price, Consensus and EPS Surprise

VeriSign, Inc. price-consensus-eps-surprise-chart | VeriSign, Inc. Quote

VeriSign’s operating expenses decreased 7.2% from the year-ago quarter to $103 million attributed to lower expenses resulting from the sale of the company’s security services business to Neustar in October 2018.

VeriSign’s research and development expenses (4.7% of total revenues) increased 6.6% from the year-ago quarter to $14.6 million.

General and administrative expenses (11% of total revenues) decreased 3% year over year to $33.9 million.

Notably, sales and marketing expenses (3.2% of total revenues) declined 28.9% year over year to $9.9 million primarily due to sale of security services division, which incurred the majority of sales and marketing expenses.

Non-GAAP operating income was $218.2 million, up 3.9% from the year-ago quarter. Non-GAAP operating margin expanded 200 basis points (bps) year over year to 70.8%.

Balance Sheet & Cash Flow

As of Sep 30, 2019, the company’s cash and cash equivalents (including marketable securities) were approximately $1.23 billion compared with $1.22 billion as of Jun 30, 2019.

Cash flow from operating activities was $208.1 million in the third quarter compared with $165 million in the previous quarter.

During the three months ended Sep 30, 2019, Verisign repurchased 1 million shares for an aggregate cost of $194.0 million.

2019 Guidance

The company expects domain name base growth rate to be between 3.2% and 3.7% compared with the prior guidance of 3% to 4.25%.

Moreover, revenues are expected to be in the range of $1.228-$1.233 billion compared with the earlier-guided figure of $1.225-$1.235 billion.

Non-GAAP operating margin guidance was narrowed to the range of 69.5-70% from the previous guidance of 68% to 69%.

Capital expenditure is anticipated in the range of $40-$50 million compared with the earlier-guided figure of $45-$55 million.

Zacks Rank & Stocks to Consider

VeriSign currently has a Zacks Rank #3 (Hold).

Five9 FIVN, Benefitfocus BNFT and NetEase NTES are some better-ranked stocks in the broader computer and technology sector. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Five9, Benefitfocus and NetEase are set to report quarterly results on Nov 5, 6 and 13, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance