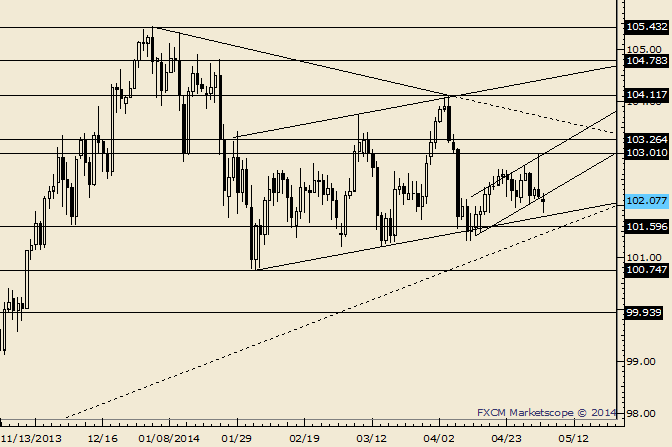

USD/JPY 5 Days Up; 102.50/70 is Still a Reaction Zone

Daily

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader and see ideas on other USD crosses

-USDJPY has rebounded from the line that extends off of the February and 3/14 lows. The rally from the February low channels in a corrective manner and makes 104.12 important from a bigger picture bearish perspective.

-The bond market reversal today requires that we consider something more bullish in USDJPY. 102.70 is a reaction level but a better tell might not come until 103.05/26.

LEVELS: 101.19 101.63 102.12 | 102.50 102.70 103.20

--Trading specifics (setups with entries, stops, targets) are availabletoJ.S. Trade Desk members.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance