USD/CAD Rally to Face Canada GDP- Support at 1.2965

DailyFX.com -

Talking Points

USD/CAD within well-defined ascending channel ahead of key Canada data

Updated targets & invalidation levels

Compete to Win Cash Prizes with FXCM’s Forex Trading Contest

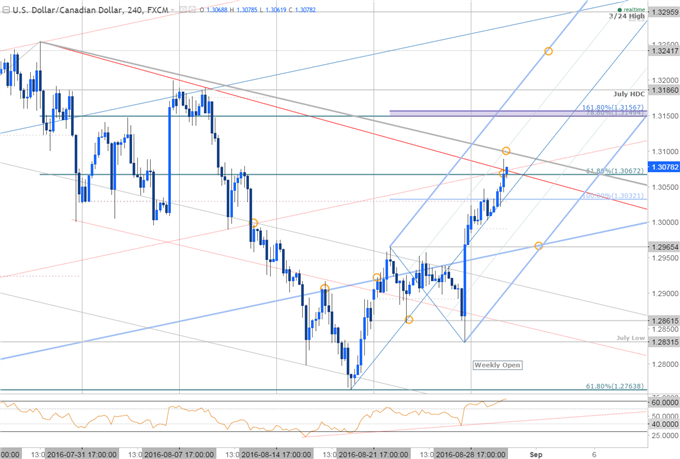

USDCAD 240min

Chart Created Using TradingView

Technical Outlook: We’ve been tracking this USDCAD setup for the past few weeks on SB Trade Desk and the pair is now eyeing near-term resistance head of tomorrow’s 2Q GDP release. The pair is trading within the confines of a newly identified ascending pitchfork formation extending off the monthly lows with the immediate long-bias vulnerable near-term while below the upper median-line parallel extending off the monthly high (grey).

Initial support is eyed at 1.3067 backed by the monthly open at 1.3029 & the weekly open at 1.2991. Key support & broader bullish invalidation rests at the highlighted 1.2965 confluence zone. Bottom line: the trade remains constructive while within this formation (looking to buy pullbacks) with a breach above median-line resistance targeting 1.3149/57 & the July high-day close at 1.3186.

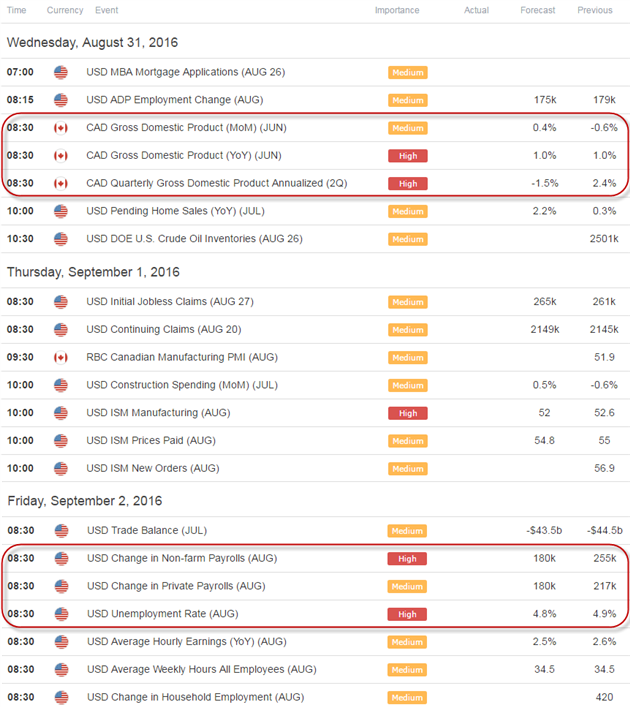

Consensus estimates are calling for an annualized contraction of 1.5% following the 2.4% expansion in the first-quarter of 2016. With markets already anticipating a weak print on account of the Alberta fires, a better-than-expected GDP figure may spark a bullish reaction in the Canadian dollar, which could offer favorable USD/CAD long entries. Keep in mind we have Non-Farm Payrolls on tap ahead of an extended holiday weekend in the U.S. For the complete setup and to continue tracking this trade & more throughout the week- Subscribe to SB Trade Desk.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

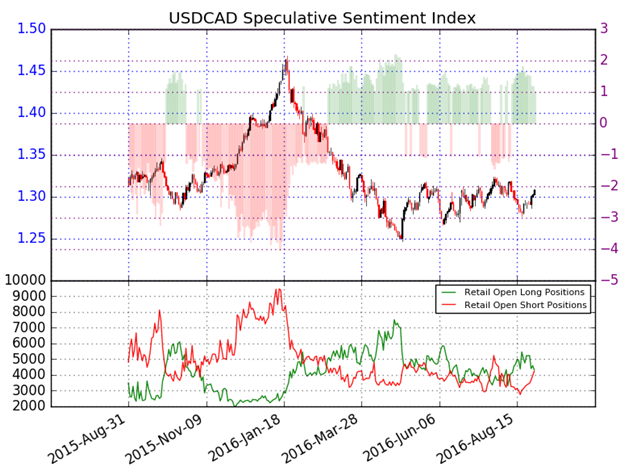

A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long USDCAD- the ratio stands at +1.04 (51% of traders are long)- weak bearish reading

Yesterday the ratio was at 1.17% - Short positions are 7.8% higher than yesterday and 32.2% above levels seen last week

Open interest is 1.3% higher than yesterday and 9.0% above its monthly average.

Although SSI will offer limited guidance within the current price range, there appears to be a broader shift in retail positioning with long positions 12.6% lower from the previous week (suggesting profit taking) while shorts are 32.2% higher during the same period.

Looking back over the last few months, it’s worth noting that retail crowds have actually been pretty decent in calling the turns within this range so use caution and don’t chase this into the monthly close.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases This Week

Other Setups in Play:

GBPJPY at Key Resistance Hurdle Ahead of UK Mortgages- 133.14 Support

Webinar: Post-Yellen USD Advance at Risk into Monthly Close / NFP

USDJPY: US GDP / Yellen Speech to Trigger Consolidation Range-Break

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance