Value-Adding Growth Stocks To Buy Now

Why invest in a stock whose growth outlook that lags behind the market? Investors looking for companies with extraordinary future prospects in terms of profitability and returns should look at the following high-growth stocks. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

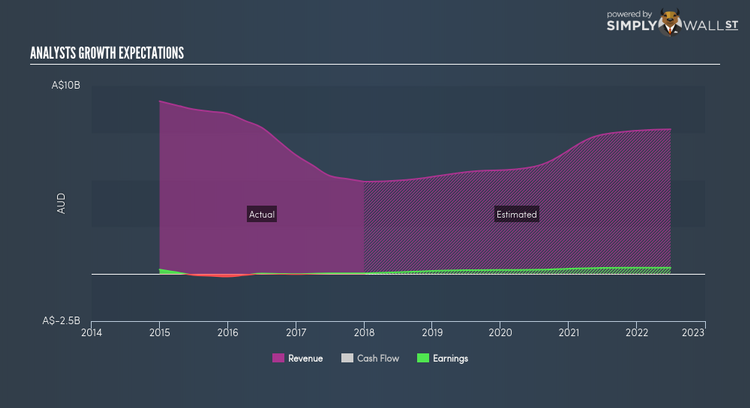

WorleyParsons Limited (ASX:WOR)

WorleyParsons Limited provides professional services to the resources and energy sectors in Australia and internationally. Formed in 1971, and currently headed by CEO Andrew Wood, the company now has 22,800 employees and with the market cap of AUD A$4.65B, it falls under the mid-cap stocks category.

WOR is expected to deliver a buoyant earnings growth over the next couple of years of 31.45%, driven by a positive double-digit revenue growth of 13.45% and cost-cutting initiatives. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 11.35%. WOR’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Could this stock be your next pick? I recommend researching its fundamentals here.

Livehire Limited (ASX:LVH)

LiveHire Limited, a talent technology company, provides business intelligence and data services to c and large enterprises in Australia. Livehire was founded in 2001 and with the company’s market cap sitting at AUD A$156.84M, it falls under the small-cap stocks category.

LVH is expected to deliver an extremely high earnings growth over the next couple of years of 56.72%, bolstered by a significant revenue which is expected to more than double. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. LVH’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. A potential addition to your portfolio? Other fundamental factors you should also consider can be found here.

Aurelia Metals Limited (ASX:AMI)

Aurelia Metals Limited, a junior mining company, explores for and develops mineral properties in Australia. Aurelia Metals is currently led by CEO James Simpson. With the company’s market capitalisation at AUD A$445.06M, we can put it in the small-cap group

Considering AMI as a potential investment? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance