USDJPY Defending a Major Support

Although the USD in February is pretty successful and the Dollar Index is climbing higher, there is another safe currency which is doing a bit better – Japanese Yen. We have to main fundamental factors that positively affect the situation on the USD/JPY. First of all, yes, when the stocks slide, JPY gets stronger and we all know that indices just had a hell of a ride. The second thing is the tightening in Japan. It is slowly happening, which is definitely a positive sign for the Yen. In February, Yen Index broke the tops from November and reached the highest levels since September.

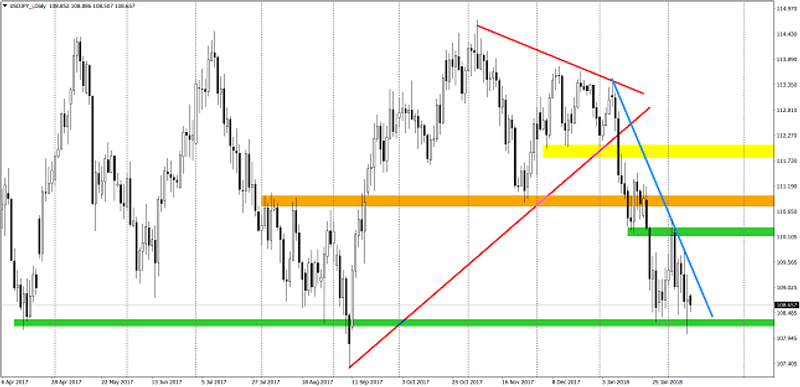

What are the charts telling us? The daily chart shows us that we are very close to the edge. One false step and we are gone. The price is above the 108.3 support, which is crucial for the mid-term situation since the April 2017. Price closing for a day below the green area will mean a major sell signal. Bearish sentiment is additionally supported here by the down trendline (blue).

From the correlations point of view, we know that a larger drop here should not happen without another major sell-off on stocks or without another bearish wave on the USD. Long story short, we are very close to the sell signal but what is the situation right now, as we speak? In my opinion, as long as we stay above the green area, the sentiment is positive and buyers can think about a small correction. This is very risky though but the potential reward can be really sweet.

This article is written by Tomasz Wisniewski, a senior analyst at Alpari Research & Analysis

This article was originally posted on FX Empire

More From FXEMPIRE:

Europe Staging a Rebound in Early Trading, Wall St Set to Open Higher

E-mini S&P 500 Index (ES) Futures Technical Analysis – February 12, 2018 Forecast

Gold Price Futures (GC) Technical Analysis – February 12, 2018 Forecast

The Ultimate Guide to Buy Ethereum (ETH); All You Need to Know

Oil Price Fundamental Daily Forecast – Showing Positive Response to Stock Market Recovery

Yahoo Finance

Yahoo Finance