Vale Gears Up to Report Q1 Earnings: What's in the Offing?

Vale S.A. VALE is scheduled to report first-quarter 2024 results on Apr 24, after the closing bell.

Q1 Estimates

The Zacks Consensus Estimate for Vale’s first-quarter sales is pegged at $8.4 billion, indicating a 0.6% decrease from the year-ago quarter's reported figure.

The consensus mark for earnings has moved down 35% over the past 30 days and is pegged at 40 cents per share. The figure suggests a 2.4% year-over-year decline.

Q4 Results

In the last reported quarter, Vale witnessed a year-over-year decline in earnings per share despite higher revenues, mainly due to an increase in provisions related to Samarco’s dam failure. While the company’s top line beat the Zacks Consensus Estimate, its bottom line missed the mark.

In the last four quarters, VALE has missed the consensus estimate on three occasions and beat the mark in one quarter. Over the past four quarters, the company has recorded an average surprise of a negative 32.1%.

VALE S.A. Price and EPS Surprise

VALE S.A. price-eps-surprise | VALE S.A. Quote

Factors to Note

Vale recently provided first-quarter 2024 production and sales update, which can indicate how the company is likely to fare in the to-be-reported quarter. Iron ore production was around 70.8 Mt in the quarter, which was up 6% year over year, attributed to improved operating performance at the S11D mine and higher third-party purchases. The figure was higher than the Zacks Consensus Estimate of 57 Mt.

Iron ore fines sales improved 14.6% from the year-ago quarter to 52.5 Mt in the first quarter, while pellet sales were up 13.4% to 9.2 Mt. However, the average realized iron ore fines price was $100.7 per ton in the first quarter, down 7.3% year over year, owing to provisional pricing adjustments due to lower-than-average forward prices on the last day of the quarter.

The Iron Solutions segment accounts for around 93% of Vale’s revenues. The Zacks Consensus Estimate for iron ore revenues for the to-be-reported quarter is around $6.1 billion, indicating 22% growth year over year. Gains from improved sales volumes are likely to be somewhat offset by lower prices. The consensus mark for pellets revenues is $1.4 billion, suggesting 5.6% growth from the year-ago quarter.

Nickel sales were recorded at 33.1 kt, down 17.5% from the year-ago comparable quarter’s figure. This reflected lower nickel output in the quarter owing to the impact of the planned furnace rebuild at Onça Puma. The figure was lower than the consensus estimate of 34.9 kt.

The average realized nickel price was $16,848 per ton, down 33% compared with $25,260 per ton in the year-ago quarter. This was mainly driven by a 36% year-over-year decrease in LME nickel reference prices. The Zacks Consensus Estimate for nickel revenues for the first quarter of 2024 is $577 million.

Vale sold 76.8 kt of copper in the first quarter of 2024, which was 22.5% higher than last year’s quarter figure. The figure surpassed the Zacks Consensus Estimate of 72.8 kt.

The average realized price for copper operations only (Salobo and Sossego) was $7,687 per ton in the first quarter of 2024, 18.8% lower than $9,465 per ton in the first quarter of 2023. The average realized copper price for all operations (including copper sales originating from nickel operations) was $7,632 per ton. The consensus estimate for copper revenues is $901.7 million, lower than $1.5 billion in the year-ago quarter as higher sales are expected to have been offset by lower prices.

Overall, Vale’s revenues in the first quarter are likely to have reflected the higher sales volumes for iron ore prices and copper. This is expected to have been offset by lower nickel sales volume, as well as lower prices for iron ore, copper and nickel.

The company has been facing higher input costs, particularly diesel and freight costs in the past few quarters. This is likely to have weighed on its margins in the quarter to be reported. However, cost-control efforts are expected to have negated some of this impact.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Vale this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, but that is not the case here.

Earnings ESP: The Earnings ESP for Vale is 0.00%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: Vale currently has a Zacks Rank of 3.

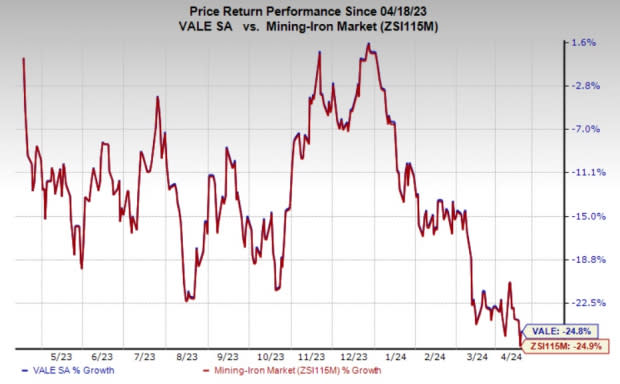

Price Performance

In a year, shares of Vale have declined 24.8% compared with the industry’s 24.9% fall.

Image Source: Zacks Investment Research

Stocks That Warrant a Look

Here are some companies in the basic materials space, which according to our model, have the right combination of elements to post an earnings beat this quarter:

Agnico Eagle Mines Limited AEM, scheduled to release earnings on Apr 25, presently has an Earnings ESP of +5.02% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AEM’s earnings for the first quarter is currently pegged at 55 cents per share.

Dow Inc. DOW, slated to release earnings on Apr 25, has an Earnings ESP of +2.28% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for DOW’s first-quarter earnings is currently pegged at 47 cents per share .

Nucor Corporation NUE, scheduled to release first-quarter earnings on Apr 22, currently has an Earnings ESP of +0.64% and a Zacks Rank of 3.

The Zacks Consensus Estimate for NUE's earnings for the first quarter is pegged at $3.62.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance