Some Vection Technologies (ASX:VR1) Shareholders Are Down 15%

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Vection Technologies Ltd. (ASX:VR1) share price is down 15% in the last year. That falls noticeably short of the market return of around -9.7%. We wouldn't rush to judgement on Vection Technologies because we don't have a long term history to look at. It's down 35% in about a quarter. Of course, this share price action may well have been influenced by the 22% decline in the broader market, throughout the period.

View our latest analysis for Vection Technologies

Vection Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Vection Technologies saw its revenue grow by 172%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 15% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

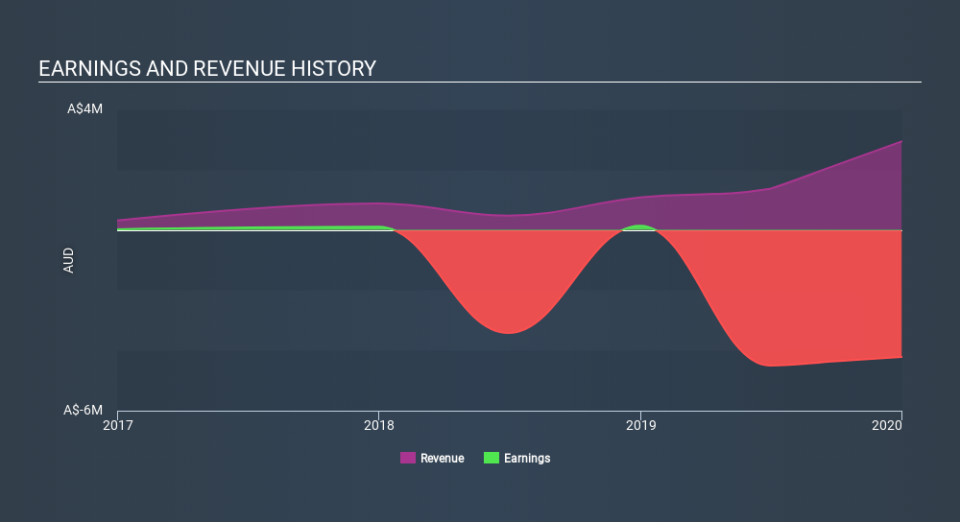

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Vection Technologies's earnings, revenue and cash flow.

A Different Perspective

We doubt Vection Technologies shareholders are happy with the loss of 15% over twelve months. That falls short of the market, which lost 9.7%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Notably, the loss over the last year isn't as bad as the 35% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Vection Technologies (including 2 which is are concerning) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance