Valeant (VRX) Up 19.3% Since Earnings Report: Can It Continue?

A month has gone by since the last earnings report for Valeant Pharmaceuticals International, Inc. VRX. Shares have added about 19.3% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is VRX due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Valeant Beats on Earnings in Q1, Raises View

Valeant reported better-than-expected results for the first-quarter results. The increase in guidance for 2018 was encouraging too.

The company’s adjusted earnings per share of $0.89 beat the Zacks Consensus Estimate of $0.23 and was also up from $0. 78 per share in the year-ago quarter.

Total revenues of $1.99 billion also topped the Zacks Consensus Estimate of $1.98 billion but declined 5.4% from the year-ago quarter.

Quarter in Detail

Revenues in the Bausch + Lomb / International segment were $1.1 billion, down 3% year over year. Excluding the impact of discontinuation of divestitures, primarily the skin care divestiture, and foreign exchange, the Bausch + Lomb/International segment organically improved by approximately 2% year over year driven by growth in the Global Vision Care business.

The Branded Rx segment revenues were $593 million, down 6% due to divestitures and discontinuations and decline in the Ortho Dermatologics business. This was partially offset by increased sales in Salix which was up by 40%. Xifaxan was up 49% while Relistor improved 54%. The FDA approved Plenvu, a 1-liter bowel cleansing preparation for colonoscopies, which is expected to be available in the third quarter of 2018.

The FDA earlier approved its new psoriasis treatment, Siliq, following which the drug was launched and expanded. The company inked a deal with AstraZeneca for Siliq but the agreement had to be amended. The FDA accepted New Drug Applications for Altreno (IDP-121), an acne treatment in lotion form; PDUFA action date of Aug 27, 2018 and Bryhali (IDP-122), a topical treatment for plaque psoriasis; PDUFA action date of Oct 5, 2018.

The U.S. Diversified Products segment revenues were $299 million, down 14% year over year due to previously reported loss of exclusivity for a basket of products and the impact of the 2017 divestitures and discontinuations.

Research and development expenses were $92 million in the reported quarter, down 4.2% from the year-ago quarter.

Selling, General and Administrative costs were $587 million compared with $651 million in the year-ago quarter.

The company repaid approximately $280 million of debt with cash in hand in the first quarter of 2018.

Concurrently, Valeant announced that the company will change its name to Bausch Health Companies Inc., effective July 2018.

2018 Guidance

The company expects total revenues in the range of $8.15-$8.35 billion, up from the earlier projected range of $8.10-$8.30 billion.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimates. There have been three revisions higher for the current quarter compared to two lower.

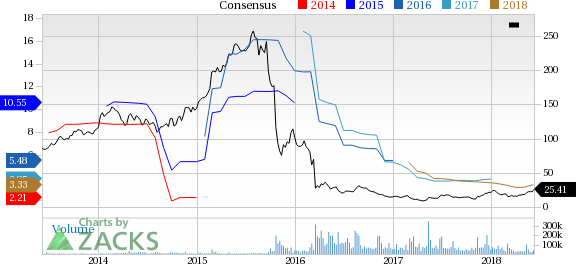

Valeant Pharmaceuticals International, Inc. Price and Consensus

Valeant Pharmaceuticals International, Inc. Price and Consensus | Valeant Pharmaceuticals International, Inc. Quote

VGM Scores

At this time, VRX has a subpar Growth Score of D. Its Momentum is doing a lot better with a B. The stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than momentum investors.

Outlook

Estimates have been broadly trending upward for the stock and the magnitude of these revisions looks promising. Interestingly, VRX has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valeant Pharmaceuticals International, Inc. (VRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance